11-12 Headland Road

11-12 Headland Road

11-12 Headland Road

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

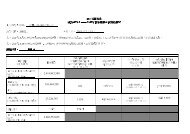

Review of Operations – Business in Hong Kong • Land Bank<br />

At 31 December 2010, the Group had a land bank in Hong Kong with a total attributable gross floor area of approximately 21.3 million<br />

square feet, made up as follows:<br />

Attributable gross floor area<br />

(million sq.ft.)<br />

Properties held for or under development 9.3<br />

Stock of unsold property units 1.6<br />

Completed investment properties 9.4<br />

Hotel properties 1.0<br />

Total: 21.3<br />

In addition, the Group held rentable car<br />

parking spaces with a total area of around<br />

2.8 million square feet.<br />

The Group remains optimistic about the<br />

prospects for the Hong Kong property<br />

market and has therefore continued to<br />

engage in the acquisition of old buildings in<br />

the urban areas for redevelopment in<br />

tandem with the Government’s policy<br />

initiative on promoting urban renewal. At<br />

the same time, the Group’s agricultural<br />

land reserve includes significant holdings<br />

in the new development areas as designated<br />

by the Government. Both of these sources<br />

are expected to bring about a significant<br />

increase in the Group’s development land<br />

bank in future years. Since the acquisition<br />

cost of old buildings and the premium<br />

payable for agricultural land-use<br />

conversion compare favourably with the<br />

transacted prices of land sites offered at<br />

public auctions, such approach to land<br />

banking has the advantage of low cost and<br />

therefore a higher contribution to earnings.<br />

(I) Redevelopment of old buildings in the urban areas<br />

A. Newly-acquired projects<br />

As mentioned above, the Group believes that the redevelopment of old buildings in the urban areas will provide a source of land supply<br />

which requires lower cost and hence yields higher margin. Since 2009, a number of old building projects have been acquired and efforts<br />

are continuing to source additional old properties for redevelopment. A summary of the projects which have been acquired is as follows:<br />

Project name and location<br />

A. Projects with ownership fully consolidated:<br />

1. 30-38 Po Tuck Street and<br />

36 Clarence Terrace, Hong Kong (Note 2)<br />

2. 23-33 Shing On Street<br />

Sai Wan Ho, Hong Kong (Note 2)<br />

3. 186-188 Tai Po <strong>Road</strong><br />

Sham Shui Po, Kowloon (Note 2)<br />

4. 75-81 Sa Po <strong>Road</strong><br />

Kowloon City, Kowloon<br />

Site<br />

area<br />

(sq.ft.)<br />

Expected gross<br />

floor area in future<br />

redevelopment<br />

(sq.ft.)<br />

Expected year<br />

of sales launch<br />

(Note 1)<br />

7,310 61,103 20<strong>12</strong><br />

4,699 39,942 20<strong>12</strong><br />

8,234 70,242 20<strong>11</strong><br />

3,582 32,238 20<strong>12</strong><br />

44<br />

Henderson Land Development Company Limited<br />

Annual Report 2010