A n nu al R ep ort - Royal Agricultural Society of NSW

A n nu al R ep ort - Royal Agricultural Society of NSW

A n nu al R ep ort - Royal Agricultural Society of NSW

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

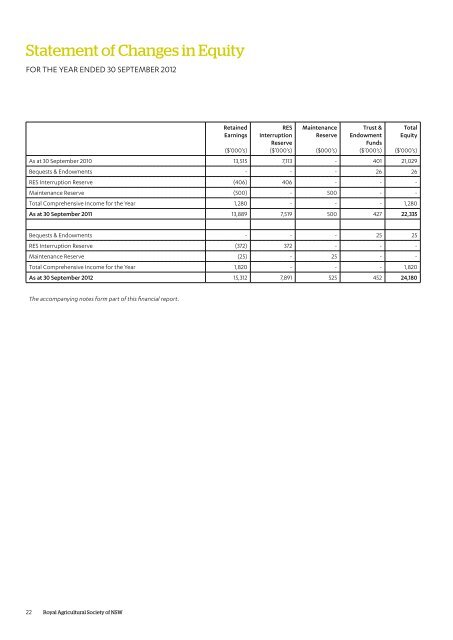

Statement <strong>of</strong> Changes in Equity<br />

FOR THE YEAR ENDED 30 SEPTEMBER 2012<br />

Notes to and forming part <strong>of</strong> the Financi<strong>al</strong> R<strong>ep</strong><strong>ort</strong><br />

FOR THE YEAR ENDED 30 SEPTEMBER 2012<br />

Retained<br />

Earnings<br />

($’000’s)<br />

RES<br />

Interruption<br />

Reserve<br />

($’000’s)<br />

Maintenance<br />

Reserve<br />

($000’s)<br />

Trust &<br />

Endowment<br />

Funds<br />

($’000’s)<br />

Tot<strong>al</strong><br />

Equity<br />

($’000’s)<br />

As at 30 S<strong>ep</strong>tember 2010 13,515 7,113 - 401 21,029<br />

Bequests & Endowments - - - 26 26<br />

RES Interruption Reserve (406) 406 - - -<br />

Maintenance Reserve (500) - 500 - -<br />

Tot<strong>al</strong> Comprehensive Income for the Year 1,280 - - - 1,280<br />

As at 30 S<strong>ep</strong>tember 2011 13,889 7,519 500 427 22,335<br />

Bequests & Endowments - - - 25 25<br />

RES Interruption Reserve (372) 372 - - -<br />

Maintenance Reserve (25) - 25 - -<br />

Tot<strong>al</strong> Comprehensive Income for the Year 1,820 - - - 1,820<br />

As at 30 S<strong>ep</strong>tember 2012 15,312 7,891 525 452 24,180<br />

The accompanying notes form part <strong>of</strong> this financi<strong>al</strong> r<strong>ep</strong><strong>ort</strong>.<br />

1. INCORPORATION<br />

The Roy<strong>al</strong> Agricultur<strong>al</strong> <strong>Society</strong> <strong>of</strong> <strong>NSW</strong> (RAS) is incorporated in Austr<strong>al</strong>ia<br />

under the Roy<strong>al</strong> Agricultur<strong>al</strong> <strong>Society</strong> Act 1869.<br />

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES<br />

(a) Basis <strong>of</strong> Pr<strong>ep</strong>aration<br />

The financi<strong>al</strong> r<strong>ep</strong><strong>ort</strong> is a speci<strong>al</strong> purpose financi<strong>al</strong> r<strong>ep</strong><strong>ort</strong> that has<br />

been pr<strong>ep</strong>ared for distribution to the members to fulfil the directors’<br />

financi<strong>al</strong> r<strong>ep</strong><strong>ort</strong>ing requirements. The accounting policies used in the<br />

pr<strong>ep</strong>aration <strong>of</strong> this financi<strong>al</strong> r<strong>ep</strong><strong>ort</strong>, as described below, are consistent<br />

with the previous years, and are, in the opinion <strong>of</strong> the directors,<br />

appropriate to meet the needs <strong>of</strong> members.<br />

Accordingly, the financi<strong>al</strong> r<strong>ep</strong><strong>ort</strong> has been pr<strong>ep</strong>ared in accordance with<br />

the measurement requirements <strong>of</strong> applicable Accounting Standards<br />

and other mandatory pr<strong>of</strong>ession<strong>al</strong> r<strong>ep</strong><strong>ort</strong>ing requirements.<br />

The financi<strong>al</strong> r<strong>ep</strong><strong>ort</strong> complies with Austr<strong>al</strong>ian Accounting Standards,<br />

which includes Austr<strong>al</strong>ian equiv<strong>al</strong>ents to Internation<strong>al</strong> Financi<strong>al</strong><br />

R<strong>ep</strong><strong>ort</strong>ing Standards (AIFRS). Some AIFRS and other Austr<strong>al</strong>ian<br />

Accounting Standards contain requirements specific to not-forpr<strong>of</strong>it<br />

entities that are inconsistent with IFRS requirements, including<br />

Austr<strong>al</strong>ian Accounting Standards AASB 102 Inventories, AASB 116<br />

Property, Plant and Equipment, AASB 136 Impairment <strong>of</strong> Assets and<br />

AASB 1004 Contributions.<br />

The financi<strong>al</strong> r<strong>ep</strong><strong>ort</strong> is presented in Austr<strong>al</strong>ian dollars ($).<br />

