INVESTMENT SUMMIT - Euromoney Institutional Investor PLC

INVESTMENT SUMMIT - Euromoney Institutional Investor PLC

INVESTMENT SUMMIT - Euromoney Institutional Investor PLC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

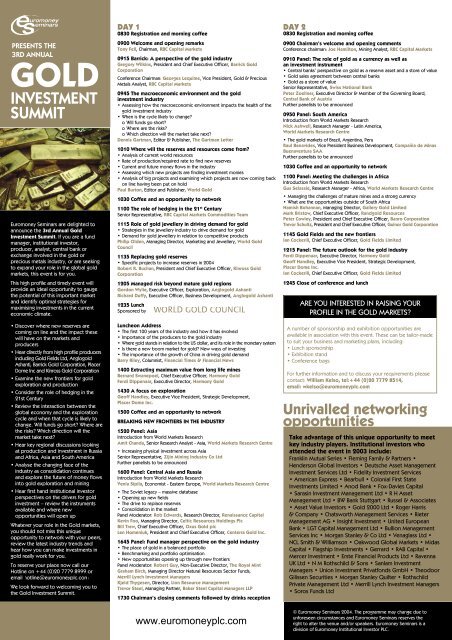

PRESENTS THE<br />

3RD ANNUAL<br />

GOLD<br />

<strong>INVESTMENT</strong><br />

<strong>SUMMIT</strong><br />

<strong>Euromoney</strong> Seminars are delighted to<br />

announce the 3rd Annual Gold<br />

Investment Summit. If you are a fund<br />

manager, institutional investor,<br />

producer, analyst, central bank or<br />

exchange involved in the gold or<br />

precious metals industry, or are seeking<br />

to expand your role in the global gold<br />

markets, this event is for you.<br />

This high profile and timely event will<br />

provide an ideal opportunity to gauge<br />

the potential of this important market<br />

and identify optimal strategies for<br />

maximising investments in the current<br />

economic climate.<br />

• Discover where new reserves are<br />

coming on line and the impact these<br />

will have on the markets and<br />

producers<br />

• Hear directly from high profile producers<br />

including Gold Fields Ltd, Anglogold<br />

Ashanti, Barrick Gold Corporation, Placer<br />

Dome Inc and Kinross Gold Corporation<br />

• Examine the new frontiers for gold<br />

exploration and production<br />

• Consider the role of hedging in the<br />

21st Century<br />

• Review the interaction between the<br />

global economy and the exploration<br />

cycle and when that cycle is likely to<br />

change. Will funds go short Where are<br />

the risks Which direction will the<br />

market take next<br />

• Hear key regional discussions looking<br />

at production and investment in Russia<br />

and Africa, Asia and South America<br />

• Analyse the changing face of the<br />

industry as consolidation continues<br />

and explore the future of money flows<br />

into gold exploration and mining<br />

• Hear first hand institutional investor<br />

perspectives on the drivers for gold<br />

investment – review the instruments<br />

available and where new<br />

opportunities will open up<br />

Whatever your role in the Gold markets,<br />

you should not miss this unique<br />

opportunity to network with your peers,<br />

review the latest industry trends and<br />

hear how you can make investments in<br />

gold really work for you.<br />

To reserve your place now call our<br />

Hotline on +44 (0)20 7779 8999 or<br />

email hotline@euromoneyplc.com<br />

We look forward to welcoming you to<br />

the Gold Investment Summit.<br />

DAY 1<br />

0830 Registration and morning coffee<br />

0900 Welcome and opening remarks<br />

Tony Fell, Chairman, RBC Capital Markets<br />

0915 Barrick: A perspective of the gold industry<br />

Gregory Wilkins, President and Chief Executive Officer, Barrick Gold<br />

Corporation<br />

Conference Chairman: Georges Lequime, Vice President, Gold & Precious<br />

Metals Analyst, RBC Capital Markets<br />

0945 The macroeconomic environment and the gold<br />

investment industry<br />

• Assessing how the macroeconomic environment impacts the health of the<br />

gold investment industry<br />

• When is the cycle likely to change<br />

o Will funds go short<br />

o Where are the risks<br />

o Which direction will the market take next<br />

Dennis Gartman, Editor & Publisher, The Gartman Letter<br />

1010 Where will the reserves and resources come from<br />

• Analysis of current world resources<br />

• Rate of production/required rate to find new reserves<br />

• Current and future money flows in the industry<br />

• Assessing which new projects are finding investment monies<br />

• Analysis of big projects and examining which projects are now coming back<br />

