1.7 MB - Husky Energy

1.7 MB - Husky Energy

1.7 MB - Husky Energy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Diluted net earnings and cash flow from operations per common share were calculated using<br />

418.6 million, 321.2 million and 270.3 million shares for the years ended December 31, 2001,<br />

2000 and 1999, respectively, which included the dilutive impact of options and warrants<br />

outstanding under the employee stock option plan calculated using the “treasury stock method”.<br />

The number of antidilutive options and warrants at December 31, 2001 and 2000 were nil and<br />

1<strong>1.7</strong> million, respectively.<br />

During 2001 the Company declared dividends of $0.36 per common share.<br />

Note 13<br />

Capital Securities<br />

The Company issued U.S. $225 million unsecured capital securities under an indenture dated<br />

August 10, 1998. Such securities rank junior to all senior debt and other financial debt of the<br />

Company. They yield an annual return of 8.9 percent, payable semi-annually until August 15,<br />

2008 and mature in 2028. The capital securities are redeemable, in whole or in part, by the<br />

Company at any time prior to August 15, 2008 at a price determinable at the time of redemption.<br />

They are redeemable at par, in whole but not in part, by the Company on or after August 15, 2008.<br />

If not redeemed in whole, commencing on August 15, 2008, the annual return changes to a<br />

floating rate equal to U.S. Libor plus 5.50 percent payable semi-annually. The Company has the<br />

right at any time prior to maturity to defer payment of the return on the securities. Since the<br />

Company also has the unrestricted ability to settle its deferred return, principal and redemption<br />

obligations through the issuance of common or preferred shares, the principal amount of the<br />

capital securities, net of issue costs, have been classified as equity. The return amounts, net of<br />

income taxes, are classified as distributions of equity.<br />

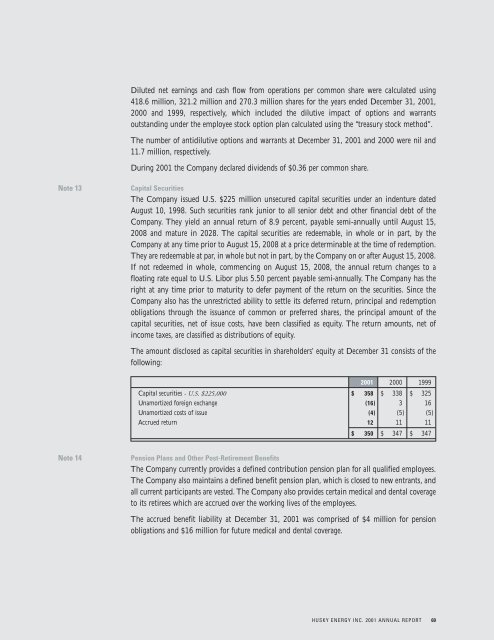

The amount disclosed as capital securities in shareholders’ equity at December 31 consists of the<br />

following:<br />

2001 2000 1999<br />

Capital securities - U.S. $225,000 $ 358 $ 338 $ 325<br />

Unamortized foreign exchange (16) 3 16<br />

Unamortized costs of issue (4) (5) (5)<br />

Accrued return 12 11 11<br />

$ 350 $ 347 $ 347<br />

Note 14<br />

Pension Plans and Other Post-Retirement Benefits<br />

The Company currently provides a defined contribution pension plan for all qualified employees.<br />

The Company also maintains a defined benefit pension plan, which is closed to new entrants, and<br />

all current participants are vested. The Company also provides certain medical and dental coverage<br />

to its retirees which are accrued over the working lives of the employees.<br />

The accrued benefit liability at December 31, 2001 was comprised of $4 million for pension<br />

obligations and $16 million for future medical and dental coverage.<br />

HUSKY ENERGY INC. 2001 ANNUAL REPORT 69