Korea as a Knowledge Economy - ISBN: 9780821372012

Korea as a Knowledge Economy - ISBN: 9780821372012

Korea as a Knowledge Economy - ISBN: 9780821372012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Overview of <strong>Korea</strong>’s Development Process until 1997 33<br />

A major contributing factor in <strong>Korea</strong>’s economic transformation is the large amount of<br />

capital accumulation, which w<strong>as</strong> possible because of high <strong>Korea</strong>n savings rates.<br />

Asian growth performance, it is apparent that <strong>Korea</strong> h<strong>as</strong> poured tremendous effort<br />

into upgrading knowledge and human resource b<strong>as</strong>es. <strong>Korea</strong>’s industrialization<br />

process w<strong>as</strong> not only a process of capital accumulation; but also involved the learning<br />

process, a key concept of the knowledge-b<strong>as</strong>ed economy.<br />

Elements of a KE development strategy, such <strong>as</strong> aggressively improving human<br />

resources and domestic technological capability, also played key roles in <strong>Korea</strong>’s economic<br />

development in the p<strong>as</strong>t four decades.<br />

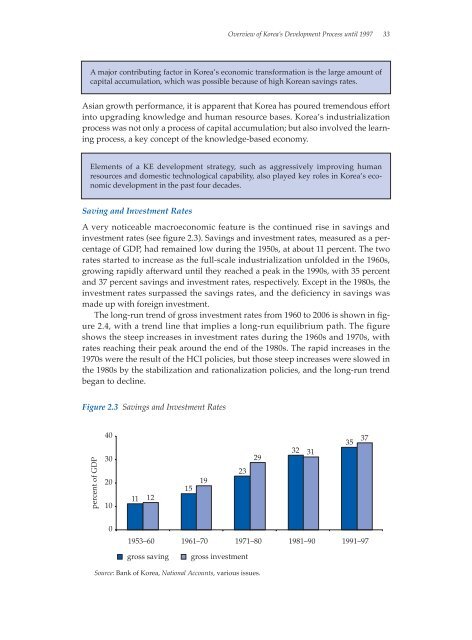

Saving and Investment Rates<br />

A very noticeable macroeconomic feature is the continued rise in savings and<br />

investment rates (see figure 2.3). Savings and investment rates, me<strong>as</strong>ured <strong>as</strong> a percentage<br />

of GDP, had remained low during the 1950s, at about 11 percent. The two<br />

rates started to incre<strong>as</strong>e <strong>as</strong> the full-scale industrialization unfolded in the 1960s,<br />

growing rapidly afterward until they reached a peak in the 1990s, with 35 percent<br />

and 37 percent savings and investment rates, respectively. Except in the 1980s, the<br />

investment rates surp<strong>as</strong>sed the savings rates, and the deficiency in savings w<strong>as</strong><br />

made up with foreign investment.<br />

The long-run trend of gross investment rates from 1960 to 2006 is shown in figure<br />

2.4, with a trend line that implies a long-run equilibrium path. The figure<br />

shows the steep incre<strong>as</strong>es in investment rates during the 1960s and 1970s, with<br />

rates reaching their peak around the end of the 1980s. The rapid incre<strong>as</strong>es in the<br />

1970s were the result of the HCI policies, but those steep incre<strong>as</strong>es were slowed in<br />

the 1980s by the stabilization and rationalization policies, and the long-run trend<br />

began to decline.<br />

Figure 2.3 Savings and Investment Rates<br />

percent of GDP<br />

40<br />

30<br />

20<br />

10<br />

11<br />

12<br />

15<br />

19<br />

23<br />

29<br />

32<br />

31<br />

35<br />

37<br />

0<br />

1953–60 1961–70 1971–80 1981–90 1991–97<br />

gross saving<br />

gross investment<br />

Source: Bank of <strong>Korea</strong>, National Accounts, various issues.