Comprehensive Annual Financial Report - South Suburban Parks ...

Comprehensive Annual Financial Report - South Suburban Parks ...

Comprehensive Annual Financial Report - South Suburban Parks ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

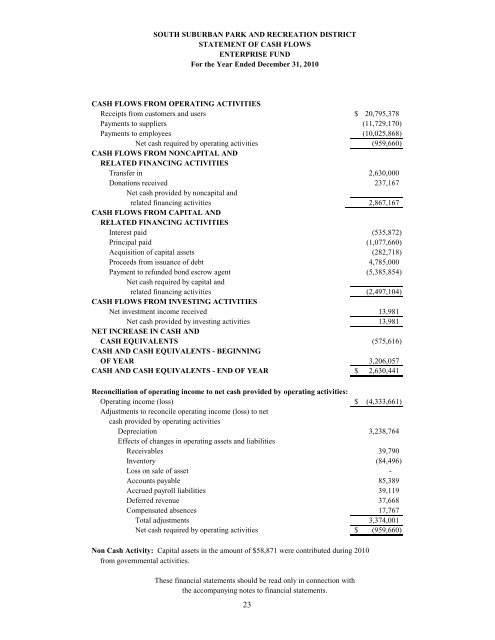

SOUTH SUBURBAN PARK AND RECREATION DISTRICT<br />

STATEMENT OF CASH FLOWS<br />

ENTERPRISE FUND<br />

For the Year Ended December 31, 2010<br />

CASH FLOWS FROM OPERATING ACTIVITIES<br />

Receipts from customers and users $ 20,795,378<br />

Payments to suppliers (11,729,170)<br />

Payments to employees (10,025,868)<br />

Net cash required by operating activities (959,660)<br />

CASH FLOWS FROM NONCAPITAL AND<br />

RELATED FINANCING ACTIVITIES<br />

Transfer in 2,630,000<br />

Donations received 237,167<br />

Net cash provided by noncapital and<br />

related financing activities 2,867,167<br />

CASH FLOWS FROM CAPITAL AND<br />

RELATED FINANCING ACTIVITIES<br />

Interest paid (535,872)<br />

Principal paid (1,077,660)<br />

Acquisition of capital assets (282,718)<br />

Proceeds from issuance of debt 4,785,000<br />

Payment to refunded bond escrow agent (5,385,854)<br />

Net cash required by capital and<br />

related financing activities (2,497,104)<br />

CASH FLOWS FROM INVESTING ACTIVITIES<br />

Net investment income received 13,981<br />

Net cash provided by investing activities 13,981<br />

NET INCREASE IN CASH AND<br />

CASH EQUIVALENTS (575,616)<br />

CASH AND CASH EQUIVALENTS - BEGINNING<br />

OF YEAR 3,206,057<br />

CASH AND CASH EQUIVALENTS - END OF YEAR $ 2,630,441<br />

Reconciliation of operating income to net cash provided by operating activities:<br />

Operating income (loss) $ (4,333,661)<br />

Adjustments to reconcile operating income (loss) to net<br />

cash provided by operating activities<br />

Depreciation 3,238,764<br />

Effects of changes in operating assets and liabilities<br />

Receivables 39,790<br />

Inventory (84,496)<br />

Loss on sale of asset -<br />

Accounts payable 85,389<br />

Accrued payroll liabilities 39,119<br />

Deferred revenue 37,668<br />

Compensated absences 17,767<br />

Total adjustments 3,374,001<br />

Net cash required by operating activities $ (959,660)<br />

Non Cash Activity: Capital assets in the amount of $58,871 were contributed during 2010<br />

from governmental activities.<br />

These financial statements should be read only in connection with<br />

the accompanying notes to financial statements.<br />

23