Enrollment Guide - Stark State College

Enrollment Guide - Stark State College

Enrollment Guide - Stark State College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2013-14<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong><br />

<strong>Enrollment</strong> <strong>Guide</strong><br />

Including admissions, financial aid and registering for classes<br />

Information essential to your college success.<br />

starkstate.edu

Welcome<br />

You’re on your way to joining the <strong>Stark</strong> <strong>State</strong> <strong>College</strong> family.<br />

Read this entire booklet to get an overview of the enrollment process.<br />

Review the following checklists to determine if you have completed<br />

all necessary steps for starting classes in the coming semester,<br />

including admission, financial aid and registration.<br />

We look forward to assisting you.<br />

330-494-6170 | 1-800-797-8275 | www.starkstate.edu<br />

Table of contents<br />

Apply for admission ............................................................... 1<br />

Apply for financial aid ........................................................... 2<br />

Types of aid ........................................................................... 4<br />

General eligibility requirements ........................................... 4<br />

Additional financial aid services ........................................... 6<br />

Student grants, work programs and scholarships ................. 6<br />

Tax credits ............................................................................. 8<br />

Veterans’ benefits ................................................................. 9<br />

Registering for classes .......................................................... 11<br />

Cost/disbursement ............................................................. 12<br />

Standards of academic progress ......................................... 14<br />

Frequently asked questions ................................................. 16<br />

Other information to know .................................................. 20<br />

Class attendance ................................................................. 20<br />

Title IV refund ..................................................................... 20<br />

Student rights/responsibilities/information ....................... 21<br />

Student confidentiality........................................................ 22<br />

Student services.................................................................. 22<br />

Directory....................................................... inside back cover<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong> does not discriminate on the basis of race, color, national origin,<br />

sex, disability or age in its programs and activities. For inquiries regarding the<br />

<strong>College</strong>’s non-discrimination policies (Section 504, Title IX and Title VI) contact<br />

Wally Hoffer, Dean of Student Services at 330-494-6170, Ext. 4364 or Room S307f.

1<br />

Apply for<br />

admission<br />

NOTE:<br />

Apply for admission<br />

First-time students<br />

o Apply for admission to the <strong>College</strong><br />

> online at www.starkstate.edu<br />

> via mail at 6200 Frank Ave. N.W., North Canton, OH 44720<br />

> in person at the Academic Records/Registrar’s Office<br />

Hours: Monday - Thursday 8 a.m. - 7:30 p.m.,<br />

Friday 8 a.m. - 4 p.m.<br />

o Submit these documents to the Academic Records/<br />

Registrar’s Office:<br />

> Official high school transcript or GED scores. Contact your<br />

high school to obtain these records. Every student must<br />

submit proof of high school graduation or GED completion.<br />

Home schooled students are required to submit an equivalent<br />

diploma, which may be official GED scores or a notarized<br />

transcript that includes the graduation date, all courses<br />

with grades and final GPA. They must also submit ACT or<br />

COMPASS test scores.<br />

> ACT/SAT scores (if taken within the last two years)<br />

> Transfer students must also submit official transcripts from<br />

all previously attended colleges. The college transcripts will<br />

be evaluated to determine which courses will transfer to<br />

<strong>Stark</strong> <strong>State</strong>. Official transcripts from every college attended<br />

must be submitted, even if you anticipate the credits will<br />

not transfer.<br />

> Males between the age of 18 and 26 must supply the <strong>College</strong><br />

with their Selective Service number. To register or obtain<br />

your number go to www.sss.gov or call toll-free 847-688-2567<br />

or 847-688-6888.<br />

o Schedule an appointment<br />

Call 330-494-6170 or stop in the Office of Admissions/<br />

Student Services to complete the COMPASS assessment<br />

(pre-admission placement).<br />

Testing times are Monday - Thursday at 9 a.m., 11 a.m., 1 p.m.,<br />

3 p.m., 5 p.m. or 6 p.m. If you took the COMPASS assessment<br />

within the last two years at another college or university, have<br />

the results sent to the Office of Admissions/Student Services.<br />

o Log on to mystarkstate<br />

Information on how to access mystarkstate will be provided with<br />

your letter of acceptance to <strong>Stark</strong> <strong>State</strong> <strong>College</strong>. It is important<br />

to use mystarkstate to track the progress of your admission and<br />

financial aid applications!<br />

Fully-online students<br />

who plan to take only online classes should refer to<br />

www.starkstate.edu/estarkstate/studentservices for<br />

application information.<br />

1

2<br />

Apply for<br />

financial<br />

aid<br />

Apply for financial aid<br />

The Financial Aid Office is committed to helping find ways to make<br />

a college education affordable for <strong>Stark</strong> <strong>State</strong> students and their<br />

families. We offer a variety of services and programs designed to<br />

help meet your educational expenses. Our staff is dedicated to<br />

making sure you receive your aid in a timely and efficient manner.<br />

The key to financing your education is to start planning early. The<br />

more you know about how financial aid works, the better prepared<br />

you will be to pay for college.<br />

For the most up-to-date financial aid information, click on the<br />

financial aid link on the <strong>Stark</strong> <strong>State</strong> website, www.starkstate.edu.<br />

If you have any questions about the financial aid process, contact<br />

the Financial Aid Office at 330-494-6170. Hours are Monday<br />

through Thursday 8 a.m. to 7:30 p.m. and Friday 8 a.m. to 4 p.m.<br />

(closed at 3 p.m. on Friday during the summer).<br />

o Complete the Free Application for Federal Student<br />

Aid (FAFSA)<br />

All students should apply for financial aid by completing the<br />

FAFSA via www.fafsa.gov. The <strong>Stark</strong> <strong>State</strong> <strong>College</strong> school<br />

code is 011141. You will need your federal tax return to<br />

complete the FAFSA.<br />

You also will need a PIN to complete the FAFSA online.<br />

Apply for your PIN at www.pin.ed.gov. Dependent students<br />

will need a parent to sign the FAFSA with a PIN; parent will<br />

need to apply for a separate PIN.<br />

Priority dates<br />

Summer session<br />

March 1 FAFSA filing deadline<br />

April 1 Required documentation deadline<br />

May 1 Online loan request deadline<br />

Fall session<br />

May 1 FAFSA filing deadline<br />

June 1 Required documentation deadline<br />

July 1 Online loan request deadline<br />

Spring session<br />

Oct. 1 FAFSA filing deadline<br />

Nov 1 Required documentation deadline<br />

Dec 1 Online loan request deadline<br />

Applications received after these dates will be considered for<br />

aid, but students may not receive funds until after the start of<br />

the semester. That means you should be prepared to use your<br />

own funds to pay for a portion of your tuition and all of your<br />

books before the semester’s payment deadline.<br />

2

o FAFSA follow-up<br />

Once your FAFSA has been processed, you will receive a confirmation from the U.S. Department<br />

of Education central processing system.<br />

After central processing, <strong>Stark</strong> <strong>State</strong> then receives an electronic copy of your FAFSA usually within<br />

a week. An email will be sent to your <strong>Stark</strong> <strong>State</strong> email address notifying you of any additional<br />

required documentation. If you are asked to submit additional documentation, do so as soon as<br />

possible. Your financial aid cannot be processed without the requested documentation.<br />

Additional requirements can be found on mystarkstate >> My Stuff tab >> Financial Aid Tools<br />

channel >> Student Requirements link.<br />

o Understand your award package<br />

• After all your documentation has been reviewed, an email will be sent to your <strong>Stark</strong> <strong>State</strong><br />

email address notifying you that your financial aid award package has been created.<br />

• Note that your award is based on your enrollment as a full-time student (12 credit hours) for<br />

the entire academic year. You do not have to be a full-time student to qualify for financial aid.<br />

