- Page 1 and 2:

Estate Planning

- Page 3 and 4:

Forestland and Estate Planning Adva

- Page 5 and 6:

Essential Steps in Estate Planning

- Page 7 and 8:

Selecting Your Team 1. YOU 4. Trust

- Page 9 and 10:

Selecting Your Team 4. Trust office

- Page 11 and 12:

Reviewing Your Plan 1. Make sure th

- Page 13 and 14:

Uses of Wills 4. Provide for contin

- Page 15 and 16:

Uses of Trusts 1. Retain management

- Page 17 and 18:

Estate Planning Tools Specific: •

- Page 19 and 20:

Estate Planning Toolkit Just an int

- Page 21 and 22:

Gifts Gifts with a value less than

- Page 23 and 24:

Gifts In addition, there is an UNLI

- Page 25 and 26:

Gifts Advantages: Permits you to tr

- Page 27 and 28:

Bequests The giving of money or pro

- Page 29 and 30:

Bequests Valuation date is decedent

- Page 31 and 32:

Bequests Disadvantage: Inability y

- Page 33 and 34:

Marital Deduction Disadvantage: Doe

- Page 35 and 36:

Effective Exemption Amount The “u

- Page 37 and 38:

Effective Exemption Amount Once cum

- Page 39 and 40:

Bipartisan Estate Tax Bills Current

- Page 41 and 42:

Effective Exemption Amount As well,

- Page 43 and 44:

Effective Exemption Amount Disadvan

- Page 45 and 46:

Special Use Valuation Before 1998 t

- Page 47 and 48:

Special Use Valuation Advantages: R

- Page 49 and 50:

Special Use Valuation Elect to use

- Page 51 and 52:

Special Use Valuation The property

- Page 53 and 54:

Special Use Valuation … benefits

- Page 55 and 56:

Special Use Valuation Non‐qualifi

- Page 57 and 58:

Special Use Valuation At least one

- Page 59 and 60:

Special Use Valuation … in accord

- Page 61 and 62:

Exclusion for Interest in a Family

- Page 63 and 64:

Exclusion for a Qualified Conservat

- Page 65 and 66:

Exclusion for a Qualified Conservat

- Page 67 and 68:

Exclusion for a Qualified Conservat

- Page 69 and 70:

Exclusion for a Qualified Conservat

- Page 71 and 72:

Exclusion for a Qualified Conservat

- Page 73 and 74:

Disclaimer Advantage: Lets the tran

- Page 75 and 76: Disclaimer The transferee must not

- Page 77 and 78: Deferral and Extension of Estate Ta

- Page 79 and 80: Deferral and Extension TRA and EGTR

- Page 81 and 82: Deferral and Extension Advantages R

- Page 83 and 84: Other Tools Estate planning profess

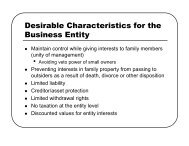

- Page 85 and 86: Forms of Business Organization Two

- Page 87 and 88: Family Limited Partnership The limi

- Page 89 and 90: Limited Liability Company But unlik

- Page 91 and 92: Lessons Learned But BE AWARE the IR

- Page 93 and 94: Lessons Learned The partners/member

- Page 95 and 96: Trusts An arrangement by which a pe

- Page 97 and 98: Lifetime Trusts A LIFETIME TRUST is

- Page 99 and 100: Testamentary Trusts A TESTAMENTARY

- Page 101 and 102: Four Kinds of Trusts and What They

- Page 103 and 104: Four Kinds of Trusts Qualified Term

- Page 105 and 106: Other Tools Generation‐skipping t

- Page 107 and 108: Economic Advantage of Estate Planni

- Page 109 and 110: Family Assets The couple’s joint

- Page 111 and 112: Hypothetical Family In addition, it

- Page 113 and 114: Hypothetical Family Say the husband

- Page 115 and 116: “I Love You” Will Is a guarante

- Page 117 and 118: Value of the Joint Estate at the Hu

- Page 119 and 120: Federal Estate Tax Payable at the W

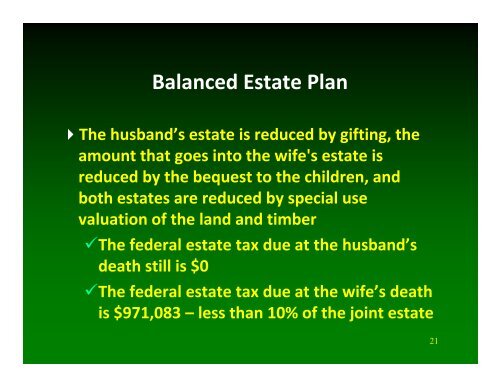

- Page 121 and 122: Balanced Estate Plan The effective

- Page 123 and 124: Balanced Estate Plan The effective

- Page 125: Balanced Estate Plan Special use va

- Page 129 and 130: Federal Estate Tax Payable at the W

- Page 131: Additional Strategies … children