Buletin informativ privind sistemul fiscal in Republica Moldova 2006

Buletin informativ privind sistemul fiscal in Republica Moldova 2006

Buletin informativ privind sistemul fiscal in Republica Moldova 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

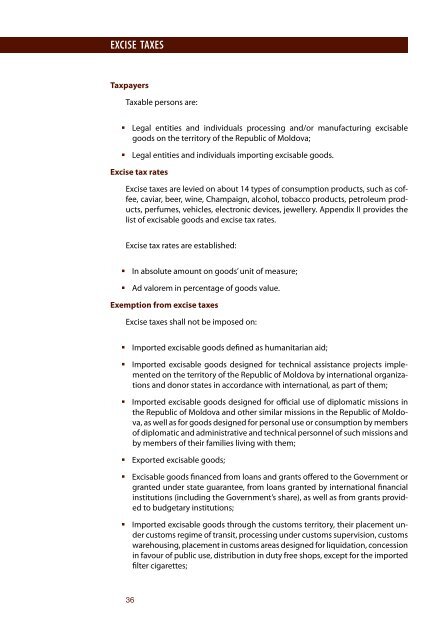

excise taxes<br />

Taxpayers<br />

Taxable persons are:<br />

• Legal entities and <strong>in</strong>dividuals process<strong>in</strong>g and/or manufactur<strong>in</strong>g excisable<br />

goods on the territory of the Republic of <strong>Moldova</strong>;<br />

• Legal entities and <strong>in</strong>dividuals import<strong>in</strong>g excisable goods.<br />

Excise tax rates<br />

Excise taxes are levied on about 14 types of consumption products, such as coffee,<br />

caviar, beer, w<strong>in</strong>e, Champaign, alcohol, tobacco products, petroleum products,<br />

perfumes, vehicles, electronic devices, jewellery. Appendix II provides the<br />

list of excisable goods and excise tax rates.<br />

Excise tax rates are established:<br />

• In absolute amount on goods’ unit of measure;<br />

• Ad valorem <strong>in</strong> percentage of goods value.<br />

Exemption from excise taxes<br />

Excise taxes shall not be imposed on:<br />

• Imported excisable goods def<strong>in</strong>ed as humanitarian aid;<br />

• Imported excisable goods designed for technical assistance projects implemented<br />

on the territory of the Republic of <strong>Moldova</strong> by <strong>in</strong>ternational organizations<br />

and donor states <strong>in</strong> accordance with <strong>in</strong>ternational, as part of them;<br />

• Imported excisable goods designed for official use of diplomatic missions <strong>in</strong><br />

the Republic of <strong>Moldova</strong> and other similar missions <strong>in</strong> the Republic of <strong>Moldova</strong>,<br />

as well as for goods designed for personal use or consumption by members<br />

of diplomatic and adm<strong>in</strong>istrative and technical personnel of such missions and<br />

by members of their families liv<strong>in</strong>g with them;<br />

• Exported excisable goods;<br />

• Excisable goods f<strong>in</strong>anced from loans and grants offered to the Government or<br />

granted under state guarantee, from loans granted by <strong>in</strong>ternational f<strong>in</strong>ancial<br />

<strong>in</strong>stitutions (<strong>in</strong>clud<strong>in</strong>g the Government’s share), as well as from grants provided<br />

to budgetary <strong>in</strong>stitutions;<br />

• Imported excisable goods through the customs territory, their placement under<br />

customs regime of transit, process<strong>in</strong>g under customs supervision, customs<br />

warehous<strong>in</strong>g, placement <strong>in</strong> customs areas designed for liquidation, concession<br />

<strong>in</strong> favour of public use, distribution <strong>in</strong> duty free shops, except for the imported<br />

filter cigarettes;<br />

36