Adjustments to your Pell grant are made based on your level of enrollment, depending upon<br />

whether you are full-time (enrolled in 12 credits or more) or part-time (enrolled in 11 credits<br />

or less).<br />

• Initially, the amounts awarded represent your funds for a fall/spring academic year. If you<br />

enroll in classes for the summer, your award will automatically be re-allocated to include<br />

all three semesters. Transfer students who have received financial aid from another school<br />

during the current award year should ask their previous school to cancel all pending financial<br />

aid. Once that aid has been cancelled, provide documentation of that cancellation to the<br />

<strong>Stark</strong> <strong>State</strong> Financial Aid Office.<br />

o Apply for a student loan<br />

• If you are offered a Direct Loan and are interested in borrowing those funds, you must formally<br />

accept the offered loans through mystarkstate >> My Stuff tab >> Financial Aid Tools channel<br />

>> Accept Award Offers link.<br />

• If you are a first-time loan borrower at <strong>Stark</strong> <strong>State</strong> you also must complete the loan application<br />

process. This includes completing a loan entrance counseling session and a Master Promissory<br />

Note. These can be accessed through mystarkstate >> My Stuff tab >> Financial Aid Tools<br />

channel >> Apply for Your Loan link or by directly accessing www.studentloans.gov.<br />

Your funds will not be processed until you complete this requirement. Keep in mind that<br />

you must be enrolled in a minimum of six credit hours in order to receive your loan funds.<br />

• Federal regulations require first-year, first-time loan borrowers to wait 30 days after the start<br />

of their semester before funds can be disbursed to them.<br />

• If you are applying for a one-semester loan, your loan will be paid in two disbursements. The<br />

first half will be paid on the established disbursement date for that term; the remaining funds<br />

will be paid at the mid-point of the semester.<br />

your connection<br />

admissions | financial aid | registration<br />

3

Types of aid<br />

Grants are need-based financial aid from the federal and state<br />

government. Grants do not require repayment. Available grant<br />

programs include the Federal Pell Grant and the Federal<br />

Supplemental Educational Opportunity Grant (SEOG).<br />

TIP:<br />

Fill out your<br />

FAFSA as early<br />

in the year as<br />

possible!<br />

Loans are financial aid that must be repaid. Available loan<br />

programs include the Federal Direct Loan and the Federal<br />

Parent Loan for Undergraduate Students (PLUS), a loan for parents<br />

of dependent students.<br />

Federal Work Study is a form of financial aid paid to a student<br />

as wages for working.<br />

Scholarships are funds provided by the <strong>College</strong> or donors to<br />

students based on pre-determined criteria.<br />

Additional resources include assistance from public agencies as<br />

described in this booklet.<br />

General eligibility requirements<br />

Eligibility for most financial aid programs is based on demonstrated<br />

financial need of the student and/or the student’s family, and on<br />

registered credit hours.<br />

For federal and state financial aid programs a student must be a<br />

citizen, national or permanent resident of the United <strong>State</strong>s.<br />

Certain persons in the process of becoming citizens or permanent<br />

residents also may be eligible.<br />

To be eligible for federal financial aid programs (Pell, FSEOG, Federal<br />

Work Study, Federal Direct Loan, Federal PLUS), you must also<br />

• be accepted by the college for admission as a regular student and<br />

demonstrate the ability to benefit from the selected program of<br />

study. Students enrolled in high school, post-secondary option<br />

students, and early admit students are not eligible for aid.<br />

• show intent on the admission application to obtain an associate<br />

degree for transfer to another college, an associate degree for<br />

the job market, or a certificate.<br />

• be enrolled in a financial aid-eligible degree or certificate program.<br />

• be enrolled in courses that provide credit toward a financial<br />

aid-eligible degree or certificate program. Courses taken as<br />

audit are not eligible.<br />

• meet the enrollment and attendance requirements for each<br />

program.<br />

• demonstrate the ability to benefit from the education offered.<br />

You must provide an official transcript to the Office of the Registrar<br />

verifying you have earned a high school diploma or GED.<br />

• comply with requirements concerning Selective Service<br />

registration. For information regarding Selective Service, or to<br />

register, visit www.sss.gov.<br />

4

• comply with requirements concerning submission of a <strong>State</strong>ment of Educational Purpose.<br />

This is included on the financial aid application (FAFSA).<br />

• certify that you are not in default on any federal loan.<br />

• certify you do not owe a refund to any federal aid program, including grant overpayments<br />

resulting from withdrawing from class(es).<br />

• maintain satisfactory academic progress as set forth in the <strong>Stark</strong> <strong>State</strong> <strong>College</strong> Satisfactory<br />

Academic Progress Policy.<br />

• accumulate no more than 30 hours of developmental courses.<br />

For Ohio programs (Ohio National Guard Tuition Assistance and War Orphans Scholarship), you<br />

must also be a resident of Ohio (according to Ohio law) for 12 consecutive months and be enrolled<br />

in an associate degree program. Students pursuing a one-year certificate are not eligible.<br />

IMPORTANT<br />

Every student needs to be aware of <strong>Stark</strong> <strong>State</strong>’s policies – some important ones are summarized<br />

here. Read the policies in their entirety on mystarkstate.<br />

• Standards of Academic Progress (SAP) Policy - As a recipient of financial aid, you are required<br />

to adhere to <strong>Stark</strong> <strong>State</strong> <strong>College</strong>’s SAP policy. Prior to registration, be sure to review the policy on<br />

page 14 of this booklet or on mystarkstate >> My Stuff tab >> Standards of Academic Progress link.<br />

Before making any adjustments to your class schedule, speak to a student service representative.<br />

• Repeat Coursework Policy - Students may receive financial aid for repeating courses. However, if<br />

retaking a previously passed course, financial aid can only be used for one repeat of that course.<br />

Any course that is repeated will be used in the calculation of a student’s Satisfactory Academic<br />

Progress status. More information on this policy is available through mystarkstate >> My Stuff tab<br />

>> Financial Aid Tools >> Repeat Coursework Policy link.<br />

• Title IV Refund Policy - This policy regulates what happens to federal financial aid if you withdraw<br />

or cease attendance in your scheduled classes. More information on this policy is available on page<br />

20 of this booklet or through mystarkstate >> My Stuff tab >> Title IV Refund Policy link.<br />

• Class Attendance Policy - Attendance will be taken in all classes to document that students who<br />

are eligible for federal financial aid attend class. Students who receive federal financial aid and<br />

do not attend their classes risk having their financial aid cancelled or reduced. More information<br />

on this policy is available on page 20 of this booklet or through mystarkstate >> My Stuff tab >><br />

Financial Aid Tools >> Attendance Policy link.<br />

• Developmental Classes - A student is limited to 30 developmental credit hours while receiving<br />

federal financial aid. Federal financial aid programs will not cover any developmental courses<br />

taken after reaching the maximum 30 hours. These courses include, but are not limited to<br />

MTH100, MTH101, MTH103, MTH123, ENG010, ENG011, ENG100, ENG101, ENG103, ENG105,<br />

OAD/AOT100, OAD/AOT101, IDS101, IDS102, CAL101, CAL102, and CAL105, ITD100 and ITD101.<br />

• Freeze Date - The amount of your financial aid award is determined by your enrollment at the<br />

end of the sixth day of the semester. This is known as the “freeze date.” If you add or drop classes<br />

before the freeze date, your aid will be adjusted based on the number of credit hours you are<br />

enrolled. If you add or drop classes after the freeze date in any given semester, your aid will not be<br />

adjusted for that term, but you could be in violation of the Standards of Academic Progress policy.<br />

Contact the Financial Aid Office for more information on the freeze date and how it will impact<br />

your financial aid.<br />

• If you violate the SAP Policy, Title IV Refund Policy or Class Attendance Policy, you may be subject<br />

to sanctions that may include an immediate return of some or all of the funds awarded to you<br />

and/or a suspension of your eligibility for future financial aid funding.<br />

your connection<br />

admissions | financial aid | registration<br />

5

Additional financial aid services<br />

Phone counseling<br />

General information can be obtained by phone; to ensure confidentiality, however, dollar amounts<br />

cannot be discussed. Phone counseling is available during office hours. Callers with detailed<br />

questions or complicated situations may be asked to make an appointment. During the busy months<br />

of July, August and September, the Financial Aid Office will assist callers to the best of our abilities.<br />

We apologize if the high volume of calls/visits to our office results in delays in service. Please be<br />

patient and understand that we will help you as soon as possible.<br />

Appointments<br />

Appointments are offered to assist with in-depth questions or concerns. Appointments are<br />

available Monday through Thursday from 8 a.m. - 6 p.m. and Friday 8 a.m. - 4 p.m. Same day<br />

appointments will be accommodated as schedules permit and cannot be guaranteed. To schedule<br />

an appointment, call the Financial Aid Office, 330-494-6170.<br />

Student grants, work programs and scholarships<br />

Federal programs<br />

To apply for these programs you must complete the FAFSA<br />

Federal Pell Grant (PELL) An award of $605 to $5,645 per year, based on financial need. Eligibility<br />

is based upon need, enrollment and cost of education.<br />

Federal Supplemental Education Opportunity Grant (FSEOG) Allocation of funds is at the<br />

discretion of <strong>Stark</strong> <strong>State</strong>. Awards are based on need and application date. Award amounts vary,<br />

up to $400 per year. Apply through the FAFSA. According to federal regulations, students must be<br />

Pell-eligible to receive FSEOG funds. You must apply early! Funds are limited and are distributed<br />

on a first-come, first-served basis.<br />

Federal Work Study Program (FWSP) Allows students to be employed at the <strong>College</strong> to earn<br />

money for educational expenses. Awards are based on financial need; submit a written request<br />

to the Financial Aid Office. An award does not guarantee earnings; students are paid with a<br />

bi-weekly paycheck for hours actually worked. Check mystarkstate >> Student Support tab<br />

>> Work Study – Jobs List channel for job postings.<br />

Federal Direct Loan Programs A Federal Direct Loan offers freshman students up to<br />

$5,500 and sophomores up to $6,500 per year. Students pursuing a one-year certificate will remain<br />

at freshman level for borrowing purposes. This is a loan and must be repaid. Interest rates vary<br />

annually. If you already have a Direct Loan, borrowing a new loan will not affect the rate or terms<br />

of your previous loan(s). You may qualify for a subsidized and/or an unsubsidized Direct Loan up<br />

to the amounts listed above.<br />

Subsidized Direct Loans These loans are based on financial need; therefore, some students may<br />

not qualify. With a subsidized Direct Loan, no interest accumulates and no repayment is required<br />

as long as the student is enrolled in college at least half time.<br />

6

Unsubsidized Direct Loans Students who do not qualify for a subsidized Direct Loan may borrow<br />

up to the maximum amounts designated on the award notification through an unsubsidized<br />

Direct Loan. Loan payments can be deferred as long as the student is enrolled at least half-time.<br />

Interest will accrue and can be paid by the borrower while in school and during the grace and<br />

repayment period. Independent students (see definition, page 17) have the option of<br />

borrowing an additional $4,000 in unsubsidized Direct Loan Funds.<br />

Federal Parent Loan for Undergraduate Students (Federal PLUS) The Federal PLUS program is for<br />

parents of dependent students. It is a loan in which family income is not taken into consideration;<br />

therefore, the program is open to almost any parent who has good credit. The parent can borrow up<br />

to the cost of the college education, less aid, at a variable rate of interest (currently not to exceed<br />

9%). Repayment begins 60 days after the final disbursement of the funds, according to the terms<br />

negotiated by the bank. We recommend students first utilize all eligibility for grants and the Federal<br />

Direct Loans before receiving a federal PLUS. This is a loan and must be repaid. Funds are made in<br />

multiple disbursements and given to the parent(s) after tuition and fees have been paid.<br />

<strong>State</strong> programs<br />

Ohio National Guard If you enlist in the National Guard for six years, the National Guard will pay<br />

100% of tuition costs. You must be an Ohio resident enrolled in at least six credit hours at an Ohio<br />

college. Contact your local National Guard at 614-336-7053 for more information.<br />

Montgomery GI Bill If you serve in the Army Reserve or the National Guard, you may be eligible<br />

to receive education benefits while attending classes. In addition, you may qualify for loan<br />

repayment. Contact the local Army Reserve or National Guard Office for more information.<br />

The Academic Records/Registrar’s Office certifies enrollment for this program.<br />

Institutional programs<br />

President’s Scholars Award Awarded to new, first-time, full-time students ONLY. Must meet two<br />

of three criteria: 1) high school GPA 3.0 or higher, 2) rank in the top 25% of your high school class<br />

3) ACT composite score of 22 or higher. The total scholarship award is $2,500 divided over six<br />

semesters. Additional requirements – detailed when the award is made – must be met to maintain<br />

eligibility and receive the full award amount.<br />

Other scholarships Application is made by filing the FAFSA prior to June 1. A complete list of<br />

scholarships is available at www.starkstate.edu/scholarships. For additional information on<br />

outside scholarship funding, visit www.brokescholar.com or www.fastweb.com or your local<br />

library. Scholarships are divided between fall and spring semesters unless otherwise designated<br />

by the donor.<br />

your connection<br />

admissions | financial aid | registration<br />

7

Social service programs<br />

Bureau of Vocational Rehabilitation (BVR) Educational assistance may be available for students<br />

with special needs. Call the Canton (330-438-0500) or Akron (330-643-3080) BVR office for more<br />

information.<br />

Workforce Initiative Association (WIA) and Trade Adjustment Assistance (TAA) for individuals<br />

who recently lost jobs or are entering the workforce after an extended period of unemployment.<br />

You must complete the FAFSA to determine eligibility for grants before being considered<br />

for WIA and TAA funding. For information about WIA and TAA, contact the Employment Source<br />

at 330-433-9675.<br />

Tax credits and deductions<br />

For the 2012 tax year, two tax credits are available to help you offset the costs of higher<br />

education. You may be eligible to claim an education credit if you, your spouse, or a dependent<br />

you claim on your tax return was a student enrolled at or attending an eligible educational<br />

institution. The credits are based on the amount of qualified education expenses paid for the<br />

student in 2012 for academic periods beginning in 2012 and in the first three months of 2013.<br />

Lifetime Learning Tax Credit The Lifetime Learning tax credit is a non-refundable federal<br />

income tax credit of up to $2,000 (20% of the first $10,000) for qualified tuition and related<br />

expenses. The amount of your lifetime learning credit for 2012 is gradually reduced if your<br />

modified adjusted gross income is between $52,000 and $62,000 ($104,000 and $124,000<br />

if you file a joint return).<br />

American Opportunity Credit The American Opportunity Credit is a partially refundable credit<br />

up to $2,500 (100% of the first $2,000 and 25% of the next $2,000) for qualified expenses<br />

paid for each eligible student. This credit is only available to students who are in the first four<br />

years of post-secondary education. The amount of your American Opportunity Credit for 2012<br />

is gradually reduced if your modified adjusted gross income is between $80,000 and $90,000<br />

($160,000 and $180,000 if filing a joint return).<br />

In addition to the two tax credits, two deductions may be available to you.<br />

Student Loan Interest Deduction Students can deduct up to $2,500 of student loan interest paid<br />

in 2012 on any federal or private educational loans on your federal tax return. The loans must<br />

have been used to fund half-time or greater attendance. You may qualify for this deduction if<br />

your modified adjusted gross income is less than $75,000 ($155,000 if you file a joint return).<br />

