DIRECT TAX - Nangia & Co

DIRECT TAX - Nangia & Co

DIRECT TAX - Nangia & Co

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

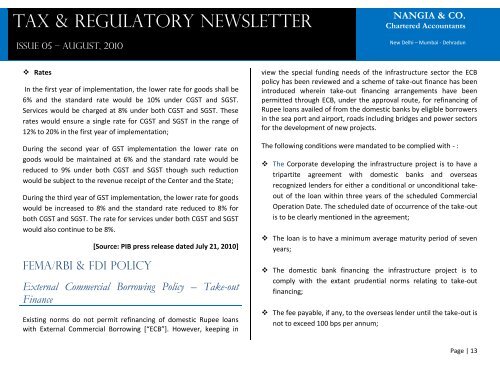

Tax & Regulatory Newsletter<br />

Issue 05 – AUGUST, 2010<br />

NANGIA & CO.<br />

Chartered Accountants<br />

New Delhi – Mumbai - Dehradun<br />

Rates<br />

In the first year of implementation, the lower rate for goods shall be<br />

6% and the standard rate would be 10% under CGST and SGST.<br />

Services would be charged at 8% under both CGST and SGST. These<br />

rates would ensure a single rate for CGST and SGST in the range of<br />

12% to 20% in the first year of implementation;<br />

During the second year of GST implementation the lower rate on<br />

goods would be maintained at 6% and the standard rate would be<br />

reduced to 9% under both CGST and SGST though such reduction<br />

would be subject to the revenue receipt of the Center and the State;<br />

During the third year of GST implementation, the lower rate for goods<br />

would be increased to 8% and the standard rate reduced to 8% for<br />

both CGST and SGST. The rate for services under both CGST and SGST<br />

would also continue to be 8%.<br />

FEMA/RBI & FDI POLICY<br />

[Source: PIB press release dated July 21, 2010]<br />

External <strong>Co</strong>mmercial Borrowing Policy – Take-out<br />

Finance<br />

Existing norms do not permit refinancing of domestic Rupee loans<br />

with External <strong>Co</strong>mmercial Borrowing *“ECB”+. However, keeping in<br />

view the special funding needs of the infrastructure sector the ECB<br />

policy has been reviewed and a scheme of take-out finance has been<br />

introduced wherein take-out financing arrangements have been<br />

permitted through ECB, under the approval route, for refinancing of<br />

Rupee loans availed of from the domestic banks by eligible borrowers<br />

in the sea port and airport, roads including bridges and power sectors<br />

for the development of new projects.<br />

The following conditions were mandated to be complied with - :<br />

The <strong>Co</strong>rporate developing the infrastructure project is to have a<br />

tripartite agreement with domestic banks and overseas<br />

recognized lenders for either a conditional or unconditional takeout<br />

of the loan within three years of the scheduled <strong>Co</strong>mmercial<br />

Operation Date. The scheduled date of occurrence of the take-out<br />

is to be clearly mentioned in the agreement;<br />

The loan is to have a minimum average maturity period of seven<br />

years;<br />

The domestic bank financing the infrastructure project is to<br />

comply with the extant prudential norms relating to take-out<br />

financing;<br />

The fee payable, if any, to the overseas lender until the take-out is<br />

not to exceed 100 bps per annum;<br />

Page | 13