Recognition Awards - Maadvisor.net

Recognition Awards - Maadvisor.net

Recognition Awards - Maadvisor.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2011 AWARD WINNERS<br />

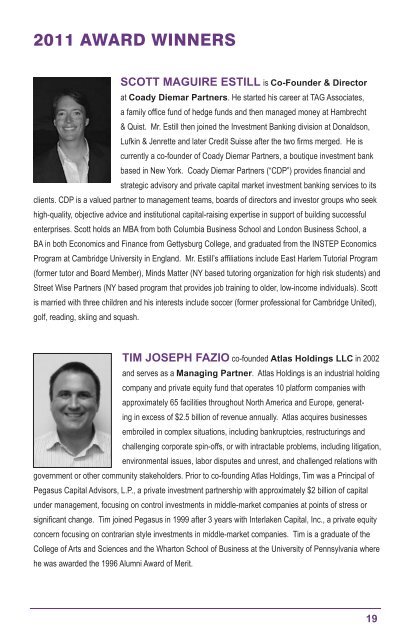

SCOTT MAGUIRE ESTILL is Co-Founder & Director<br />

at Coady Diemar Partners. He started his career at TAG Associates,<br />

a family office fund of hedge funds and then managed money at Hambrecht<br />

& Quist. Mr. Estill then joined the Investment Banking division at Donaldson,<br />

Lufkin & Jenrette and later Credit Suisse after the two firms merged. He is<br />

currently a co-founder of Coady Diemar Partners, a boutique investment bank<br />

based in New York. Coady Diemar Partners (“CDP”) provides financial and<br />

strategic advisory and private capital market investment banking services to its<br />

clients. CDP is a valued partner to management teams, boards of directors and investor groups who seek<br />

high-quality, objective advice and institutional capital-raising expertise in support of building successful<br />

enterprises. Scott holds an MBA from both Columbia Business School and London Business School, a<br />

BA in both Economics and Finance from Gettysburg College, and graduated from the INSTEP Economics<br />

Program at Cambridge University in England. Mr. Estill’s affiliations include East Harlem Tutorial Program<br />

(former tutor and Board Member), Minds Matter (NY based tutoring organization for high risk students) and<br />

Street Wise Partners (NY based program that provides job training to older, low-income individuals). Scott<br />

is married with three children and his interests include soccer (former professional for Cambridge United),<br />

golf, reading, skiing and squash.<br />

TIM JOSEPH FAZIO co-founded Atlas Holdings LLC in 2002<br />

and serves as a Managing Partner. Atlas Holdings is an industrial holding<br />

company and private equity fund that operates 10 platform companies with<br />

approximately 65 facilities throughout North America and Europe, generating<br />

in excess of $2.5 billion of revenue annually. Atlas acquires businesses<br />

embroiled in complex situations, including bankruptcies, restructurings and<br />

challenging corporate spin-offs, or with intractable problems, including litigation,<br />

environmental issues, labor disputes and unrest, and challenged relations with<br />

government or other community stakeholders. Prior to co-founding Atlas Holdings, Tim was a Principal of<br />

Pegasus Capital Advisors, L.P., a private investment partnership with approximately $2 billion of capital<br />

under management, focusing on control investments in middle-market companies at points of stress or<br />

significant change. Tim joined Pegasus in 1999 after 3 years with Interlaken Capital, Inc., a private equity<br />

concern focusing on contrarian style investments in middle-market companies. Tim is a graduate of the<br />

College of Arts and Sciences and the Wharton School of Business at the University of Pennsylvania where<br />

he was awarded the 1996 Alumni Award of Merit.<br />

19