Tuition and Fees Tax Deduction You can reduce your taxable income by as much as $4,000<br />

and may benefit from this deduction if you are not eligible for any of the education tax credits.<br />

If your modified adjusted gross income is less than $80,000 ($160,000 if you file a joint return)<br />

you may be eligible for a $2,000 deduction. If your modified adjusted gross income is less than<br />

$65,000 ($130,000 if you file a joint return) you could be eligible for the maximum $4,000<br />

deduction. The amount of the tuition and fees deduction you are eligible for depends on the<br />

amount of qualified tuition and related expenses you paid.<br />

NOTE: These summaries, current at press time, are meant to give a general overview of these<br />

educational tax initiatives. Consult a tax advisor or IRS Publication 970 regarding the specifics<br />

of your personal situation.<br />

8

Veterans’ benefits<br />

How to apply for veterans’ benefits<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong> is privileged to honor the service and sacrifice of our veterans. The <strong>College</strong><br />

is fully-accredited under the laws that provide educational benefits for veterans. The Academic<br />

Records/Registrar’s Office certifies veterans’ eligibility and assists new and continuing student<br />

veterans with the processing of VA forms for educational benefits.<br />

To receive benefits, you must apply for admission to the <strong>College</strong> by following the instructions<br />

at www.starkstate.edu/admissions. You can apply online, by mail or in person at the Academic<br />

Records/Registrar’s Office.<br />

Once you are notified of your admission to the <strong>College</strong>, call the <strong>College</strong>’s veterans’ representative<br />

at 330-494-6170, Ext. 4254 to schedule an appointment or drop by Room S308. Hours for<br />

one-on-one benefit counseling are Monday and Thursday 8 a.m. - 4 p.m., Tuesday 1 p.m. - 4 p.m.,<br />

Wednesday 11:30 a.m. - 4 p.m. and Friday 8 a.m. - 11 a.m.<br />

The <strong>College</strong>’s veterans’ representative will provide guidance in preparing your Application for<br />

VA Education Benefits for submission to the U.S. Department of Veterans Affairs. Additional<br />

information regarding educational benefits is available at www.va.gov.<br />

Ohio GI Promise<br />

In an effort to assist veterans, service members and their families with reducing the costs associated<br />

with obtaining a college degree, the state of Ohio spearheaded an initiative known as the Ohio<br />

GI Promise which allows U.S. armed services veterans, their spouses and dependents who choose<br />

to attend Ohio colleges and universities to do so at in-state tuition rates. Details about the Ohio<br />

GI Promise can be found at the University System of Ohio website www.uso.edu. To determine if<br />

you meet the qualifications for in-state tuition rates, visit www.starkstate.edu/veterans to print the<br />

residency reclassification application, complete and return it to the Academic Records/Registrar’s<br />

Office with the appropriate required supporting documentation.<br />

Additional military scholarships/financial aid opportunities Scholarships and grants exclusively for<br />

the military community can be found at www.military.com. The Ohio National Guard Scholarship<br />

provides tuition assistance to qualified members;<br />

visit www.ongsp.org.<br />

The Veterans Club of <strong>Stark</strong> <strong>State</strong> <strong>College</strong><br />

This student organization assists and encourages veterans and their family members to develop<br />

educationally and socially, gain organizational and leadership skills and learn more about the<br />

community involving the veterans through personal interaction. For more information, contact<br />

330-494-6170, Ext. 4173 or stop by Room B230.<br />

your connection<br />

admissions | financial aid | registration<br />

9

Receiving credit for military service<br />

Some of your military experience may be applied toward credit for a degree. To receive credit,<br />

you must submit transcripts for your branch of the military. Go to www.starkstate.edu/veterans<br />

and click on “Receiving Credit for Military Service” to view transcript submission information.<br />

Other resources<br />

The General Educational Development (GED) Testing Service (GEDTS) maintains all records of<br />

GED transcripts obtained by active duty US military personnel tested after October 1, 1985,<br />

and by US military personnel and dependents tested overseas after September 1974 under the<br />

Defense Activity for Nontraditional Educational Support (DANTES) program. GEDTS also maintains<br />

records of GED tests taken at the Veterans Medical Centers after October 1, 1989. To obtain an<br />

official copy of the GED transcript, users should complete the GED transcript request form<br />

(www.acenet.edu/clll/ged/trans-request.cfm) and submit it to: GED Testing Service,<br />

One Dupont Circle, NW, Suite 250, Washington, DC 20036; phone 1-800-626-9433 or<br />

202-930-9400, fax 202-659-8875, www.gedtest.org.<br />

DANTES maintains the educational records of the service members who have completed<br />

DANTES Subject Standardized Tests (DSSTs), CLEP examinations, GED, and United <strong>State</strong>s<br />

Armed Forces Institute (USAFI) tests. For more information, visit the DANTES website at<br />

http://www.dantes.doded.mil.<br />

For tests and courses taken under the auspices of USAFI before September 1974,<br />

contact Thomson Prometric, USAFI Records, P.O. Box 6605, Princeton, NJ 08541-6605;<br />

609-895-5011, toll-free 877-471-9860, fax 609-895-5026.<br />

There is no charge for transcripts sent to military test control officers for counseling<br />

purposes.<br />

Certificate of Release or Discharge from Active Duty<br />

You can request a copy of your Certificate of Release or Discharge from Active Duty Form<br />

(DD-214) at www.archives.gov.<br />

Don’t have a computer<br />

Mail your request to National Personnel Records Center, Military Personnel Records,<br />

9700 Page Avenue, St. Louis, MO 63132; call 314- 801-0800 or fax 314- 801-9195.<br />

10

3<br />

Registering<br />

for<br />

classes<br />

Registering for classes<br />

First-time students<br />

o Meet with an admissions counselor<br />

All new <strong>Stark</strong> <strong>State</strong> <strong>College</strong> students are required to meet<br />

with an admissions counselor prior to registering for classes.<br />

Schedule an appointment by calling 330-494-6170 or stop in<br />

the Office of Admissions/Student Services. During this meeting<br />

you’ll review COMPASS assessment results, select a major and<br />

develop a student learning plan.<br />

o Register for classes in the Academic Records/<br />

Registrar’s Office .<br />

o Review your student schedule for correct classes, days,<br />

times, payment deadline dates, refunds and other deadlines.<br />

Registration procedures and services<br />

o If you need to add or drop a class use mystarkstate<br />

or file a schedule change form with the Academic Records/<br />

Registrar’s Office.<br />

IMPORTANT<br />

Adjustments to your schedule could result in adjustments to<br />

your financial aid. Visit the Financial Aid Office before making<br />

any schedule changes to determine the effect a schedule<br />

change may have on your financial aid eligibility.<br />

o <strong>Enrollment</strong> verifications can be requested through<br />

mystarkstate. Also, after the third week of each semester,<br />

enrollment information is available from the national<br />

clearinghouse link found there.<br />

NOTE:<br />

Fully-online Students<br />

who plan to take only online classes should refer to<br />

www.starkstate.edu/estarkstate/studentservices for<br />

application information.<br />

your connection<br />

admissions | financial aid | registration<br />

11

TIP:<br />

File your<br />

FAFSA when<br />

you file your<br />

taxes!<br />

Costs/disbursement<br />

Estimated costs for nine months of full-time<br />

education at <strong>Stark</strong> <strong>State</strong> for 2013-14<br />

Tuition and Fees $3,667.00<br />

Books and Supplies $1,000<br />

Transportation* $1,872<br />

Personal Expenses* $4,208<br />

Living Costs* $1,596-$5,612<br />

*budget item estimate based on information provided by The <strong>College</strong> Board organization<br />

