NHO International 2009 - Benefits Online

NHO International 2009 - Benefits Online

NHO International 2009 - Benefits Online

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

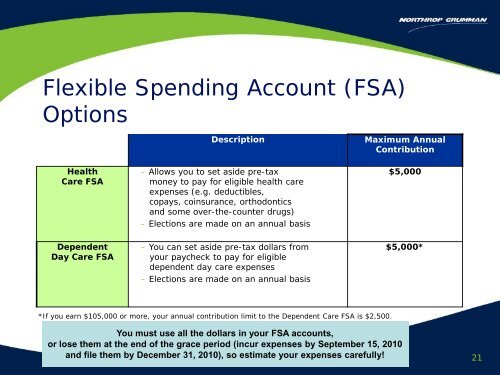

Flexible Spending Account (FSA)<br />

Options<br />

Health<br />

Care FSA<br />

Description<br />

– Allows you to set aside pre-tax<br />

money to pay for eligible health care<br />

expenses (e.g. deductibles,<br />

copays, coinsurance, orthodontics<br />

and some over-the-counter drugs)<br />

– Elections are made on an annual basis<br />

Maximum Annual<br />

Contribution<br />

$5,000<br />

Dependent<br />

Day Care FSA<br />

– You can set aside pre-tax dollars from<br />

your paycheck to pay for eligible<br />

dependent day care expenses<br />

– Elections are made on an annual basis<br />

$5,000*<br />

*If you earn $105,000 or more, your annual contribution limit to the Dependent Care FSA is $2,500.<br />

You must use all the dollars in your FSA accounts,<br />

or lose them at the end of the grace period (incur expenses by September 15, 2010<br />

and file them by December 31, 2010), so estimate your expenses carefully!<br />

21