Memorandum-to-the-Prime-Minister-on-Unaffordable-Housing

Memorandum-to-the-Prime-Minister-on-Unaffordable-Housing

Memorandum-to-the-Prime-Minister-on-Unaffordable-Housing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

for much of <str<strong>on</strong>g>the</str<strong>on</strong>g> mid-1990s. It has now risen again and at <str<strong>on</strong>g>the</str<strong>on</strong>g> end of 2004 s<str<strong>on</strong>g>to</str<strong>on</strong>g>od at 107.4.<br />

Given <str<strong>on</strong>g>the</str<strong>on</strong>g> unprecedented rise in house price levels it may seem surprising that affordability, in terms of takehome<br />

pay used <str<strong>on</strong>g>to</str<strong>on</strong>g> pay <str<strong>on</strong>g>the</str<strong>on</strong>g> mortgage, should have remained relatively low in <str<strong>on</strong>g>the</str<strong>on</strong>g> early 2000s.The explanati<strong>on</strong><br />

probably lies in a combinati<strong>on</strong> of fac<str<strong>on</strong>g>to</str<strong>on</strong>g>rs - his<str<strong>on</strong>g>to</str<strong>on</strong>g>rically low interest rates,‘low-start’ mortgage products and<br />

leng<str<strong>on</strong>g>the</str<strong>on</strong>g>ned repayment terms are all possible fac<str<strong>on</strong>g>to</str<strong>on</strong>g>rs that reduce <str<strong>on</strong>g>the</str<strong>on</strong>g> m<strong>on</strong>th by m<strong>on</strong>th impact of expending<br />

higher capital sums <strong>on</strong> house purchase. Clearly <str<strong>on</strong>g>the</str<strong>on</strong>g>re are dangers here if interest rates rise and/or disruptive life<br />

events such as unemployment, disability or relati<strong>on</strong>ship break-up occur during <str<strong>on</strong>g>the</str<strong>on</strong>g> extended repayment period.<br />

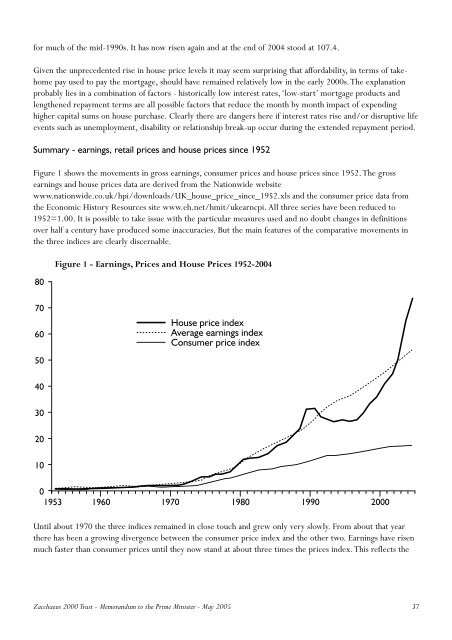

Summary - earnings, retail prices and house prices since 1952<br />

Figure 1 shows <str<strong>on</strong>g>the</str<strong>on</strong>g> movements in gross earnings, c<strong>on</strong>sumer prices and house prices since 1952.The gross<br />

earnings and house prices data are derived from <str<strong>on</strong>g>the</str<strong>on</strong>g> Nati<strong>on</strong>wide website<br />

www.nati<strong>on</strong>wide.co.uk/hpi/downloads/UK_house_price_since_1952.xls and <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>sumer price data from<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> Ec<strong>on</strong>omic His<str<strong>on</strong>g>to</str<strong>on</strong>g>ry Resources site www.eh.net/hmit/ukearncpi. All three series have been reduced <str<strong>on</strong>g>to</str<strong>on</strong>g><br />

1952=1.00. It is possible <str<strong>on</strong>g>to</str<strong>on</strong>g> take issue with <str<strong>on</strong>g>the</str<strong>on</strong>g> particular measures used and no doubt changes in definiti<strong>on</strong>s<br />

over half a century have produced some inaccuracies. But <str<strong>on</strong>g>the</str<strong>on</strong>g> main features of <str<strong>on</strong>g>the</str<strong>on</strong>g> comparative movements in<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g> three indices are clearly discernable.<br />

80<br />

Figure 1 - Earnings, Prices and House Prices 1952-2004<br />

70<br />

60<br />

House price index<br />

Average earnings index<br />

C<strong>on</strong>sumer price index<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

1953<br />

1960 1970 1980 1990 2000<br />

Until about 1970 <str<strong>on</strong>g>the</str<strong>on</strong>g> three indices remained in close <str<strong>on</strong>g>to</str<strong>on</strong>g>uch and grew <strong>on</strong>ly very slowly. From about that year<br />

<str<strong>on</strong>g>the</str<strong>on</strong>g>re has been a growing divergence between <str<strong>on</strong>g>the</str<strong>on</strong>g> c<strong>on</strong>sumer price index and <str<strong>on</strong>g>the</str<strong>on</strong>g> o<str<strong>on</strong>g>the</str<strong>on</strong>g>r two. Earnings have risen<br />

much faster than c<strong>on</strong>sumer prices until <str<strong>on</strong>g>the</str<strong>on</strong>g>y now stand at about three times <str<strong>on</strong>g>the</str<strong>on</strong>g> prices index.This reflects <str<strong>on</strong>g>the</str<strong>on</strong>g><br />

Zacchaeus 2000 Trust - <str<strong>on</strong>g>Memorandum</str<strong>on</strong>g> <str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>the</str<strong>on</strong>g> <str<strong>on</strong>g>Prime</str<strong>on</strong>g> <str<strong>on</strong>g>Minister</str<strong>on</strong>g> - May 2005 37