annual report - inner - TOTAL Nigeria Plc

annual report - inner - TOTAL Nigeria Plc

annual report - inner - TOTAL Nigeria Plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

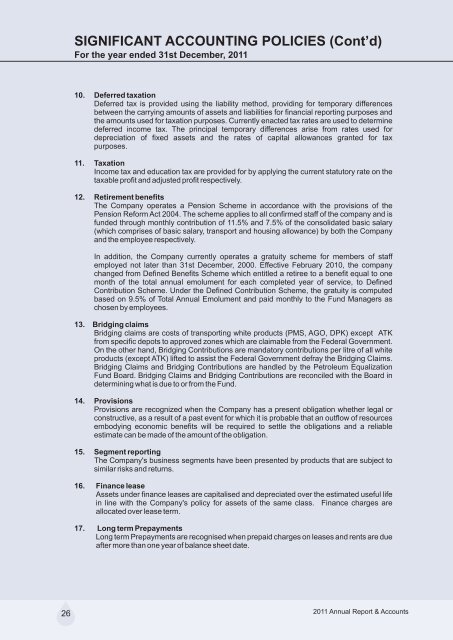

SIGNIFICANT ACCOUNTING POLICIES (Cont’d)<br />

For the year ended 31st December, 2011<br />

10. Deferred taxation<br />

Deferred tax is provided using the liability method, providing for temporary differences<br />

between the carrying amounts of assets and liabilities for financial <strong>report</strong>ing purposes and<br />

the amounts used for taxation purposes. Currently enacted tax rates are used to determine<br />

deferred income tax. The principal temporary differences arise from rates used for<br />

depreciation of fixed assets and the rates of capital allowances granted for tax<br />

purposes.<br />

11. Taxation<br />

Income tax and education tax are provided for by applying the current statutory rate on the<br />

taxable profit and adjusted profit respectively.<br />

12. Retirement benefits<br />

The Company operates a Pension Scheme in accordance with the provisions of the<br />

Pension Reform Act 2004. The scheme applies to all confirmed staff of the company and is<br />

funded through monthly contribution of 11.5% and 7.5% of the consolidated basic salary<br />

(which comprises of basic salary, transport and housing allowance) by both the Company<br />

and the employee respectively.<br />

In addition, the Company currently operates a gratuity scheme for members of staff<br />

employed not later than 31st December, 2000. Effective February 2010, the company<br />

changed from Defined Benefits Scheme which entitled a retiree to a benefit equal to one<br />

month of the total <strong>annual</strong> emolument for each completed year of service, to Defined<br />

Contribution Scheme. Under the Defined Contribution Scheme, the gratuity is computed<br />

based on 9.5% of Total Annual Emolument and paid monthly to the Fund Managers as<br />

chosen by employees.<br />

13. Bridging claims<br />

Bridging claims are costs of transporting white products (PMS, AGO, DPK) except ATK<br />

from specific depots to approved zones which are claimable from the Federal Government.<br />

On the other hand, Bridging Contributions are mandatory contributions per litre of all white<br />

products (except ATK) lifted to assist the Federal Government defray the Bridging Claims.<br />

Bridging Claims and Bridging Contributions are handled by the Petroleum Equalization<br />

Fund Board. Bridging Claims and Bridging Contributions are reconciled with the Board in<br />

determining what is due to or from the Fund.<br />

14. Provisions<br />

Provisions are recognized when the Company has a present obligation whether legal or<br />

constructive, as a result of a past event for which it is probable that an outflow of resources<br />

embodying economic benefits will be required to settle the obligations and a reliable<br />

estimate can be made of the amount of the obligation.<br />

15. Segment <strong>report</strong>ing<br />

The Company's business segments have been presented by products that are subject to<br />

similar risks and returns.<br />

16. Finance lease<br />

Assets under finance leases are capitalised and depreciated over the estimated useful life<br />

in line with the Company's policy for assets of the same class. Finance charges are<br />

allocated over lease term.<br />

17. Long term Prepayments<br />

Long term Prepayments are recognised when prepaid charges on leases and rents are due<br />

after more than one year of balance sheet date.<br />

26 2011 Annual Report & Accounts