on line having been put on hold<br />

Paul Burton, Editor and Publisher, World Gold<br />

1030 Coffee and an opportunity to network<br />

1100 The role of hedging in the 21 st Century<br />

Senior Representative, RBC Capital Markets Commodities Team<br />

1115 Role of gold jewellery in driving demand for gold<br />

• Strategies in the jewellery industry to drive demand for gold<br />

• Demand for gold jewellery in relation to competitive products<br />

Philip Olden, Managing Director, Marketing and Jewellery, World Gold<br />

Council<br />

1135 Replacing gold reserves<br />

• Specific projects to increase reserves in 2004<br />

Robert R. Buchan, President and Chief Executive Officer, Kinross Gold<br />

Corporation<br />

1205 Managed risk beyond mature gold regions<br />

Gordon Wylie, Executive Officer, Exploration, Anglogold Ashanti<br />

Richard Duffy, Executive Officer, Business Development, Anglogold Ashanti<br />

1235 Lunch<br />

Sponsored by<br />

Luncheon Address<br />

• The first 100 years of the industry and how it has evolved<br />

• Importance of the producers to the gold industry<br />

• Where gold stands in relation to the US dollar, and its role in the monetary system<br />

• Is there a new boom market for gold New ways of investing<br />

• The importance of the growth of China in driving gold demand<br />

Barry Riley, Columnist, Financial Times & Financial News<br />

1400 Extracting maximum value from long life mines<br />

Bernard Swanepoel, Chief Executive Officer, Harmony Gold<br />

Ferdi Dippenaar, Executive Director, Harmony Gold<br />

1430 A focus on exploration<br />

Geoff Handley, Executive Vice President, Strategic Development,<br />

Placer Dome Inc.<br />

1500 Coffee and an opportunity to network<br />

BREAKING NEW FRONTIERS IN THE INDUSTRY<br />

1520 Panel: Asia<br />

Introduction from World Markets Research<br />

Amit Chanda, Senior Research Analyst - Asia, World Markets Research Centre<br />

• Increasing physical investment across Asia<br />

Senior Representative, Zijin Mining Industry Co Ltd<br />

Further panelists to be announced<br />

1600 Panel: Central Asia and Russia<br />

Introduction from World Markets Research<br />

Venla Sipila, Economist - Eastern Europe, World Markets Research Centre<br />

• The Soviet legacy – massive database<br />

• Opening up new fields<br />

• The drive to replace reserves<br />

• Consolidation in the market<br />

Panel Moderator: Rob Edwards, Research Director, Renaissance Capital<br />

Kevin Foo, Managing Director, Celtic Resources Holdings Plc<br />

Bill Trew, Chief Executive Officer, Oxus Gold plc<br />

Len Homeniuk, President and Chief Executive Officer, Centerra Gold Inc.<br />

1645 Panel: Fund manager perspective on the gold industry<br />

• The place of gold in a balanced portfolio<br />

• Benchmarking and portfolio optimisation<br />

• New opportunities opening up through new frontiers<br />

Panel Moderator: Robert Guy, Non-Executive Director, The Royal Mint<br />

Graham Birch, Managing Director Natural Resources Sector Funds,<br />

Merrill Lynch Investment Managers<br />

Kjeld Thygesen, Director, Lion Resource Management<br />

Trevor Steel, Managing Partner, Baker Steel Capital Managers LLP<br />

1730 Chairman’s closing comments followed by drinks reception<br />

DAY 2<br />

0830 Registration and morning coffee<br />

0900 Chairman’s welcome and opening comments<br />

Conference chairman: Joe Hamilton, Mining Analyst, RBC Capital Markets<br />

0910 Panel: The role of gold as a currency as well as<br />

an investment instrument<br />

• Central banks’ perspective on gold as a reserve asset and a store of value<br />

