SJP Application Form - Ingenious Media

SJP Application Form - Ingenious Media

SJP Application Form - Ingenious Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

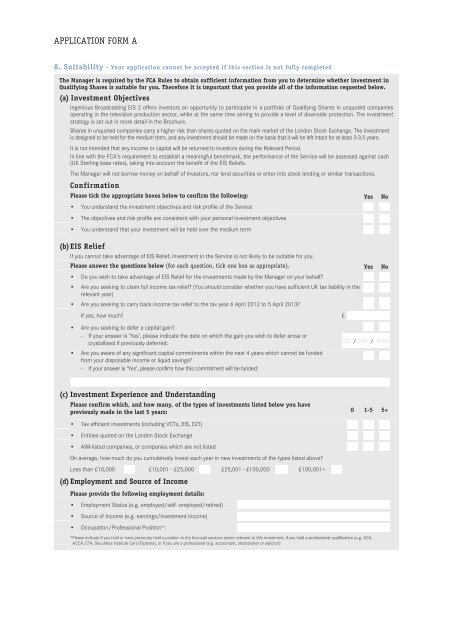

APPLICATION FORM A<br />

8. Suitability - Your application cannot be accepted if this section is not fully completed<br />

The Manager is required by the FCA Rules to obtain sufficient information from you to determine whether investment in<br />

Qualifying Shares is suitable for you. Therefore it is important that you provide all of the information requested below.<br />

(a) Investment Objectives<br />

<strong>Ingenious</strong> Broadcasting EIS 2 offers investors an opportunity to participate in a portfolio of Qualifying Shares in unquoted companies<br />

operating in the television production sector, while at the same time aiming to provide a level of downside protection. The investment<br />

strategy is set out in more detail in the Brochure.<br />

Shares in unquoted companies carry a higher risk than shares quoted on the main market of the London Stock Exchange. The investment<br />

is designed to be held for the medium term, and any investment should be made on the basis that it will be left intact for at least 3-3.5 years.<br />

It is not intended that any income or capital will be returned to investors during the Relevant Period.<br />

In line with the FCA’s requirement to establish a meaningful benchmark, the performance of the Service will be assessed against cash<br />

(UK Sterling base rates), taking into account the benefit of the EIS Reliefs.<br />

The Manager will not borrow money on behalf of Investors, nor lend securities or enter into stock lending or similar transactions.<br />

Confirmation<br />

Please tick the appropriate boxes below to confirm the following: Yes No<br />

• You understand the investment objectives and risk profile of the Service<br />

• The objectives and risk profile are consistent with your personal investment objectives<br />

• You understand that your investment will be held over the medium term<br />

(b)EIS Relief<br />

If you cannot take advantage of EIS Relief, investment in the Service is not likely to be suitable for you.<br />

Please answer the questions below (for each question, tick one box as appropriate). Yes No<br />

• Do you wish to take advantage of EIS Relief for the investments made by the Manager on your behalf<br />

• Are you seeking to claim full income tax relief (You should consider whether you have sufficient UK tax liability in the<br />

relevant year)<br />

• Are you seeking to carry back income tax relief to the tax year 6 April 2012 to 5 April 2013<br />

If yes, how much £<br />

• Are you seeking to defer a capital gain<br />

--<br />

If your answer is ‘Yes’, please indicate the date on which the gain you wish to defer arose or<br />

crystallised if previously deferred:<br />

• Are you aware of any significant capital commitments within the next 4 years which cannot be funded<br />

from your disposable income or liquid savings<br />

--<br />

If your answer is ‘Yes’, please confirm how this commitment will be funded:<br />

DD / MM / YEAR<br />

(c) Investment Experience and Understanding<br />

Please confirm which, and how many, of the types of investments listed below you have<br />

previously made in the last 5 years: 0 1-5 5+<br />

• Tax efficient investments (including VCTs, EIS, EZT)<br />

• Entities quoted on the London Stock Exchange<br />

• AIM-listed companies, or companies which are not listed<br />

On average, how much do you cumulatively invest each year in new investments of the types listed above<br />

Less than £10,000 £10,001 - £25,000 £25,001 - £100,000 £100,001+<br />

(d) Employment and Source of Income<br />

Please provide the following employment details:<br />

• Employment Status (e.g. employed/self- employed/retired)<br />

• Source of Income (e.g. earnings/investment income)<br />

• Occupation/Professional Position*:<br />

*Please indicate if you hold or have previously held a position in the financial services sector relevant to this investment, if you hold a professional qualification (e.g. ACA,<br />

ACCA, CTA, Securities Institute Cert/Diploma), or if you are a professional (e.g. accountant, stockbroker or solicitor)