<strong>Stark</strong> <strong>State</strong> Plus Card<br />

You will be sent a <strong>Stark</strong> <strong>State</strong> Plus Card when you enroll in classes.<br />

Activate your card as soon as you receive it; it’s the only way<br />

to receive your refund from <strong>Stark</strong> <strong>State</strong> <strong>College</strong>. Go to<br />

www.starkstatepluscard.com to select a refund preference<br />

from the following options<br />

• have your funds deposited into your current bank account -<br />

the money will be available to you two to three days after the<br />

<strong>College</strong> releases the funds — OR —<br />

• choose a Higher One debit/checking account - the money will<br />

be available to you within 24 hours after the <strong>College</strong><br />

releases the funds — OR —<br />

• select a paper check option<br />

Payment of fees with financial aid<br />

The method for payment of fees varies with each type of aid<br />

program. Your award notification lists your financial aid<br />

eligibility by semesters at full-time status. The amount of aid<br />

typically available to you each semester is the amount listed.<br />

Your aid will be pro-rated for enrollments less than full-time<br />

(12 credit hours).<br />

Financial aid is first applied to the student’s tuition account.<br />

Any excess funds can be disbursed to you as a refund.<br />

• Financial aid funds will be applied to your account<br />

after your attendance is verified in all classes.<br />

• You will receive your financial aid refund<br />

after the term has begun.<br />

Distribution of refunds<br />

• Summer semester: third week of classes<br />

• Fall and spring semesters: fourth week of classes<br />

• First-time loan borrowers who are subject to the 30-day<br />

disbursement delay will not receive a refund of loan proceeds<br />

until the fifth week of classes.<br />

• Arrival of your refund depends on the refund preference you<br />

selected when you activated your <strong>Stark</strong> <strong>State</strong> Plus Card. Visit<br />

www.starkstatepluscard.com if you wish to change your refund<br />

preference or to view account activity.<br />

12

Bursar/Business Office<br />

The Financial Aid Office works closely with the Bursar’s Office to coordinate student billing<br />

and balances due. Refunds and disbursements are handled by the Bursar’s Office based on<br />

your enrollment.<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong> Student Installment Plan (SIPP)<br />

The Student Installment Payment Plan (SIPP) is printed on your schedule/receipt each semester.<br />

This program offers you the option of paying your tuition in installments. A fee of $20 is assessed;<br />

however, no interest is charged. Visit www.starkstate.edu/sipp for details.<br />

IMPORTANT<br />

Revisions and cancellations<br />

The <strong>College</strong> reserves the right to review, revise or cancel financial awards at any time due to<br />

• changes in your financial, residential or academic status.<br />

• your failure to comply with the policies, procedures or laws pertaining to these programs.<br />

• the availability of federal, state and institutional funds for each program.<br />

• changes in <strong>College</strong> policy. The <strong>College</strong> is not obligated to satisfy the total financial need<br />

of a student.<br />

Buying books with financial aid money<br />

The <strong>Stark</strong> <strong>State</strong> <strong>College</strong> Store offers a variety of products and services at its two locations on<br />

main campus. The main store, located in the Student Center (S105), is open Monday - Thursday<br />

8 a.m. - 8 p.m. and Friday 8 a.m. - 4 p.m. (hours vary between semesters and during summer<br />

session). The textbook center in G105 is open during the first 4-6 weeks of each semester. Once<br />

G105 closes, books can be purchased in the main store.<br />

The <strong>College</strong> Store offers competitively priced textbooks, used books and many textbook rentals,<br />

along with e-books when applicable. You must show your student ID and your schedule to buy<br />

books. You may use your financial aid to purchase books as long as your funds are available and<br />

allocated to the bookstore (after the fourth week of the term no charges to financial aid can be<br />

made). Check mystarkstate for your account balance. If using financial aid, you will need to<br />

show a photo ID.<br />

The <strong>College</strong> Store website lets you search for and price your required texts. You also have the option<br />

to order books online and have them delivered to your home, but financial aid cannot be used for<br />

online purchases.<br />

The <strong>College</strong> Store also offers clothing, insignia items, academic supplies and various other supplies<br />

necessary for certain programs of study. You can also buy laptops, academically priced Microsoft<br />

and Adobe software, as well as gas cards, SARTA bus passes, fax services and laminating.<br />

Supporting the <strong>Stark</strong> <strong>State</strong> <strong>College</strong> Store supports your college. All funds generated through the<br />

store go back into <strong>Stark</strong> <strong>State</strong> <strong>College</strong>’s general fund to support you, the student.<br />

your connection<br />

admissions | financial aid | registration<br />

13

Standards of Academic Progress (SAP)<br />

At <strong>Stark</strong> <strong>State</strong> <strong>College</strong>, we care about your success! That’s why it’s<br />

important for you to understand and meet the requirements of Standards<br />

of Academic Progress (SAP). This series of standards required<br />

to maintain eligibility for federal student aid includes requirements<br />

pertaining to completion of credit hours, grade point average (GPA)<br />

and maximum time frame as defined below.<br />

If you do not meet these requirements you will be disqualified<br />

from future financial aid.<br />

SAP requirements<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong> requires that any student who applies for or<br />

receives federal financial aid make satisfactory academic progress<br />

toward an Ohio Board of Regents (OBR)-approved degree or certificate.<br />

Satisfactory academic progress is measured as<br />

• Overall grade point average of 2.0.<br />

• Successful completion of 67% of the cumulative attempted*<br />

credit hours, including hours of repeated coursework. Attempted<br />

hours are determined by the number of credit hours you are<br />

registered for at the end of the sixth day of the semester.<br />

• Completion of an OBR-approved degree or certificate within<br />

the number of required credit hours listed in the <strong>College</strong> catalog<br />

for the associate or certificate degree, multiplied by 150% (as<br />

determined by the Financial Aid Office), including accepted<br />

transfer credit hours and up to 30 attempted credit hours of<br />

required developmental coursework.<br />

Successful grade completions are A, B, C, UC, D, UD, CR<br />

Unsuccessful grade completions are F, W, IN, NC, NA<br />

If you repeat a course, both grades will appear on your academic<br />

record, and the highest grade will be used in calculating the grade<br />

point average.<br />

*Attempted hours are determined by the number of credit hours you are registered for at the<br />

end of the sixth day of the semester. Credit hours added after the sixth day of the term will<br />

be included in the SAP calculation, even if financial aid is not used to pay the tuition and fees<br />

associated with those hours.<br />

14<br />

Monitoring progress<br />

At the end of each term attended, your academic progress will be<br />

evaluated, based upon the standards listed above. If you fail to meet<br />

any of the above requirements, you will receive a notification letter<br />

from the <strong>College</strong>.<br />

After the first term in which the requirements are not met,<br />

you will be placed on financial aid warning for one subsequent term.<br />

During the warning period, you will continue to be eligible for federal<br />

financial aid. The <strong>College</strong> encourages you to meet with an academic<br />

advisor to receive assistance with your educational goals.<br />

After the second term in which the requirements are not met,<br />

you will become ineligible for federal financial aid. In order to<br />

regain federal financial aid eligibility, you will be required to pay<br />

for your classes out-of-pocket until you are able to reach the<br />

67% completion rate and a cumulative 2.0 GPA.

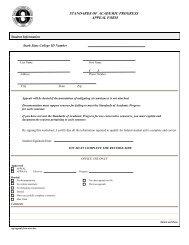

Appeal process<br />

If you have unusual or mitigating circumstances, you may submit an appeal requesting to continue<br />

to receive federal financial aid. Mitigating circumstances must be documented and approved by<br />

the Standards of Academic Progress Appeal Committee, made up of a financial aid representative,<br />

academic affairs representative, and student services representative. The appeal must be submitted<br />

by the last day to register in the term in which you are applying for continued federal financial aid.<br />

You may only submit two appeals during your time at <strong>Stark</strong> <strong>State</strong> <strong>College</strong>. Rare exceptions will be<br />

made to this policy.<br />

If federal financial aid is reinstated as a result of the appeals process, you are placed on probation<br />

for one term. During the probationary period, you must complete all registered courses and achieve<br />

a 2.0 grade point average for each semester of the probationary period to remain eligible to receive<br />

federal financial aid. After one semester of meeting the probation requirements, you will be placed<br />

on an academic plan and must continue to complete all registered courses and maintain a term 2.0<br />

GPA. As long as you are meeting the requirements of the academic plan, you will continue to receive<br />

aid. Once you are at a 67% completion rate for all attempted courses and a 2.0 grade point average,<br />

you will go back to good standing.<br />

Appeal procedure<br />

o<br />

o<br />

o<br />

Step 1 You must complete the SAP appeal form and submit it to the Financial Aid Office<br />

along with an explanation and documentation of the reasons for failing to comply with the<br />

stated academic standards. The explanation must include what improvements you have made<br />

that will ensure future academic success.<br />

Step 2 The Standards of Academic Progress Appeal Committee will review the appeal and<br />

render a decision.<br />

Step 3 You will receive the written decision of the Committee within 10 business days<br />

of the committee meeting. The decision of the Standards of Academic Progress Appeal<br />

Committee is FINAL. The Committee reserves the right to establish parameters as part<br />

of the approval process, including but not limited to restrictions of credit hours or specific<br />

courses, mandatory advising or adherence to an academic plan.<br />

If you are approved for financial aid, you are encouraged to seek an academic advisor to<br />

review an academic plan.<br />

your connection<br />

admissions | financial aid | registration<br />

15

Frequently<br />

asked<br />

questions<br />

Frequently asked questions<br />

What is financial aid<br />

Financial aid is money provided by various agencies (federal,<br />

state and local governments, colleges or universities, community<br />

organizations and private corporations or individuals)<br />

to assist students in meeting the cost of attending college. It<br />

includes gift aid (grants and scholarships) and self-help aid<br />

(loans, which must be repaid and student employment).<br />

How is my eligibility determined<br />

When you file the FAFSA, you are considered for all federal,<br />

state and institutional aid administered by the Financial Aid<br />

Office. One or more types of aid are awarded to make up the<br />

financial aid package.<br />

Do I need to be a full-time student to receive<br />

financial aid<br />

No! The amount of financial aid awarded is determined, in<br />

part, by the number of credit hours in which you are enrolled.<br />

What is the Expected Family Contribution<br />

Expected Family Contribution (EFC) is the amount of money<br />

your family is expected to contribute toward educational<br />

expenses from resources other than financial aid and is based<br />

on ability to pay. The EFC is calculated using the information<br />

provided on the FAFSA. Factors used to determine a family’s<br />

contributions include the previous year’s adjusted gross<br />

income, assets, size of family and the number of individuals<br />

in the family attending college.<br />

How is financial need determined<br />

Financial need is determined by the difference in the cost of<br />

attendance (COA) and the expected family contribution (the<br />

family’s ability to pay for college costs).<br />

How do I get my books<br />

If you have authorized your financial aid for use other than<br />

tuition, you may be eligible to charge your books to your<br />

account using your excess financial aid. The charges<br />

will then be applied to your tuition account. The system is<br />

updated on a nightly basis as aid is processed and book<br />

charges are assessed. To see if you may be eligible to<br />

charge your books to your account, check your account<br />

via mystarkstate. If a credit appears on your account, you<br />

may be able to charge your books.<br />

16

I receive no help from my parents and live on my own.<br />

Does that qualify me as an independent student<br />

Not necessarily. In order to be considered as an independent student for purposes of financial<br />

aid, you must be able to answer yes to at least one of the following questions for the 2013-2014<br />

school year:<br />

1) Were you born before January 1, 1990<br />

2) As of today, are you married<br />

3) Will you be working on a master’s or doctorate program<br />

4) Are you currently serving on active duty in the U.S. Armed Forces for purposes other than<br />

training or are you a veteran of the U.S. Armed Forces*<br />

5) Do you have children or legal dependents (other than a spouse or children who live with<br />

your) who will receive more than half of their support from you between July 1, 2013<br />

and June 30, 2014*<br />

6) At any time since you turned age 13, were both your parents deceased, were you in foster<br />

care or were you a dependent or ward of the court*<br />

7) Are you or were you an emancipated minor or in legal guardianship as determined by<br />

a court in your state of legal residence*<br />

8) At any time on or after July 1, 2012, did your high school or school district homeless<br />

liaison determine that you were an unaccompanied youth who was homeless*<br />

9) At any time on or after July 1, 2012, did the director of an emergency shelter or transitional<br />

housing program funded by the U.S. Department of Housing and Urban Development<br />

determine that you were an unaccompanied youth who was homeless*<br />

10) At any time on or after July 1, 2012, did the director of a runaway or homeless youth basic<br />

center or transitional living program determine that you were an unaccompanied youth<br />

who was homeless or were self-supporting and at risk of being homeless*<br />

If you cannot answer “yes” to any of these questions but feel there are circumstances that<br />

warrant your classification as an independent student, call or stop by the Financial Aid Office<br />

to set up an appointment so we can review your situation.<br />

*You may be required to provide documentation to the Financial Aid Office.<br />

What is verification<br />

The Department of Education selects some FAFSA applicants for a process called verification.<br />

If you are selected, you may be asked to complete a verification worksheet and provide a federal<br />

tax return transcript from the IRS and other income documents as required to the <strong>Stark</strong> <strong>State</strong><br />

<strong>College</strong> Financial Aid Office. Spouse or parents’ information and other documents may also be<br />

requested. Verification must be completed before aid eligibility can be confirmed.<br />

your connection<br />

admissions | financial aid | registration<br />

17

TIP:<br />

File a<br />

FAFSA for<br />

financial aid!<br />

I have a bachelor’s degree. May I still apply<br />

for financial aid<br />

Students with bachelor’s degrees may still apply for the<br />

Federal Work-Study Program, Federal Direct Subsidized Loan<br />

and Federal Direct Unsubsidized Loan. These students are not<br />

eligible for the Federal Pell or FSEOG grants.<br />

I am divorced/separated. What should I<br />

include on the Free Application for Federal<br />

Student Aid (FAFSA)<br />

Students who are divorced or legally separated should not<br />

include their ex-spouse’s income on the FAFSA. For more<br />

information on detailed or complicated questions, contact<br />

a <strong>Stark</strong> <strong>State</strong> <strong>College</strong> financial aid representative.<br />

I was recently married. Do I have to include<br />

my spouse’s income on the FAFSA<br />

Yes. You should include your spouse’s information on the FAFSA<br />

if you are married at the time the application is completed. If<br />

separate federal income tax returns were filed, combine the<br />

adjusted gross incomes from the tax returns and include them<br />

on the appropriate line of the FAFSA. Do the same for the<br />

amount of taxes paid and other amounts.<br />

What if I lost my job or have other special<br />

circumstances<br />

The Financial Aid Office can take into account special circumstances<br />

which may affect your need. These may include loss of<br />

income due to layoff, disability, divorce, separation or loss of<br />

untaxed benefits. You can obtain a special conditions form<br />

from the Financial Aid Office and make an appointment with<br />

a financial aid counselor. NOTE: Not all requests for special<br />

conditions are approved.<br />

Can I get financial aid for the summer semester<br />

Yes. You need to complete the FAFSA by March 1 of each year<br />

in order to have your aid ready for the summer.<br />

What is Standards of Academic Progress (SAP)<br />

Standards of Academic Progress is a federal policy that the<br />

school is required to enforce to ensure that you are making<br />

progress toward your degree. Refer to the Standards of<br />

Academic Progress for <strong>Stark</strong> <strong>State</strong> <strong>College</strong> outlined in<br />

this booklet or visit www.starkstate.edu/sap.<br />

18

What if I need to change my address<br />

If your address changes, you need to immediately notify the Academic Records/<br />

