download - South West Alliance of Rural Health

download - South West Alliance of Rural Health

download - South West Alliance of Rural Health

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

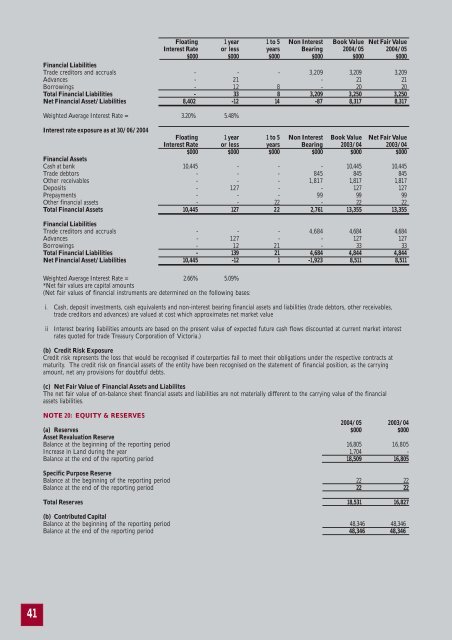

Floating 1 year 1 to 5 Non Interest Book Value Net Fair Value<br />

Interest Rate or less years Bearing 2004/05 2004/05<br />

$000 $000 $000 $000 $000 $000<br />

Financial Liabilities<br />

Trade creditors and accruals - - - 3,209 3,209 3,209<br />

Advances - 21 - 21 21<br />

Borrowings - 12 8 - 20 20<br />

Total Financial Liabilities - 33 8 3,209 3,250 3,250<br />

Net Financial Asset/Liabilities 8,402 -12 14 -87 8,317 8,317<br />

Weighted Average Interest Rate = 3.20% 5.48%<br />

Interest rate exposure as at 30/06/2004<br />

Floating 1 year 1 to 5 Non Interest Book Value Net Fair Value<br />

Interest Rate or less years Bearing 2003/04 2003/04<br />

$000 $000 $000 $000 $000 $000<br />

Financial Assets<br />

Cash at bank 10,445 - - - 10,445 10,445<br />

Trade debtors - - - 845 845 845<br />

Other receivables - - - 1,817 1,817 1,817<br />

Deposits - 127 - - 127 127<br />

Prepayments - - - 99 99 99<br />

Other financial assets - - 22 - 22 22<br />

Total Financial Assets 10,445 127 22 2,761 13,355 13,355<br />

Financial Liabilities<br />

Trade creditors and accruals - - - 4,684 4,684 4,684<br />

Advances - 127 - - 127 127<br />

Borrowings - 12 21 - 33 33<br />

Total Financial Liabilities - 139 21 4,684 4,844 4,844<br />

Net Financial Asset/Liabilities 10,445 -12 1 -1,923 8,511 8,511<br />

Weighted Average Interest Rate = 2.66% 5.09%<br />

*Net fair values are capital amounts<br />

(Net fair values <strong>of</strong> financial instruments are determined on the following bases:<br />

i. Cash, deposit investments, cash equivalents and non-interest bearing financial assets and liabilities (trade debtors, other receivables,<br />

trade creditors and advances) are valued at cost which approximates net market value<br />

ii<br />

Interest bearing liabilities amounts are based on the present value <strong>of</strong> expected future cash flows discounted at current market interest<br />

rates quoted for trade Treasury Corporation <strong>of</strong> Victoria.)<br />

(b) Credit Risk Exposure<br />

Credit risk represents the loss that would be recognised if couterparties fail to meet their obligations under the respective contracts at<br />

maturity. The credit risk on financial assets <strong>of</strong> the entity have been recognised on the statement <strong>of</strong> financial position, as the carrying<br />

amount, net any provisions for doubtful debts.<br />

(c) Net Fair Value <strong>of</strong> Financial Assets and Liabilites<br />

The net fair value <strong>of</strong> on-balance sheet financial assets and liabilities are not materially different to the carrying value <strong>of</strong> the financial<br />

assets liabilities.<br />

NOTE 20: EQUITY & RESERVES<br />

2004/05 2003/04<br />

(a) Reserves $000 $000<br />

Asset Revaluation Reserve<br />

Balance at the beginning <strong>of</strong> the reporting period 16,805 16,805<br />

Increase in Land during the year 1,704 -<br />

Balance at the end <strong>of</strong> the reporting period 18,509 16,805<br />

Specific Purpose Reserve<br />

Balance at the beginning <strong>of</strong> the reporting period 22 22<br />

Balance at the end <strong>of</strong> the reporting period 22 22<br />

Total Reserves 18,531 16,827<br />

(b) Contributed Capital<br />

Balance at the beginning <strong>of</strong> the reporting period 48,346 48,346<br />

Balance at the end <strong>of</strong> the reporting period 48,346 48,346<br />

41