Atlantic Canada's Urban Growth Agenda - Greater Halifax Partnership

Atlantic Canada's Urban Growth Agenda - Greater Halifax Partnership

Atlantic Canada's Urban Growth Agenda - Greater Halifax Partnership

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• A central inventory of federally owned lands and buildings, their current and future use that could have the<br />

potential for strategic urban redevelopment; and<br />

• Removal or reduction of the capital gains tax on the restoration, preservation and adaptive reuse of heritage<br />

buildings.<br />

They also recommended that the National Sustainable Infrastructure Program have specific criteria,<br />

performance measurements, rigorous evaluation and monitoring of all projects funded under this program. The<br />

recommendations are currently under consideration and expected to be part of a formal national urban agenda in the<br />

future.<br />

5.2 Social Issues<br />

Another key thrust of the national urban agenda involves the social health of Canadian cities. There is increasing<br />

pressure on social infrastructure within Canada’s largest cities. Affordable housing, better integration of immigrants,<br />

safe, accessible public spaces and environmentally-sustainable development.<br />

5.3 Governance/Leadership<br />

A key finding of the research relates to the issues of governance and leadership in the large urban areas in Canada.<br />

Many of the new challenges facing municipalities are still formally provincial responsibilities (or joint) but the<br />

municipalities are funding an increasing share and as they are becoming ‘urban’ issues (i.e. environmental, housing,<br />

etc.) the pressure on the municipal level of government is increasing.<br />

5.3.1 The fiscal imbalance<br />

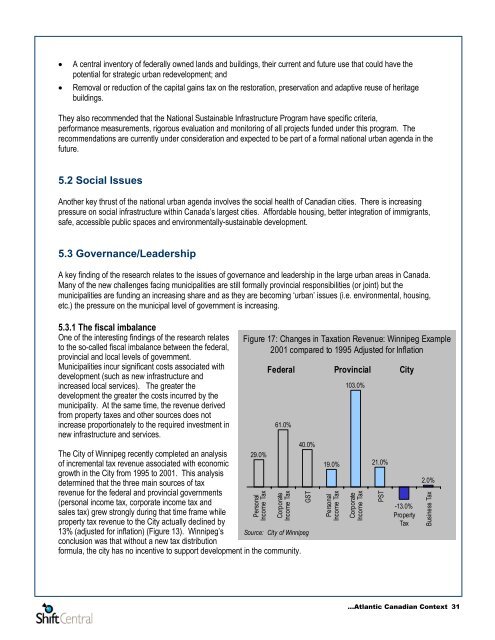

One of the interesting findings of the research relates<br />

to the so-called fiscal imbalance between the federal,<br />

provincial and local levels of government.<br />

Municipalities incur significant costs associated with<br />

development (such as new infrastructure and<br />

increased local services). The greater the<br />

development the greater the costs incurred by the<br />

municipality. At the same time, the revenue derived<br />

from property taxes and other sources does not<br />

increase proportionately to the required investment in<br />

new infrastructure and services.<br />

61.0%<br />

The City of Winnipeg recently completed an analysis 29.0%<br />

of incremental tax revenue associated with economic<br />

growth in the City from 1995 to 2001. This analysis<br />

determined that the three main sources of tax<br />

revenue for the federal and provincial governments<br />

(personal income tax, corporate income tax and<br />

sales tax) grew strongly during that time frame while<br />

property tax revenue to the City actually declined by<br />

13% (adjusted for inflation) (Figure 13). Winnipeg’s<br />

conclusion was that without a new tax distribution<br />

formula, the city has no incentive to support development in the community.<br />

Figure 17: Changes in Taxation Revenue: Winnipeg Example<br />

2001 compared to 1995 Adjusted for Inflation<br />

Personal<br />

Income Tax<br />

Federal Provincial City<br />

Corporate<br />

Income Tax<br />

40.0%<br />

GST<br />

Source: City of Winnipeg<br />

19.0%<br />

Personal<br />

Income Tax<br />

103.0%<br />

Corporate<br />

Income Tax<br />

21.0%<br />

PST<br />

-13.0%<br />

Property<br />

Tax<br />

2.0%<br />

Business Tax<br />

…<strong>Atlantic</strong> Canadian Context 31