Chapter 6 Chapter 6

Chapter 6 Chapter 6

Chapter 6 Chapter 6

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24<br />

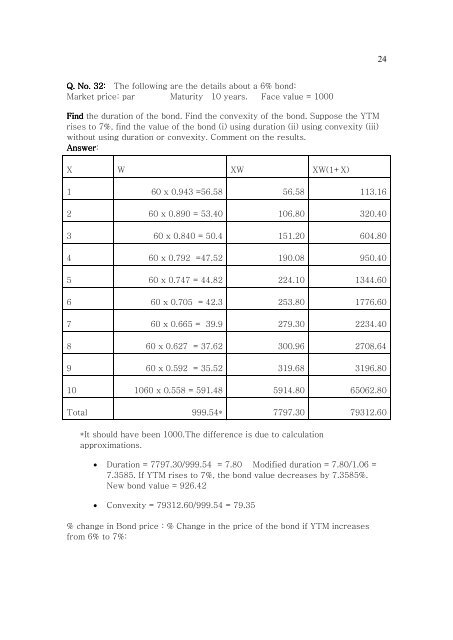

Q. No. 32: The following are the details about a 6% bond:<br />

Market price: par Maturity 10 years. Face value = 1000<br />

Find the duration of the bond. Find the convexity of the bond. Suppose the YTM<br />

rises to 7%, find the value of the bond (i) using duration (ii) using convexity (iii)<br />

without using duration or convexity. Comment on the results.<br />

Answer:<br />

X W XW XW(1+X)<br />

1 60 x 0.943 =56.58 56.58 113.16<br />

2 60 x 0.890 = 53.40 106.80 320.40<br />

3 60 x 0.840 = 50.4 151.20 604.80<br />

4 60 x 0.792 =47.52 190.08 950.40<br />

5 60 x 0.747 = 44.82 224.10 1344.60<br />

6 60 x 0.705 = 42.3 253.80 1776.60<br />

7 60 x 0.665 = 39.9 279.30 2234.40<br />

8 60 x 0.627 = 37.62 300.96 2708.64<br />

9 60 x 0.592 = 35.52 319.68 3196.80<br />

10 1060 x 0.558 = 591.48 5914.80 65062.80<br />

Total 999.54* 7797.30 79312.60<br />

*It should have been 1000.The difference is due to calculation<br />

approximations.<br />

• Duration = 7797.30/999.54 = 7.80 Modified duration = 7.80/1.06 =<br />

7.3585. If YTM rises to 7%, the bond value decreases by 7.3585%.<br />

New bond value = 926.42<br />

• Convexity = 79312.60/999.54 = 79.35<br />

% change in Bond price : % Change in the price of the bond if YTM increases<br />

from 6% to 7%: