Conservation Easements, A Guide for Texas Landowners

Conservation Easements, A Guide for Texas Landowners

Conservation Easements, A Guide for Texas Landowners

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Part Two: Qu e s t i o n s Ab o u t Co n s e rvat i o n Ea s e m e n t s<br />

Does every conservation easement qualify <strong>for</strong> an income tax deduction<br />

No. To qualify as a charitable contribution, conservation easement donations must:<br />

• be perpetual, meaning continuing <strong>for</strong>ever;<br />

• be donated to a qualified organization (a land trust or governmental entity); and<br />

• be donated exclusively <strong>for</strong> recognized “conservation purposes,” as set out in the<br />

Internal Revenue Code.<br />

Does every conservation easement have to be perpetual<br />

For the donation to qualify <strong>for</strong> income and estate tax benefits, the conservation<br />

easement must be perpetual and apply to all future owners. Some organizations,<br />

however, may be willing to purchase or otherwise accept conservation easements<br />

that are designed <strong>for</strong> a period of years. For example, the Wetlands Reserve Program<br />

administered by the Natural Resources <strong>Conservation</strong> Service (NRCS), pays landowners<br />

<strong>for</strong> limited-term conservation easements on restored or existing wetlands that provide<br />

significant habitat <strong>for</strong> birds and other wildlife. However, these term conservation<br />

easementss do not qualify <strong>for</strong> federal tax benefits.<br />

Can conservation easements be purchased<br />

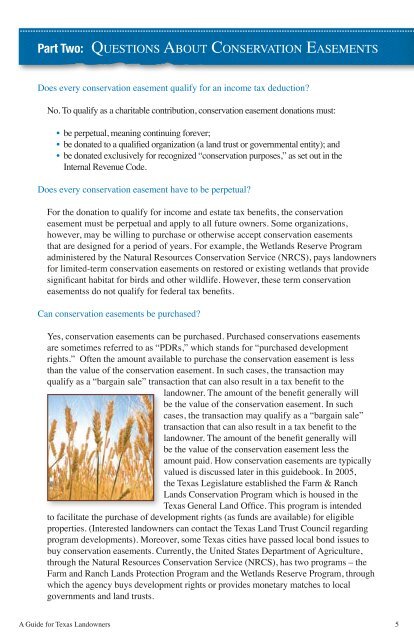

Yes, conservation easements can be purchased. Purchased conservations easements<br />

are sometimes referred to as “PDRs,” which stands <strong>for</strong> “purchased development<br />

rights.” Often the amount available to purchase the conservation easement is less<br />

than the value of the conservation easement. In such cases, the transaction may<br />

qualify as a “bargain sale” transaction that can also result in a tax benefit to the<br />

landowner. The amount of the benefit generally will<br />

be the value of the conservation easement. In such<br />

cases, the transaction may qualify as a “bargain sale”<br />

transaction that can also result in a tax benefit to the<br />

landowner. The amount of the benefit generally will<br />

be the value of the conservation easement less the<br />

amount paid. How conservation easements are typically<br />

valued is discussed later in this guidebook. In 2005,<br />

the <strong>Texas</strong> Legislature established the Farm & Ranch<br />

Lands <strong>Conservation</strong> Program which is housed in the<br />

<strong>Texas</strong> General Land Office. This program is intended<br />

to facilitate the purchase of development rights (as funds are available) <strong>for</strong> eligible<br />

properties. (Interested landowners can contact the <strong>Texas</strong> Land Trust Council regarding<br />

program developments). Moreover, some <strong>Texas</strong> cities have passed local bond issues to<br />

buy conservation easements. Currently, the United States Department of Agriculture,<br />

through the Natural Resources <strong>Conservation</strong> Service (NRCS), has two programs – the<br />

Farm and Ranch Lands Protection Program and the Wetlands Reserve Program, through<br />

which the agency buys development rights or provides monetary matches to local<br />

governments and land trusts.<br />

A <strong>Guide</strong> <strong>for</strong> <strong>Texas</strong> <strong>Landowners</strong><br />

5