Introduction to Index Futures and Options - Bell Potter Securities

Introduction to Index Futures and Options - Bell Potter Securities

Introduction to Index Futures and Options - Bell Potter Securities

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Directional Trading Using ASX SPI<br />

200 <strong>Index</strong> <strong>Futures</strong><br />

Bullish View<br />

How do you profit from a rising share<br />

market using futures<br />

Buy a ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> contract<br />

<strong>and</strong> then sell the contract when the price<br />

has risen. This is also known as going long a<br />

futures contract.<br />

Example<br />

Buy a ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> contract<br />

when the price is 5800 points <strong>and</strong> then sell a<br />

ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> when the price<br />

has risen.<br />

If the ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> contract<br />

price increased by 200 points <strong>to</strong> 6000 points<br />

then the value of your exposure would have<br />

increased <strong>to</strong> $150,000 (ie 6,000 x $25) from<br />

$145,000. In this case you have effectively<br />

made $5,000 or a 50% profit on your initial<br />

margin* outlay of, for example, $10,000. To<br />

realise your gain you simply sell your futures<br />

contract at the higher level.<br />

Example<br />

Sell a ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> contract<br />

when the price is 6,100 points <strong>and</strong> then buy a<br />

ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> contract when the<br />

price has fallen.<br />

By paying your broker an initial margin* of,<br />

for example, $10,000 you can sell a ASX SPI<br />

200 <strong>Index</strong> <strong>Futures</strong> contract. Unlike when you<br />

bought the futures contract, this time you make<br />

a profit if the market falls. If the ASX SPI 200 <br />

<strong>Index</strong> <strong>Futures</strong> price decreases by 250 points<br />

<strong>to</strong> 5,850 points you are able <strong>to</strong> close out your<br />

futures contract by buying at the lower level.<br />

If you originally sold the contract at 6100 <strong>and</strong><br />

bought at 5850 you would have made a profit<br />

equal <strong>to</strong> $6,250 (ie 250 x $25) or a 62.5%<br />

profit on your initial margin* of $10,000.<br />

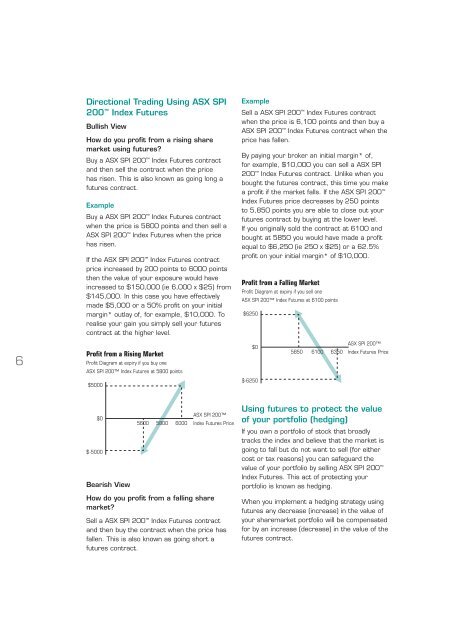

Profit from a Falling Market<br />

Profit Diagram at expiry if you sell one<br />

ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> at 6100 points<br />

$6250<br />

6<br />

Profit from a Rising Market<br />

Profit Diagram at expiry if you buy one<br />

ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> at 5800 points<br />

$0<br />

5850 6100 6350<br />

ASX SPI 200<br />

<strong>Index</strong> <strong>Futures</strong> Price<br />

$5000<br />

$-6250<br />

$0<br />

$-5000<br />

Bearish View<br />

5600 5800 6000<br />

ASX SPI 200<br />

<strong>Index</strong> <strong>Futures</strong> Price<br />

Using futures <strong>to</strong> protect the value<br />

of your portfolio (hedging)<br />

If you own a portfolio of s<strong>to</strong>ck that broadly<br />

tracks the index <strong>and</strong> believe that the market is<br />

going <strong>to</strong> fall but do not want <strong>to</strong> sell (for either<br />

cost or tax reasons) you can safeguard the<br />

value of your portfolio by selling ASX SPI 200 <br />

<strong>Index</strong> <strong>Futures</strong>. This act of protecting your<br />

portfolio is known as hedging.<br />

How do you profit from a falling share<br />

market<br />

Sell a ASX SPI 200 <strong>Index</strong> <strong>Futures</strong> contract<br />

<strong>and</strong> then buy the contract when the price has<br />

fallen. This is also known as going short a<br />

futures contract.<br />

When you implement a hedging strategy using<br />

futures any decrease (increase) in the value of<br />

your sharemarket portfolio will be compensated<br />

for by an increase (decrease) in the value of the<br />

futures contract.