Contents - Genting Group

Contents - Genting Group

Contents - Genting Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GENTING BERHAD • Annual Report 2001<br />

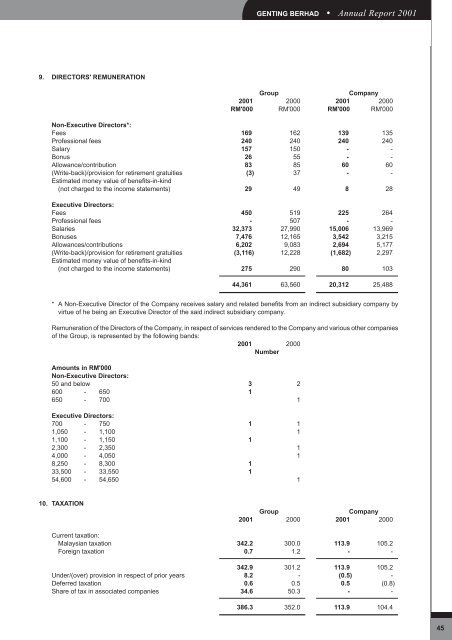

9. DIRECTORS' REMUNERATION<br />

<strong>Group</strong> Company<br />

2001 2000 2001 2000<br />

RM'000 RM'000 RM'000 RM'000<br />

Non-Executive Directors*:<br />

Fees 169 162 139 135<br />

Professional fees 240 240 240 240<br />

Salary 157 150 - -<br />

Bonus 26 55 - -<br />

Allowance/contribution 83 85 60 60<br />

(Write-back)/provision for retirement gratuities (3) 37 - -<br />

Estimated money value of benefits-in-kind<br />

(not charged to the income statements) 29 49 8 28<br />

Executive Directors:<br />

Fees 450 519 225 264<br />

Professional fees - 507 - -<br />

Salaries 32,373 27,990 15,006 13,969<br />

Bonuses 7,476 12,165 3,542 3,215<br />

Allowances/contributions 6,202 9,083 2,694 5,177<br />

(Write-back)/provision for retirement gratuities (3,116) 12,228 (1,682) 2,297<br />

Estimated money value of benefits-in-kind<br />

(not charged to the income statements) 275 290 80 103<br />

44,361 63,560 20,312 25,488<br />

* A Non-Executive Director of the Company receives salary and related benefits from an indirect subsidiary company by<br />

virtue of he being an Executive Director of the said indirect subsidiary company.<br />

Remuneration of the Directors of the Company, in respect of services rendered to the Company and various other companies<br />

of the <strong>Group</strong>, is represented by the following bands:<br />

2001 2000<br />

Number<br />

Amounts in RM'000<br />

Non-Executive Directors:<br />

50 and below 3 2<br />

600 - 650 1<br />

650 - 700 1<br />

Executive Directors:<br />

700 - 750 1 1<br />

1,050 - 1,100 1<br />

1,100 - 1,150 1<br />

2,300 - 2,350 1<br />

4,000 - 4,050 1<br />

8,250 - 8,300 1<br />

33,500 - 33,550 1<br />

54,600 - 54,650 1<br />

10. TAXATION<br />

<strong>Group</strong> Company<br />

2001 2000 2001 2000<br />

Current taxation:<br />

Malaysian taxation 342.2 300.0 113.9 105.2<br />

Foreign taxation 0.7 1.2 - -<br />

342.9 301.2 113.9 105.2<br />

Under/(over) provision in respect of prior years 8.2 - (0.5) -<br />

Deferred taxation 0.6 0.5 0.5 (0.8)<br />

Share of tax in associated companies 34.6 50.3 - -<br />

386.3 352.0 113.9 104.4<br />

45