(b) New Accounting Standards and Interpretations<br />

(i) Changes in accounting policy and disclosures<br />

The accounting policies adopted are consistent with those <strong>of</strong> the<br />

previous financi<strong>al</strong> year.<br />

(ii) Accounting standards and interpretations issued but not yet effective<br />

Certain Austr<strong>al</strong>ian Accounting Standards and Interpretations have<br />

recently been issued or amended but are not yet effective and have not<br />

been adopted by the <strong>Society</strong> for the an<strong>nu</strong><strong>al</strong> r<strong>ep</strong><strong>ort</strong>ing period ended<br />

30 S<strong>ep</strong>tember 2012. The directors have not early adopted any <strong>of</strong> these<br />

new or amended standards or interpretations. The directors have not<br />

yet fully assessed the impact <strong>of</strong> these new or amended standards (to<br />

the extent relevant to the RAS).<br />

(c) Cash At Bank and On Hand<br />

For the purposes <strong>of</strong> the Cash Flow Statement, cash includes cash on<br />

hand, in banks, in cash funds and commerci<strong>al</strong> bills readily converted to<br />

cash within 3 months or less.<br />

(d) Investments<br />

Investments and financi<strong>al</strong> assets in the scope <strong>of</strong> AASB 139 Financi<strong>al</strong><br />

Instruments: Recognition and Measurement are categorised as either<br />

financi<strong>al</strong> assets at fair v<strong>al</strong>ue through pr<strong>of</strong>it or loss, loans and receivables,<br />

held-to-maturity investments, or available-for-s<strong>al</strong>e financi<strong>al</strong> assets. The<br />

classification d<strong>ep</strong>ends on the purpose for which the investments were<br />

acquired. Designation is re-ev<strong>al</strong>uated at each financi<strong>al</strong> year end, but<br />

there are restrictions on reclassifying to other categories.<br />

When financi<strong>al</strong> assets are recognised initi<strong>al</strong>ly, they are measured at fair<br />

v<strong>al</strong>ue, plus, in the case <strong>of</strong> assets not at fair v<strong>al</strong>ue through pr<strong>of</strong>it or loss,<br />

directly attributable transaction costs.<br />

(i) Recognition and de-recognition<br />

All regular way purchases and s<strong>al</strong>es <strong>of</strong> financi<strong>al</strong> assets are recognised on<br />

the trade date i.e., the date that the <strong>Society</strong> commits to purchase the<br />

asset. Regular way purchases or s<strong>al</strong>es are purchases or s<strong>al</strong>es <strong>of</strong> financi<strong>al</strong><br />

assets under contracts that require delivery <strong>of</strong> the assets within the<br />

period established gener<strong>al</strong>ly by regulation or convention in the market<br />

place. Financi<strong>al</strong> assets are derecognised when the right to receive cash<br />

flows from the financi<strong>al</strong> assets have expired or been transferred.<br />

(ii) Held-to-maturity investments<br />

Non-derivative financi<strong>al</strong> assets with fixed or determinable payments<br />

and fixed maturity are classified as held-to-maturity when the <strong>Society</strong><br />

has the positive intention and ability to hold to maturity. Investments<br />

intended to be held for an undefined period are not included in this<br />

classification. Investments that are intended to be held-to-maturity,<br />

such as bonds, are subsequently measured at am<strong>ort</strong>ised cost. This<br />

cost is computed as the amount initi<strong>al</strong>ly recognised mi<strong>nu</strong>s princip<strong>al</strong><br />

r<strong>ep</strong>ayments, plus or mi<strong>nu</strong>s the cumulative am<strong>ort</strong>isation using the<br />

effective interest method <strong>of</strong> any difference between the initi<strong>al</strong>ly<br />

recognised amount and the maturity amount. This c<strong>al</strong>culation includes<br />

<strong>al</strong>l fees and points paid or received between parties to the contract<br />

that are an integr<strong>al</strong> part <strong>of</strong> the effective interest rate, transaction costs<br />

and <strong>al</strong>l other premiums and discounts. For investments carried at<br />

am<strong>ort</strong>ised cost, gains and losses are recognised in pr<strong>of</strong>it or loss when<br />

the investments are derecognised or impaired, as well as through the<br />

am<strong>ort</strong>ization process.<br />

(e) Trade and Other Receivables<br />

Trade receivables are recognised and carried at origin<strong>al</strong> invoice amount<br />

less a provision for any uncollectible debts. An assessment for doubtful<br />

debts is made when collection <strong>of</strong> the full amount is no longer probable.<br />

Bad debts are written <strong>of</strong>f as incurred.<br />

(f) Inventories<br />

Inventories r<strong>ep</strong>resent food and beverage stock and have been v<strong>al</strong>ued<br />

at the lower <strong>of</strong> cost and net re<strong>al</strong>isable v<strong>al</strong>ue. Cost is determined on the<br />

average cost basis and comprises the cost <strong>of</strong> the purchase including<br />

the costs <strong>of</strong> bringing the inventories to location.<br />

22 Roy<strong>al</strong> Agricultur<strong>al</strong> <strong>Society</strong> <strong>of</strong> <strong>NSW</strong> An<strong>nu</strong><strong>al</strong> R<strong>ep</strong><strong>ort</strong> 2011/2012 23