• Gold sales agreement between central banks<br />

• Gold as a store of value<br />

Senior Representative, Swiss National Bank<br />

Peter Zoellner, Executive Director & Member of the Governing Board,<br />

Central Bank of Austria<br />

Further panelists to be announced<br />

0950 Panel: South America<br />

Introduction from World Markets Research<br />

Nick Ashwell, Research Manager - Latin America,<br />

World Markets Research Centre<br />

• The gold markets of Brazil, Argentina, Peru<br />

Raul Benavides, Vice President Business Development, Compañia de Minas<br />

Buenaventura SAA<br />

Further panelists to be announced<br />

1030 Coffee and an opportunity to network<br />

1100 Panel: Meeting the challenges in Africa<br />

Introduction from World Markets Research<br />

Gus Selassie, Research Manager - Africa, World Markets Research Centre<br />

• Managing the challenges of mature mines and a strong currency<br />

• What are the opportunities outside of South Africa<br />

Hamish Bohannan, Managing Director, Gallery Gold Limited<br />

Mark Bristow, Chief Executive Officer, Randgold Resources<br />

Peter Cowley, President and Chief Executive Officer, Banro Corporation<br />

Trevor Schultz, President and Chief Executive Officer, Guinor Gold Corporation<br />

1145 Gold Fields and the new frontiers<br />

Ian Cockerill, Chief Executive Officer, Gold Fields Limited<br />

1215 Panel: The future outlook for the gold industry<br />

Ferdi Dippenaar, Executive Director, Harmony Gold<br />

Geoff Handley, Executive Vice President, Strategic Development,<br />

Placer Dome Inc.<br />

Ian Cockerill, Chief Executive Officer, Gold Fields Limited<br />

1245 Close of conference and lunch<br />

ARE YOU INTERESTED IN RAISING YOUR<br />

PROFILE IN THE GOLD MARKETS<br />

A number of sponsorship and exhibition opportunities are<br />

available in association with this event. These can be tailor-made<br />

to suit your business and marketing plans, including:<br />

• Lunch sponsorship<br />

• Exhibition stand<br />

• Conference bags<br />

For further information and to discuss your requirements please<br />

contact: William Kelso, tel:+44 (0)20 7779 8514,<br />

email: wkelso@euromoneyplc.com<br />

Unrivalled networking<br />

opportunities<br />

Take advantage of this unique opportunity to meet<br />

key industry players. <strong>Institutional</strong> investors who<br />

attended the event in 2003 include:<br />

Franklin Mutual Series • Fleming Family & Partners •<br />

Henderson Global <strong>Investor</strong>s • Deutsche Asset Management<br />

Investment Services Ltd • Fidelity Investment Services<br />

• American Express • Bearbull • Colonial First State<br />

Investments Limited • Anod Bank • Fox-Davies Capital<br />

• Sarasin Investment Management Ltd • R H Asset<br />

Management Ltd • BW Bank Stuttgart • Russel & Associates<br />

• Asset Value <strong>Investor</strong>s • Gold 2000 Ltd • Roger Harris<br />

& Company • Chatsworth Management Services • Rieter<br />

Management AG • Insight Investment • United European<br />

Bank • LGT Capital Management Ltd • Bullion Management<br />

Services Inc • Morgan Stanley & Co Ltd • Venaglass Ltd •<br />

NCL Smith & Williamson • Oakwood Global Markets • Midas<br />

Capital • Flagship Investments • Gerrard • RAB Capital •<br />

Mercer Investment • Erste Financial Products Ltd • Ravenna<br />

UK Ltd • N M Rothschild & Sons • Sanlam Investment<br />

Managers • Union Investment Privatfonds GmbH • Theodoor<br />

Gilissen Securities • Morgan Stanley Quilter • Rothschild<br />

Private Management Ltd • Merrill Lynch Investment Managers<br />

• Soros Funds Ltd<br />

www.euromoneyplc.com<br />

© <strong>Euromoney</strong> Seminars 2004. The programme may change due to<br />

unforeseen circumstances and <strong>Euromoney</strong> Seminars reserves the<br />

right to alter the venue and/or speakers. <strong>Euromoney</strong> Seminars is a<br />

division of <strong>Euromoney</strong> <strong>Institutional</strong> <strong>Investor</strong> <strong>PLC</strong>.