Additional information to the extended consolidated ... - tauron

Additional information to the extended consolidated ... - tauron

Additional information to the extended consolidated ... - tauron

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TAURON Polska Energia S.A.<br />

<strong>Additional</strong> <strong>information</strong> <strong>to</strong> <strong>the</strong> <strong>extended</strong> <strong>consolidated</strong> financial report of <strong>the</strong> TAURON Group for <strong>the</strong> 1 st quarter of 2011<br />

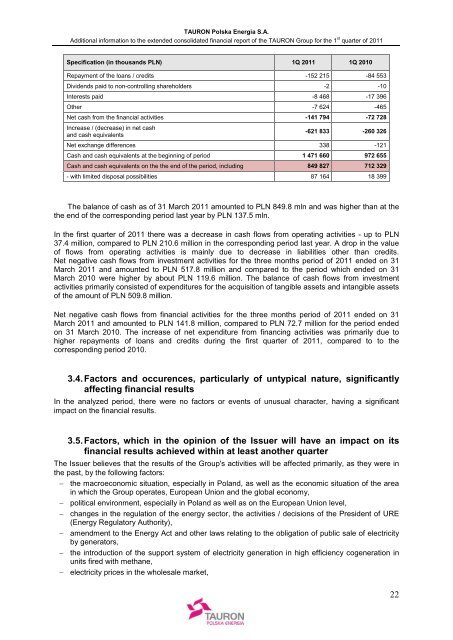

Specification (in thousands PLN) 1Q 2011 1Q 2010<br />

Repayment of <strong>the</strong> loans / credits -152 215 -84 553<br />

Dividends paid <strong>to</strong> non-controlling shareholders -2 -10<br />

Interests paid -8 468 -17 396<br />

O<strong>the</strong>r -7 624 -465<br />

Net cash from <strong>the</strong> financial activities -141 794 -72 728<br />

Increase / (decrease) in net cash<br />

and cash equivalents<br />

-621 833 -260 326<br />

Net exchange differences 338 -121<br />

Cash and cash equivalents at <strong>the</strong> beginning of period 1 471 660 972 655<br />

Cash and cash equivalents on <strong>the</strong> <strong>the</strong> end of <strong>the</strong> period, including 849 827 712 329<br />

- with limited disposal possibilities 87 164 18 399<br />

The balance of cash as of 31 March 2011 amounted <strong>to</strong> PLN 849.8 mln and was higher than at <strong>the</strong><br />

<strong>the</strong> end of <strong>the</strong> corresponding period last year by PLN 137.5 mln.<br />

In <strong>the</strong> first quarter of 2011 <strong>the</strong>re was a decrease in cash flows from operating activities - up <strong>to</strong> PLN<br />

37.4 million, compared <strong>to</strong> PLN 210.6 million in <strong>the</strong> corresponding period last year. A drop in <strong>the</strong> value<br />

of flows from operating activities is mainly due <strong>to</strong> decrease in liabilities o<strong>the</strong>r than credits.<br />

Net negative cash flows from investment activities for <strong>the</strong> three months period of 2011 ended on 31<br />

March 2011 and amounted <strong>to</strong> PLN 517.8 million and compared <strong>to</strong> <strong>the</strong> period which ended on 31<br />

March 2010 were higher by about PLN 119.6 million. The balance of cash flows from investment<br />

activities primarily consisted of expenditures for <strong>the</strong> acquisition of tangible assets and intangible assets<br />

of <strong>the</strong> amount of PLN 509.8 million.<br />

Net negative cash flows from financial activities for <strong>the</strong> three months period of 2011 ended on 31<br />

March 2011 and amounted <strong>to</strong> PLN 141.8 million, compared <strong>to</strong> PLN 72.7 million for <strong>the</strong> period ended<br />

on 31 March 2010. The increase of net expenditure from financing activities was primarily due <strong>to</strong><br />

higher repayments of loans and credits during <strong>the</strong> first quarter of 2011, compared <strong>to</strong> <strong>to</strong> <strong>the</strong><br />

corresponding period 2010.<br />

3.4. Fac<strong>to</strong>rs and occurences, particularly of untypical nature, significantly<br />

affecting financial results<br />

In <strong>the</strong> analyzed period, <strong>the</strong>re were no fac<strong>to</strong>rs or events of unusual character, having a significant<br />

impact on <strong>the</strong> financial results.<br />

3.5. Fac<strong>to</strong>rs, which in <strong>the</strong> opinion of <strong>the</strong> Issuer will have an impact on its<br />

financial results achieved within at least ano<strong>the</strong>r quarter<br />

The Issuer believes that <strong>the</strong> results of <strong>the</strong> Group's activities will be affected primarily, as <strong>the</strong>y were in<br />

<strong>the</strong> past, by <strong>the</strong> following fac<strong>to</strong>rs:<br />

<strong>the</strong> macroeconomic situation, especially in Poland, as well as <strong>the</strong> economic situation of <strong>the</strong> area<br />

in which <strong>the</strong> Group operates, European Union and <strong>the</strong> global economy,<br />

political environment, especially in Poland as well as on <strong>the</strong> European Union level,<br />

changes in <strong>the</strong> regulation of <strong>the</strong> energy sec<strong>to</strong>r, <strong>the</strong> activities / decisions of <strong>the</strong> President of URE<br />

(Energy Regula<strong>to</strong>ry Authority),<br />

amendment <strong>to</strong> <strong>the</strong> Energy Act and o<strong>the</strong>r laws relating <strong>to</strong> <strong>the</strong> obligation of public sale of electricity<br />

by genera<strong>to</strong>rs,<br />

<strong>the</strong> introduction of <strong>the</strong> support system of electricity generation in high efficiency cogeneration in<br />

units fired with methane,<br />

electricity prices in <strong>the</strong> wholesale market,<br />

22