96-132 Texas Sales and Use Tax Rates January 2011

96-132 Texas Sales and Use Tax Rates January 2011

96-132 Texas Sales and Use Tax Rates January 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

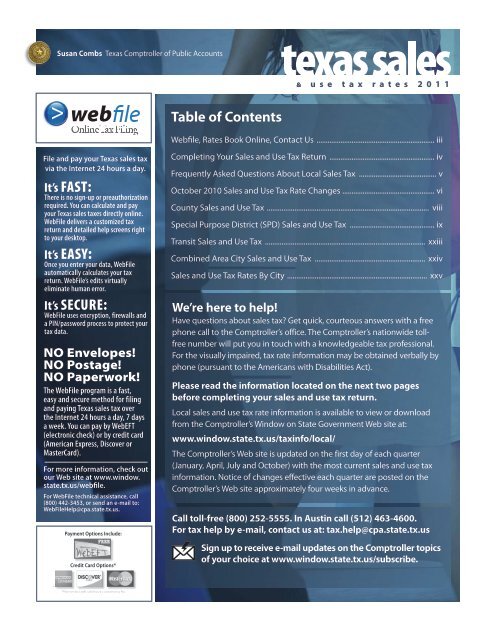

Susan Combs <strong>Texas</strong> Comptroller of Public Accounts<br />

& u s e t a x r a t e s 2 0 1 1<br />

Table of Contents<br />

Webfile, <strong>Rates</strong> Book Online, Contact Us ................................................................. iii<br />

File <strong>and</strong> pay your <strong>Texas</strong> sales tax<br />

via the Internet 24 hours a day.<br />

It’s FAST:<br />

There is no sign-up or preauthorization<br />

required. You can calculate <strong>and</strong> pay<br />

your <strong>Texas</strong> sales taxes directly online.<br />

WebFile delivers a customized tax<br />

return <strong>and</strong> detailed help screens right<br />

to your desktop.<br />

It’s EASY:<br />

Once you enter your data, WebFile<br />

automatically calculates your tax<br />

return. WebFile’s edits virtually<br />

eliminate human error.<br />

It’s SECURE:<br />

WebFile uses encryption, firewalls <strong>and</strong><br />

a PIN/password process to protect your<br />

tax data.<br />

NO Envelopes!<br />

NO Postage!<br />

NO Paperwork!<br />

The WebFile program is a fast,<br />

easy <strong>and</strong> secure method for filing<br />

<strong>and</strong> paying <strong>Texas</strong> sales tax over<br />

the Internet 24 hours a day, 7 days<br />

a week. You can pay by WebEFT<br />

(electronic check) or by credit card<br />

(American Express, Discover or<br />

MasterCard).<br />

For more information, check out<br />

our Web site at www.window.<br />

state.tx.us/webfile.<br />

For WebFile technical assistance, call<br />

(800) 442-3453, or send an e-mail to:<br />

WebFileHelp@cpa.state.tx.us.<br />

Payment Options Include:<br />

Credit Card Options*<br />

Completing Your <strong>Sales</strong> <strong>and</strong> <strong>Use</strong> <strong>Tax</strong> Return .......................................................... iv<br />

Frequently Asked Questions About Local <strong>Sales</strong> <strong>Tax</strong> ........................................... v<br />

October 2010 <strong>Sales</strong> <strong>and</strong> <strong>Use</strong> <strong>Tax</strong> Rate Changes .................................................. vi<br />

County <strong>Sales</strong> <strong>and</strong> <strong>Use</strong> <strong>Tax</strong> ........................................................................................ viii<br />

Special Purpose District (SPD) <strong>Sales</strong> <strong>and</strong> <strong>Use</strong> <strong>Tax</strong> ............................................... ix<br />

Transit <strong>Sales</strong> <strong>and</strong> <strong>Use</strong> <strong>Tax</strong> ........................................................................................ xxiii<br />

Combined Area City <strong>Sales</strong> <strong>and</strong> <strong>Use</strong> <strong>Tax</strong> ............................................................. xxiv<br />

<strong>Sales</strong> <strong>and</strong> <strong>Use</strong> <strong>Tax</strong> <strong>Rates</strong> By City ............................................................................ xxv<br />

We’re here to help!<br />

Have questions about sales tax Get quick, courteous answers with a free<br />

phone call to the Comptroller’s office. The Comptroller’s nationwide tollfree<br />

number will put you in touch with a knowledgeable tax professional.<br />

For the visually impaired, tax rate information may be obtained verbally by<br />

phone (pursuant to the Americans with Disabilities Act).<br />

Please read the information located on the next two pages<br />

before completing your sales <strong>and</strong> use tax return.<br />

Local sales <strong>and</strong> use tax rate information is available to view or download<br />

from the Comptroller’s Window on State Government Web site at:<br />

www.window.state.tx.us/taxinfo/local/<br />

The Comptroller’s Web site is updated on the first day of each quarter<br />

(<strong>January</strong>, April, July <strong>and</strong> October) with the most current sales <strong>and</strong> use tax<br />

information. Notice of changes effective each quarter are posted on the<br />

Comptroller’s Web site approximately four weeks in advance.<br />

Call toll-free (800) 252-5555. In Austin call (512) 463-4600.<br />

For tax help by e-mail, contact us at: tax.help@cpa.state.tx.us<br />

Sign up to receive e-mail updates on the Comptroller topics<br />

of your choice at www.window.state.tx.us/subscribe.