Newsletter February 2002

Newsletter February 2002

Newsletter February 2002

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

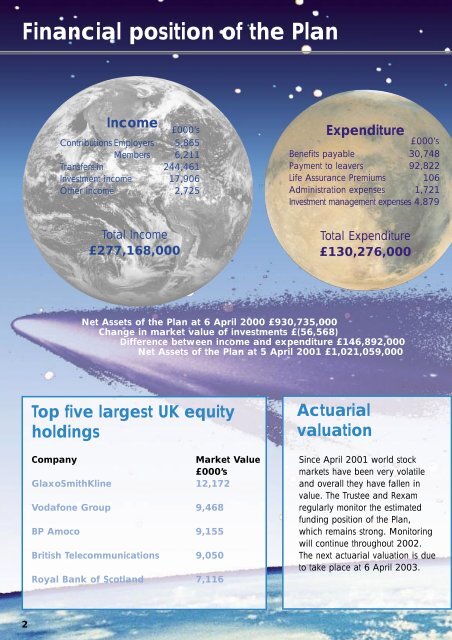

Financial position of the Plan<br />

Income<br />

£000’s<br />

Contributions Employers 5,865<br />

Members 6,211<br />

Transfers-in 244,461<br />

Investment income 17,906<br />

Other income 2,725<br />

Expenditure<br />

£000’s<br />

Benefits payable 30,748<br />

Payment to leavers 92,822<br />

Life Assurance Premiums 106<br />

Administration expenses 1,721<br />

Investment management expenses 4,879<br />

Total Income<br />

£277,168,000<br />

Total Expenditure<br />

£130,276,000<br />

Net Assets of the Plan at 6 April 2000 £930,735,000<br />

Change in market value of investments £(56,568)<br />

Difference between income and expenditure £146,892,000<br />

Net Assets of the Plan at 5 April 2001 £1,021,059,000<br />

Top five largest UK equity<br />

holdings<br />

Company<br />

Market Value<br />

£000’s<br />

GlaxoSmithKline 12,172<br />

Vodafone Group 9,468<br />

BP Amoco 9,155<br />

British Telecommunications 9,050<br />

Royal Bank of Scotland 7,116<br />

Actuarial<br />

valuation<br />

Since April 2001 world stock<br />

markets have been very volatile<br />

and overall they have fallen in<br />

value. The Trustee and Rexam<br />

regularly monitor the estimated<br />

funding position of the Plan,<br />

which remains strong. Monitoring<br />

will continue throughout <strong>2002</strong>.<br />

The next actuarial valuation is due<br />

to take place at 6 April 2003.<br />

2