2012 Perspectives Magazine - Manitoba Heavy Construction ...

2012 Perspectives Magazine - Manitoba Heavy Construction ...

2012 Perspectives Magazine - Manitoba Heavy Construction ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

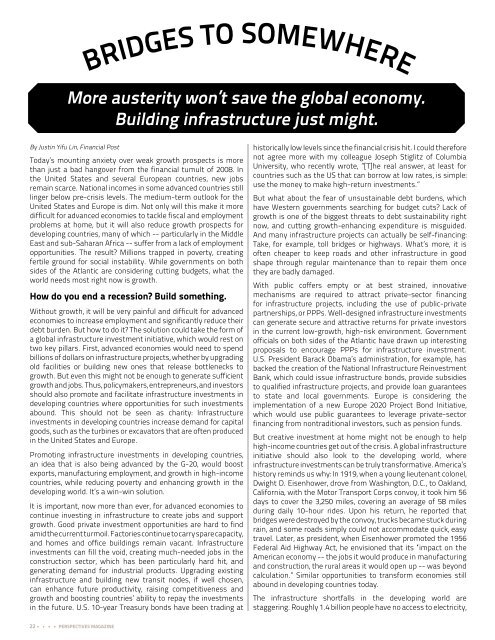

BriDges to Somewhere<br />

More austerity won’t save the global economy.<br />

Building infrastructure just might.<br />

By Justin Yifu Lin, Financial Post<br />

Today’s mounting anxiety over weak growth prospects is more<br />

than just a bad hangover from the financial tumult of 2008. In<br />

the United States and several European countries, new jobs<br />

remain scarce. National incomes in some advanced countries still<br />

linger below pre-crisis levels. The medium-term outlook for the<br />

United States and Europe is dim. Not only will this make it more<br />

difficult for advanced economies to tackle fiscal and employment<br />

problems at home, but it will also reduce growth prospects for<br />

developing countries, many of which -- particularly in the Middle<br />

East and sub-Saharan Africa -- suffer from a lack of employment<br />

opportunities. The result? Millions trapped in poverty, creating<br />

fertile ground for social instability. While governments on both<br />

sides of the Atlantic are considering cutting budgets, what the<br />

world needs most right now is growth.<br />

How do you end a recession? Build something.<br />

Without growth, it will be very painful and difficult for advanced<br />

economies to increase employment and significantly reduce their<br />

debt burden. But how to do it? The solution could take the form of<br />

a global infrastructure investment initiative, which would rest on<br />

two key pillars. First, advanced economies would need to spend<br />

billions of dollars on infrastructure projects, whether by upgrading<br />

old facilities or building new ones that release bottlenecks to<br />

growth. But even this might not be enough to generate sufficient<br />

growth and jobs. Thus, policymakers, entrepreneurs, and investors<br />

should also promote and facilitate infrastructure investments in<br />

developing countries where opportunities for such investments<br />

abound. This should not be seen as charity: Infrastructure<br />

investments in developing countries increase demand for capital<br />

goods, such as the turbines or excavators that are often produced<br />

in the United States and Europe.<br />

Promoting infrastructure investments in developing countries,<br />

an idea that is also being advanced by the G-20, would boost<br />

exports, manufacturing employment, and growth in high-income<br />

countries, while reducing poverty and enhancing growth in the<br />

developing world. It’s a win-win solution.<br />

It is important, now more than ever, for advanced economies to<br />

continue investing in infrastructure to create jobs and support<br />

growth. Good private investment opportunities are hard to find<br />

amid the current turmoil. Factories continue to carry spare capacity,<br />

and homes and office buildings remain vacant. Infrastructure<br />

investments can fill the void, creating much-needed jobs in the<br />

construction sector, which has been particularly hard hit, and<br />

generating demand for industrial products. Upgrading existing<br />

infrastructure and building new transit nodes, if well chosen,<br />

can enhance future productivity, raising competitiveness and<br />

growth and boosting countries’ ability to repay the investments<br />

in the future. U.S. 10-year Treasury bonds have been trading at<br />

historically low levels since the financial crisis hit. I could therefore<br />

not agree more with my colleague Joseph Stiglitz of Columbia<br />

University, who recently wrote, ”[T]he real answer, at least for<br />

countries such as the US that can borrow at low rates, is simple:<br />

use the money to make high-return investments.”<br />

But what about the fear of unsustainable debt burdens, which<br />

have Western governments searching for budget cuts? Lack of<br />

growth is one of the biggest threats to debt sustainability right<br />

now, and cutting growth-enhancing expenditure is misguided.<br />

And many infrastructure projects can actually be self-financing:<br />

Take, for example, toll bridges or highways. What’s more, it is<br />

often cheaper to keep roads and other infrastructure in good<br />

shape through regular maintenance than to repair them once<br />

they are badly damaged.<br />

With public coffers empty or at best strained, innovative<br />

mechanisms are required to attract private-sector financing<br />

for infrastructure projects, including the use of public-private<br />

partnerships, or PPPs. Well-designed infrastructure investments<br />

can generate secure and attractive returns for private investors<br />

in the current low-growth, high-risk environment. Government<br />

officials on both sides of the Atlantic have drawn up interesting<br />

proposals to encourage PPPs for infrastructure investment.<br />

U.S. President Barack Obama’s administration, for example, has<br />

backed the creation of the National Infrastructure Reinvestment<br />

Bank, which could issue infrastructure bonds, provide subsidies<br />

to qualified infrastructure projects, and provide loan guarantees<br />

to state and local governments. Europe is considering the<br />

implementation of a new Europe 2020 Project Bond Initiative,<br />

which would use public guarantees to leverage private-sector<br />

financing from nontraditional investors, such as pension funds.<br />

But creative investment at home might not be enough to help<br />

high-income countries get out of the crisis. A global infrastructure<br />

initiative should also look to the developing world, where<br />

infrastructure investments can be truly transformative. America’s<br />

history reminds us why: In 1919, when a young lieutenant colonel,<br />

Dwight D. Eisenhower, drove from Washington, D.C., to Oakland,<br />

California, with the Motor Transport Corps convoy, it took him 56<br />

days to cover the 3,250 miles, covering an average of 58 miles<br />

during daily 10-hour rides. Upon his return, he reported that<br />

bridges were destroyed by the convoy, trucks became stuck during<br />

rain, and some roads simply could not accommodate quick, easy<br />

travel. Later, as president, when Eisenhower promoted the 1956<br />

Federal Aid Highway Act, he envisioned that its “impact on the<br />

American economy -- the jobs it would produce in manufacturing<br />

and construction, the rural areas it would open up -- was beyond<br />

calculation.” Similar opportunities to transform economies still<br />

abound in developing countries today.<br />

The infrastructure shortfalls in the developing world are<br />

staggering. Roughly 1.4 billion people have no access to electricity,<br />

22 perspectives <strong>Magazine</strong>