Cannery Lofts Apartments - Wealth Management

Cannery Lofts Apartments - Wealth Management

Cannery Lofts Apartments - Wealth Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

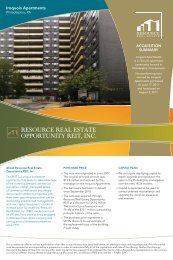

DAYTON, OH<br />

PROPERTY FEATURES<br />

<strong>Cannery</strong> <strong>Lofts</strong> is a 156-unit apartment community. <strong>Cannery</strong> was<br />

constructed as an industrial building in 1838 and subsequently<br />

renovated and converted into an apartment community. The most<br />

recent renovation was completed in 2001. <strong>Cannery</strong> is comprised<br />

of one 5-story and one 6-story building which together encompass<br />

approximately 160,000 rentable square feet of apartment rental<br />

space and approximately 40,000 rentable square feet of retail<br />

space. <strong>Cannery</strong> offers tenants amenities including a fitness center,<br />

clubroom, roof deck, parking and elevators.<br />

<strong>Cannery</strong> <strong>Lofts</strong><br />

<strong>Apartments</strong><br />

PROPERTY LOCATION<br />

<strong>Cannery</strong> is located at the northern end of Dayton’s “Oregon District,”<br />

a neighborhood in downtown Dayton that has numerous restaurant<br />

and entertainment venues. <strong>Cannery</strong> is also situated within five miles<br />

of most of Dayton’s major employers, including Wright Patterson<br />

Air Force Base, the University of Dayton and Miami Valley Hospital.<br />

RISK FACTORS<br />

» No public market currently exists for<br />

our shares of common stock, and we<br />

have no current plans to list our shares<br />

on an exchange.<br />

» We set the offering price arbitrarily.<br />

This price is unrelated to the book<br />

or net value of our assets or to our<br />

expected operating income.<br />

» We have a limited operating history,<br />

and as of June 30, 2011, our total<br />

assets were $44.5 million, and<br />

consisted primarily of $39.0 million<br />

of investments, $900,000 of cash,<br />

and $4.0 million of deferred offering<br />

costs. We have not identified all of<br />

the investments to acquire from the<br />

proceeds of this offering. Consequently,<br />

you will not have the opportunity to<br />

evaluate all of our investments before<br />

we make them.<br />

» We are dependent on our advisor<br />

and its affiliates to select investments<br />

and conduct our operations and this<br />

offering. Our advisor has a limited<br />

operating history and no experience<br />

operating a public company.<br />

» We pay substantial fees and expenses<br />

to our advisor, its affiliates and brokerdealers,<br />

which payments increase the<br />

risk that you will not earn a profit on<br />

your investment.<br />

» Our executive officers and some<br />

of our directors face conflicts of<br />

interest.<br />

» We may lack diversification if we raise<br />

substantially less than the maximum<br />

offering.<br />

» There are restrictions on the ownership<br />

and transferability of our shares of<br />

common stock. See “Description of<br />

Shares – Restriction on Ownership of<br />

Shares”, found in the prospectus.<br />

» Our charter permits us to pay<br />

distributions from any source, including<br />

from offering proceeds, borrowings,<br />

sales of assets or waivers or deferrals<br />

of fees otherwise owed to our advisor.<br />

To the extent these distributions<br />

exceed our net income or net capital<br />

gain, a greater proportion of your<br />

distributions will generally represent<br />

a return of capital as opposed to<br />

current income or gain, as applicable.<br />

Our organizational documents do not<br />

limit the amount of distributions that<br />

we can fund from sources other than<br />

from cash flows from operations.<br />

» We may change our targeted investments<br />

without stockholder consent.<br />

» Some of the other programs sponsored<br />

by our sponsor, Resource Real Estate,<br />

Inc. (“RRE”) have experienced adverse<br />

business developments or conditions.<br />

RESOURCE REAL ESTATE, INC.<br />

One Commerce Square<br />

2005 Market Street, 15th Floor<br />

Philadelphia, PA 19103<br />

For information call (866) 773-4120<br />

or email Sales@ResourceREIT.com<br />

www.ResourceREIT.com<br />

FA4-REIT1-D 101411