Tata Fixed Tenure Fund Series - 2 Scheme B - Securities and ...

Tata Fixed Tenure Fund Series - 2 Scheme B - Securities and ...

Tata Fixed Tenure Fund Series - 2 Scheme B - Securities and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

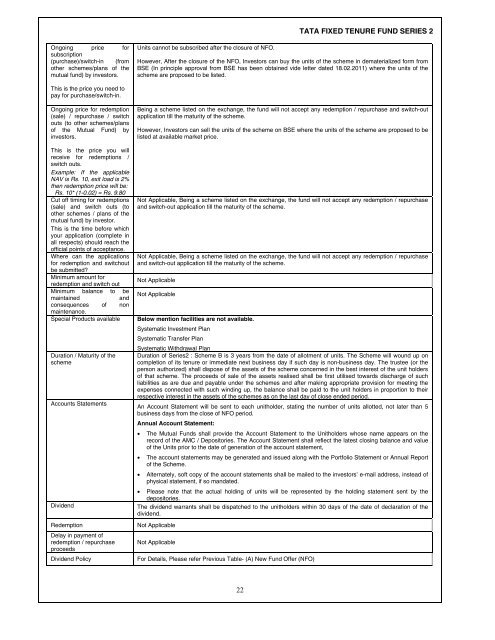

TATA FIXED TENURE FUND SERIES 2<br />

Ongoing price for<br />

subscription<br />

(purchase)/switch-in (from<br />

other schemes/plans of the<br />

mutual fund) by investors.<br />

Units cannot be subscribed after the closure of NFO.<br />

However, After the closure of the NFO, Investors can buy the units of the scheme in dematerialized form from<br />

BSE (In principle approval from BSE has been obtained vide letter dated 18.02.2011) where the units of the<br />

scheme are proposed to be listed.<br />

This is the price you need to<br />

pay for purchase/switch-in.<br />

Ongoing price for redemption<br />

(sale) / repurchase / switch<br />

outs (to other schemes/plans<br />

of the Mutual <strong>Fund</strong>) by<br />

investors.<br />

This is the price you will<br />

receive for redemptions /<br />

switch outs.<br />

Example: If the applicable<br />

NAV is Rs. 10, exit load is 2%<br />

then redemption price will be:<br />

Rs. 10* (1-0.02) = Rs. 9.80<br />

Cut off timing for redemptions<br />

(sale) <strong>and</strong> switch outs (to<br />

other schemes / plans of the<br />

mutual fund) by investor.<br />

This is the time before which<br />

your application (complete in<br />

all respects) should reach the<br />

official points of acceptance.<br />

Where can the applications<br />

for redemption <strong>and</strong> switchout<br />

be submitted?<br />

Minimum amount for<br />

redemption <strong>and</strong> switch out<br />

Minimum balance to be<br />

maintained<br />

<strong>and</strong><br />

consequences of non<br />

maintenance.<br />

Special Products available<br />

Duration / Maturity of the<br />

scheme<br />

Accounts Statements<br />

Dividend<br />

Redemption<br />

Delay in payment of<br />

redemption / repurchase<br />

proceeds<br />

Dividend Policy<br />

Being a scheme listed on the exchange, the fund will not accept any redemption / repurchase <strong>and</strong> switch-out<br />

application till the maturity of the scheme.<br />

However, Investors can sell the units of the scheme on BSE where the units of the scheme are proposed to be<br />

listed at available market price.<br />

Not Applicable, Being a scheme listed on the exchange, the fund will not accept any redemption / repurchase<br />

<strong>and</strong> switch-out application till the maturity of the scheme.<br />

Not Applicable, Being a scheme listed on the exchange, the fund will not accept any redemption / repurchase<br />

<strong>and</strong> switch-out application till the maturity of the scheme.<br />

Not Applicable<br />

Not Applicable<br />

Below mention facilities are not available.<br />

Systematic Investment Plan<br />

Systematic Transfer Plan<br />

Systematic Withdrawal Plan<br />

Duration of <strong>Series</strong>2 : <strong>Scheme</strong> B is 3 years from the date of allotment of units. The <strong>Scheme</strong> will wound up on<br />

completion of its tenure or immediate next business day if such day is non-business day. The trustee (or the<br />

person authorized) shall dispose of the assets of the scheme concerned in the best interest of the unit holders<br />

of that scheme. The proceeds of sale of the assets realised shall be first utilised towards discharge of such<br />

liabilities as are due <strong>and</strong> payable under the schemes <strong>and</strong> after making appropriate provision for meeting the<br />

expenses connected with such winding up, the balance shall be paid to the unit holders in proportion to their<br />

respective interest in the assets of the schemes as on the last day of close ended period.<br />

An Account Statement will be sent to each unitholder, stating the number of units allotted, not later than 5<br />

business days from the close of NFO period.<br />

Annual Account Statement:<br />

• The Mutual <strong>Fund</strong>s shall provide the Account Statement to the Unitholders whose name appears on the<br />

record of the AMC / Depositories. The Account Statement shall reflect the latest closing balance <strong>and</strong> value<br />

of the Units prior to the date of generation of the account statement,<br />

• The account statements may be generated <strong>and</strong> issued along with the Portfolio Statement or Annual Report<br />

of the <strong>Scheme</strong>.<br />

• Alternately, soft copy of the account statements shall be mailed to the investors’ e-mail address, instead of<br />

physical statement, if so m<strong>and</strong>ated.<br />

• Please note that the actual holding of units will be represented by the holding statement sent by the<br />

depositories.<br />

The dividend warrants shall be dispatched to the unitholders within 30 days of the date of declaration of the<br />

dividend.<br />

Not Applicable<br />

Not Applicable<br />

For Details, Please refer Previous Table- (A) New <strong>Fund</strong> Offer (NFO)<br />

22