Registrar’s Office. This will update all <strong>College</strong> addresses. You can update your address<br />

through mystarkstate or by submitting the change of address form available in the<br />

Office of Admissions/Student Services.<br />

What if I receive more financial aid than the cost of my tuition<br />

If you have excess money after tuition and fees are paid, you can be issued a refund.<br />

Financial aid funds will be applied to your account after your attendance is verified in all classes.<br />

You will receive your financial aid refund from the Business Office after the term has begun.<br />

What will happen to my financial aid if I drop a class or just<br />

stop attending<br />

Attendance and academic performance are important! Withdrawing or ceasing attendance<br />

before the 60% point of the term could cause you to owe the <strong>College</strong> and/or the U.S.<br />

Department of Education money. Also, you will jeopardize your future eligibility for financial<br />

aid. See the Financial Aid Office before any withdrawal so that you may be made aware of the<br />

potential impact of your decision.<br />

Do I have to apply for financial aid every year<br />

Yes! When you file your taxes, you need to begin the FAFSA process for the new year.<br />

How can I check the status of my financial aid on the web<br />

You can access your financial aid information through mystarkstate where you can view<br />

detailed information regarding your financial aid status, as well as review and approve<br />

financial aid awards.<br />

How will the <strong>College</strong> contact me concerning my financial aid<br />

The Financial Aid Office will contact you by email and provide you with access to mystarkstate.<br />

your connection<br />

admissions | financial aid | registration<br />

19

!<br />

Other<br />

information<br />

to know<br />

Other information to know<br />

Class attendance<br />

To ensure our commitment to student success, attendance must be<br />

taken in all classes, regardless of modality, starting with the first day of<br />

the class. Faculty may elect to relate course attendance to the course<br />

grading policy. This will be specified in each course syllabus.<br />

For federal financial aid compliance, attendance will be recorded by<br />

the faculty and reported to the <strong>College</strong> Registrar’s Office. A student is<br />

considered a non-attendee in any course modality when he or she does<br />

not physically attend a class session or does not log in and participate in<br />

the course content as per the federal financial aid guidelines.<br />

Students who receive federal financial aid and do not physically attend<br />

or log into classes will be dropped from their classes and have their<br />

financial aid cancelled or reduced. The federal government mandates<br />

that federal monies for non-attendees who receive federal financial<br />

aid be returned to the Federal Government. Attendance will also be<br />

documented at the end of each semester to verify the last day attended<br />

in each class.<br />

Title IV refund<br />

The Financial Aid Office is required by federal statute to recalculate<br />

federal financial aid eligibility for students who completely withdraw,<br />

stop attending, or take a medical leave prior to completing 60% of a<br />

payment period or term.<br />

Recalculation is based on the percentage of earned aid using the<br />

following Federal Return of Title IV funds formula: Percentage of<br />

payment period or term completed (the number of days completed up to<br />

the withdrawal date) divided by the total days in the payment period<br />

or term (any break of five days or more is not counted as part of the<br />

term). This percentage of completed days is equal to the percentage<br />

of earned aid.<br />

Title IV refund process<br />

Funds are returned to the appropriate federal program based on the<br />

percentage of unearned aid. If you earned less aid than was disbursed,<br />

the institution would be required to return a portion of the funds and/or<br />

you would be required to return a portion of the funds within 45 days.<br />

Keep in mind that when Title IV funds are returned, you may owe a<br />

balance to the institution.<br />

If you earned more aid than was disbursed to you, the institution<br />

would owe you a post-withdrawal disbursement which must be paid<br />

within 120 days of your withdrawal.<br />

Refunds are allocated in the following order:<br />

• Unsubsidized Federal Stafford Loan<br />

• Subsidized Federal Stafford Loan<br />

• Federal Parent (PLUS) Loan<br />

• Federal Pell Grant<br />

• Federal Supplemental Educational Opportunity Grant<br />

20

If there is a Pell Grant overpayment and you do not repay the funds within 30 days, the account<br />

will be turned over to the Department of Education as an overpayment of federal funds. Students<br />

who owe an overpayment of Title IV grant funds are ineligible for further disbursements from the<br />

federal financial aid programs, grants and loans at any institution until the overpayment is paid in<br />

full or payment arrangements are made with the Department of Education.<br />

If you do not pay funds due to the <strong>College</strong> to cover a tuition and fees balance that resulted from<br />

the college returning unearned federal funds, a hold will be placed on your account. This means<br />

that you will not be permitted to register for classes or receive transcripts until your balance is<br />

paid in full. Continued non-payment of fees owed to the <strong>College</strong> could result in your account being<br />

turned over to the Ohio Attorney General’s Office for collection.<br />

Student rights/responsibilities/information<br />

You have the right to<br />

• know how your financial need is determined, including the cost of attendance, and how your<br />

family contribution is determined.<br />

• know how and when you will receive student assistance.<br />

• request an explanation of the type and amount of financial assistance you are receiving.<br />

• if you have a loan – know the type, the interest rate, amount to be repaid, when you must<br />

begin repayment and other cancellation and deferment provisions.<br />

• if you are offered a Federal Work-Study job – know the kind of job, what hours you must work,<br />

what your duties will be and how and when you will be paid.<br />

• discuss your financial aid package with a representative of the Financial Aid Office.<br />

• know how the <strong>College</strong> determines if you are making satisfactory progress and what happens<br />

if you are not.<br />

You are required to<br />

• report any scholarship, fee waiver, loan, grant, employment earnings or other financial benefits<br />

which you receive from any source other than <strong>Stark</strong> <strong>State</strong> <strong>College</strong>. Such benefits, if not already<br />

taken into consideration, may result in a revision or cancellation of other financial aid benefits.<br />

• provide all documentation requested by the Financial Aid Office or other agencies.<br />

• read and understand all forms that you are asked to sign and maintain copies of them.<br />

• know and comply with all deadlines for application and re-application for financial aid.<br />

• complete the FAFSA correctly, and submit it two to three months prior to the semester<br />

you plan to attend.<br />

• follow up on any corrections or adjustments as requested.<br />

• accept responsibility for all loan promissory notes and other agreements that you sign.<br />

• understand loan obligations and make repayment as required.<br />

• notify your lender(s) of any changes in your name, address or enrollment status. If you<br />

drop below half-time status, complete and submit exit loan information.<br />

• perform in a satisfactory manner work agreed upon for Federal Work Study jobs.<br />

• know and comply with the school’s refund procedure available on the <strong>College</strong> website.<br />

your connection<br />

admissions | financial aid | registration<br />

21

Student confidentiality<br />

Financial assistance records<br />

In compliance with the Family Educational Rights and Privacy Act<br />

of 1974 (FERPA) (Public Law 93-380 as amended) all information<br />

received in connection with applications for admissions and financial<br />

aid are held in the strictest confidence. No information will<br />

be released regarding students except by written request of the<br />

student. Under FERPA, you have the right to inspect your student<br />

file. You may review information in your file and receive copies and<br />

information upon written request.<br />

Release of information to another party<br />

You must complete and sign a consent form before any information<br />

will be released to another party. On the consent form, you<br />

must indicate which semester(s) you want information released.<br />

You must allow 10 days for this processing. Information regarding<br />

fees and bookstore charges must be obtained from the Business<br />

Office. Your signature on a loan application authorizes <strong>Stark</strong> <strong>State</strong><br />

