A/B Tranching of Commercial Real Estate â Secured Loans: An ...

A/B Tranching of Commercial Real Estate â Secured Loans: An ...

A/B Tranching of Commercial Real Estate â Secured Loans: An ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

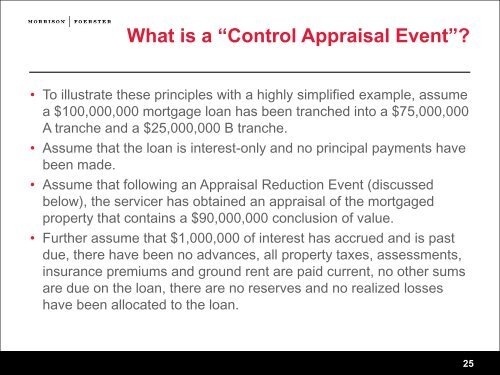

What is a “Control Appraisal Event”<br />

• To illustrate these principles with a highly simplified example, assume<br />

a $100,000,000 mortgage loan has been tranched into a $75,000,000<br />

A tranche and a $25,000,000 B tranche.<br />

• Assume that the loan is interest-only and no principal payments have<br />

been made.<br />

• Assume that following an Appraisal Reduction Event (discussed<br />

below), the servicer has obtained an appraisal <strong>of</strong> the mortgaged<br />

property that contains a $90,000,000 conclusion <strong>of</strong> value.<br />

• Further assume that $1,000,000 <strong>of</strong> interest has accrued and is past<br />

due, there have been no advances, all property taxes, assessments,<br />

insurance premiums and ground rent are paid current, no other sums<br />

are due on the loan, there are no reserves and no realized losses<br />

have been allocated to the loan.<br />

25