Brainworks_Capital_Management_2012_Annual_Report

Brainworks_Capital_Management_2012_Annual_Report

Brainworks_Capital_Management_2012_Annual_Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>2012</strong> FINANCIAL STATEMENTS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

AS AT 31 DECEMBER <strong>2012</strong><br />

47<br />

The fair value of the put option was determined at year-end through comparison of the closing price of the shares<br />

at 31 December <strong>2012</strong> and the exercise price of the shares as per the put agreement. Apart from the financial<br />

assets shown above, the Company had no other financial assets and liabilities that were carried at fair value,<br />

as at 31 December <strong>2012</strong>.<br />

Adequacy and effectiveness of risk management system<br />

The risk management system has proved adequate and effective in managing equity price risk.<br />

Sensitivity analysis<br />

A 5% increase/decrease in the value of listed shares as at 31 December <strong>2012</strong> would have resulted in an<br />

increase/decrease of US$ 3 472 to the reported Company’s profit and an increase/decrease in the statement<br />

of financial position of US$ 3 472.<br />

24.3 CREDIT RISK<br />

Definition<br />

Credit risk is the risk that a counter party will not honour its obligations to the Company as and when they<br />

become due.<br />

Identification techniques<br />

The company assesses prospective customers or investees prior to granting credit facilities to them.<br />

Measurement methods<br />

The risk is measured through assessing the risk of default through investigations of the counterparty’s credit<br />

worthiness.<br />

Impact evaluation<br />

Credit risk is rated low in the Company as the systems for identification measurement and controlling the risk<br />

are effective.<br />

Strategies for management/mitigation<br />

The Company has a credit risk management process which operates through authorisation limits.<br />

Exposure to credit risk<br />

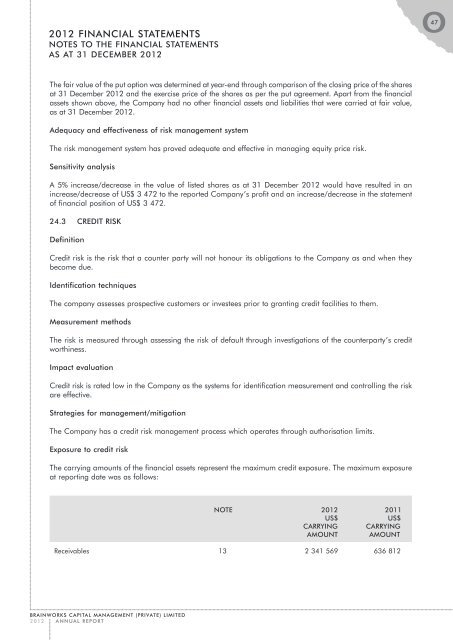

The carrying amounts of the financial assets represent the maximum credit exposure. The maximum exposure<br />

at reporting date was as follows:<br />

NOTE <strong>2012</strong> 2011<br />

US$<br />

US$<br />

CARRYING CARRYING<br />

AMOUNT AMOUNT<br />

Receivables 13 2 341 569 636 812<br />

BRAINWORKS CAPITAL MANAGEMENT (PRIVATE) LIMITED<br />

<strong>2012</strong> ANNUAL REPORT