Chapter 6 APPENDIX B - Pearsoncmg.com

Chapter 6 APPENDIX B - Pearsoncmg.com

Chapter 6 APPENDIX B - Pearsoncmg.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Chapter</strong> 6 Bonds 181<br />

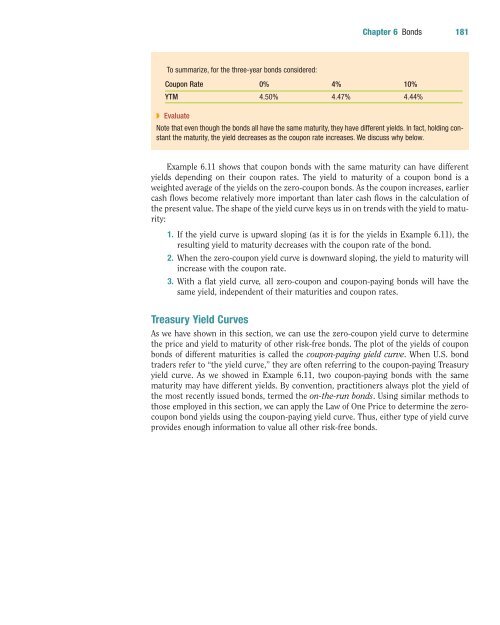

To summarize, for the three-year bonds considered:<br />

Coupon Rate 0% 4% 10%<br />

YTM 4.50% 4.47% 4.44%<br />

◗ Evaluate<br />

Note that even though the bonds all have the same maturity, they have different yields. In fact, holding constant<br />

the maturity, the yield decreases as the coupon rate increases. We discuss why below.<br />

Example 6.11 shows that coupon bonds with the same maturity can have different<br />

yields depending on their coupon rates. The yield to maturity of a coupon bond is a<br />

weighted average of the yields on the zero-coupon bonds. As the coupon increases, earlier<br />

cash flows be<strong>com</strong>e relatively more important than later cash flows in the calculation of<br />

the present value. The shape of the yield curve keys us in on trends with the yield to maturity:<br />

1. If the yield curve is upward sloping (as it is for the yields in Example 6.11), the<br />

resulting yield to maturity decreases with the coupon rate of the bond.<br />

2. When the zero-coupon yield curve is downward sloping, the yield to maturity will<br />

increase with the coupon rate.<br />

3. With a flat yield curve, all zero-coupon and coupon-paying bonds will have the<br />

same yield, independent of their maturities and coupon rates.<br />

Treasury Yield Curves<br />

As we have shown in this section, we can use the zero-coupon yield curve to determine<br />

the price and yield to maturity of other risk-free bonds. The plot of the yields of coupon<br />

bonds of different maturities is called the coupon-paying yield curve. When U.S. bond<br />

traders refer to “the yield curve,” they are often referring to the coupon-paying Treasury<br />

yield curve. As we showed in Example 6.11, two coupon-paying bonds with the same<br />

maturity may have different yields. By convention, practitioners always plot the yield of<br />

the most recently issued bonds, termed the on-the-run bonds. Using similar methods to<br />

those employed in this section, we can apply the Law of One Price to determine the zerocoupon<br />

bond yields using the coupon-paying yield curve. Thus, either type of yield curve<br />

provides enough information to value all other risk-free bonds.