<strong>College</strong> to release to the lending institution, subsequent holder,<br />

the guarantor, U.S. Department of Education, or their agents any<br />

requested information pertinent to the student loan(s).<br />

Other information<br />

For additional information about <strong>Stark</strong> <strong>State</strong> <strong>College</strong>’s facilities,<br />

programs or eligibility requirements, refer to the <strong>College</strong> catalog<br />

or call the Office of Admissions/Student Services.<br />

Information regarding the <strong>College</strong>’s drug prevention program may<br />

be obtained in the Office of Admissions/Student Services.<br />

Student services<br />

Disability Support Services<br />

The Disability Support Services Office staff assists students with<br />

disabilities by providing academic support services accommodations,<br />

academic advising, admissions and financial aid assistance,<br />

and career guidance. Examples of services may include testing<br />

accommodations, tape recorded lectures, sign language<br />

interpreters, alternative format books and note-taking services.<br />

Students with disabilities are eligible for equal access under<br />

the law. Accommodations may be available to students and<br />

prospective students of <strong>Stark</strong> <strong>State</strong> who have a documented<br />

disability. Individuals who may be eligible for services include,<br />

but are not limited to, those with mobility, orthopedic, hearing,<br />

vision, mental health, or speech impairments as well as those<br />

with learning disabilities.<br />

22

To apply for services<br />

• Make an appointment with Disability Support Services.<br />

• Complete an application to register for services.<br />

• Submit copies of documentation which may include test reports and school records,<br />

or a disability verification form from a physician, psychiatrist or psychologist.<br />

• Meet with a representative of Disability Support Services initially and touch base with<br />

them each semester to discuss accommodations.<br />

Career Development Office<br />

The Career Development Office is dedicated to empowering students and alumni in developing<br />

career planning and job search skills and facilitating mutually beneficial relationships between<br />

employers, students and alumni. Services include<br />

• advisory committee<br />

• career center<br />

• career guidance program<br />

• careers and community for people with disabilities<br />

• distribution of associate degree graduates<br />

• graduate status survey<br />

• on-campus interviews<br />

• resume referral services<br />

• employment opportunities<br />

• web-based career planning and employment links<br />

• job fair<br />

• mock interviews<br />

For details about any of the programs, call the Career Development Office.<br />

Multicultural Student Affairs<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong> acknowledges, respects and values differences among its students. The Office of<br />

Multicultural Student Affairs has been created to provide services to students of various ethnic and<br />

cultural backgrounds to enhance each student’s campus experience. The office is designed to serve as<br />

• a resource and support center for students from underrepresented groups.<br />

• an active participant in the recruitment of students from various backgrounds to more<br />

accurately reflect the demographic make-up of the larger community that the <strong>College</strong> serves.<br />

• a provider of services designed to assist students in matriculation and persistence throughout<br />

the entire <strong>College</strong> experience from application to graduation.<br />

• a promoter of cultural understanding across the <strong>College</strong> community.<br />

For more information, call of stop by the Office of Multicultural Student Affairs.<br />

your connection<br />

admissions | financial aid | registration

Satellite centers and off-campus course sites<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong> understands the importance of making<br />

college education accessible by establishing satellite centers and<br />

off-campus course sites at convenient locations. These sites offer<br />

courses that lead to associate degrees and certificate programs<br />

offered on main campus in North Canton.<br />

Financial aid and scholarship opportunities are available at satellite<br />

centers where traditional and non-traditional students are offered<br />

the same convenience, affordability, quality faculty and individualized<br />

attention as our main campus. Other advantages to taking<br />

courses at our centers include small class sizes, personal attention,<br />

convenient locations and parking and gas savings.<br />

For more information concerning satellite centers go to<br />

www.starkstate.edu/satellites.<br />

Student life<br />

Student Life encourages and supports student organizations,<br />

activities and initiatives to complement the educational environment<br />

and enhance student life, leadership and service on and<br />

off campus. The office also supports the work of students as<br />

they develop and implement activities to meet their needs and<br />

interests beyond the classroom, both personally and professionally.<br />

Overseeing more than two dozen student organizations, the Office<br />

of Student Life encourages the importance of proactive leadership,<br />

enhances team-building skills and values responsible citizenship<br />

through service to the community.<br />

Student Life organizes activities for you to increase your involvement<br />

in campus life outside the classroom, handles posting<br />

on campus bulletin boards and publishes <strong>Stark</strong> Voices, the<br />

student organization manual and calendar of events for student<br />

organization use. We provide you the opportunity to pursue<br />

interests and talents in an organized environment with your peers.<br />

For more information on how to take an active role and get<br />

involved, call or stop by the Student Life Office.<br />

24

Directory<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong><br />

6200 Frank Ave. N.W.<br />

North Canton, OH 44720<br />

330-494-6170<br />

www.starkstate.edu<br />

Academic Records/Registrar<br />

330-494-6170, Ext. 4301<br />

330-966-6598 (fax)<br />

8 a.m. - 7:30 p.m. M - Th<br />

8 a.m. - 4 p.m. F<br />

registration@starkstate.edu<br />

www.starkstate.edu/registration<br />

Room S308<br />

Office of Admissions/Student Services<br />

330-494-6170<br />

1-800-797-8275<br />

8 a.m. - 8 p.m. M - Th<br />

8 a.m. - 4:30 p.m. F<br />

admissions@starkstate.edu<br />

www.starkstate.edu/studentservices<br />

Room S305<br />

Bookstore/<strong>College</strong> Store<br />

330-966-5452<br />

8 a.m. – 8 p.m. M - Th<br />

8 a.m. – 4 p.m. F<br />

www.starkstate.edu/collegestore<br />

Room S105<br />

Cashier’s window<br />

330-494-6170, Ext 4210/4404<br />

8 a.m. - 7:30 p.m. M - Th<br />

8 a.m. - 4:00 p.m. F<br />

Room S300<br />

Career Development Office<br />

330-966-5459<br />

8 a.m. - 6:30 p.m. M - Th<br />

8 a.m. - 4:00 p.m. F<br />

Room S100<br />

Disability Support Services Office<br />

330-494-6170, Ext. 4935<br />

8 a.m. - 6:30 p.m. M - Th<br />

8 a.m. - 4:30 p.m. F<br />

Room S307<br />

Financial Aid Office<br />

330-494-6170, Ext. 4301<br />

330-966-6598 (fax)<br />

8 a.m. - 7:30 p.m. M - Th<br />

8 a.m. - 4 p.m. F<br />

financialaid@starkstate.edu<br />

www.starkstate.edu/finaid<br />

Room S308<br />

Office of Multicultural Affairs<br />

330-494-6170, Ext. 4274/4667<br />

8 a.m. - 4:30 p.m. M - F<br />

Room B230k<br />

Office of Student Life<br />

330-494-6170, Ext. 4237<br />

8 a.m. - 4:30 p.m. M - F<br />

Room S302a<br />

Veterans’ assistance<br />

<strong>Stark</strong> <strong>State</strong> <strong>College</strong> - Registrar’s Office<br />

330-494-6170, Ext. 4254<br />

www.starkstate.edu/veterans<br />

Federal student aid information<br />

For general federal student aid information<br />

1-800-433-3243<br />

www.studentaid.ed.gov<br />

Federal income tax information<br />

Internal Revenue Service<br />

Request a tax return transcript<br />

1-800-908-9946 or 1-800-829-1040<br />

www.irs.gov<br />

<strong>State</strong> grants and scholarships<br />

Ohio Board of Regents<br />

University System of Ohio<br />

25 South Front Street<br />

Columbus, Ohio 43215<br />

1-800-233-6734 or 614-466-6000<br />

hotline@regents.state.oh.us<br />

www.ohiohighered.org/board<br />

www.ohiomeanssuccess.org/students/pay-forcollege/ohio-financial-aid<br />

Direct lending<br />

www.myedaccount.com<br />

1-800-848-0979

<strong>Stark</strong> <strong>State</strong> <strong>College</strong><br />