Islamic Finance â an Introduction â Part III - Risk Reward Limited

Islamic Finance â an Introduction â Part III - Risk Reward Limited

Islamic Finance â an Introduction â Part III - Risk Reward Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

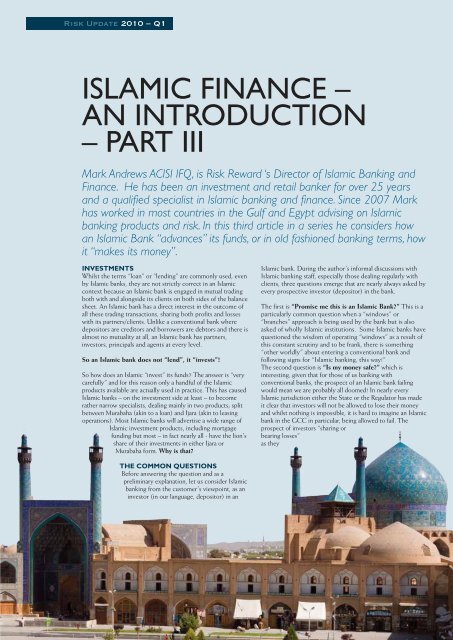

<strong>Risk</strong> Update 2010 – Q1<br />

ISLAMIC FINANCE –<br />

AN INTRODUCTION<br />

– PART <strong>III</strong><br />

Mark Andrews ACISI IFQ, is <strong>Risk</strong> <strong>Reward</strong> ‘s Director of <strong>Islamic</strong> B<strong>an</strong>king <strong>an</strong>d<br />

<strong>Fin<strong>an</strong>ce</strong>. He has been <strong>an</strong> investment <strong>an</strong>d retail b<strong>an</strong>ker for over 25 years<br />

<strong>an</strong>d a qualified specialist in <strong>Islamic</strong> b<strong>an</strong>king <strong>an</strong>d fin<strong>an</strong>ce. Since 2007 Mark<br />

has worked in most countries in the Gulf <strong>an</strong>d Egypt advising on <strong>Islamic</strong><br />

b<strong>an</strong>king products <strong>an</strong>d risk. In this third article in a series he considers how<br />

<strong>an</strong> <strong>Islamic</strong> B<strong>an</strong>k “adv<strong>an</strong>ces” its funds, or in old fashioned b<strong>an</strong>king terms, how<br />

it “makes its money”.<br />

INVESTMENTS<br />

Whilst the terms “lo<strong>an</strong>” or “lending” are commonly used, even<br />

by <strong>Islamic</strong> b<strong>an</strong>ks, they are not strictly correct in <strong>an</strong> <strong>Islamic</strong><br />

context because <strong>an</strong> <strong>Islamic</strong> b<strong>an</strong>k is engaged in mutual trading<br />

both with <strong>an</strong>d alongside its clients on both sides of the bal<strong>an</strong>ce<br />

sheet. An <strong>Islamic</strong> b<strong>an</strong>k has a direct interest in the outcome of<br />

all these trading tr<strong>an</strong>sactions, sharing both profits <strong>an</strong>d losses<br />

with its partners/clients. Unlike a conventional b<strong>an</strong>k where<br />

depositors are creditors <strong>an</strong>d borrowers are debtors <strong>an</strong>d there is<br />

almost no mutuality at all, <strong>an</strong> <strong>Islamic</strong> b<strong>an</strong>k has partners,<br />

investors, principals <strong>an</strong>d agents at every level.<br />

So <strong>an</strong> <strong>Islamic</strong> b<strong>an</strong>k does not “lend”, it “invests”!<br />

So how does <strong>an</strong> <strong>Islamic</strong> “invest” its funds The <strong>an</strong>swer is “very<br />

carefully” <strong>an</strong>d for this reason only a h<strong>an</strong>dful of the <strong>Islamic</strong><br />

products available are actually used in practice. This has caused<br />

<strong>Islamic</strong> b<strong>an</strong>ks – on the investment side at least – to become<br />

rather narrow specialists, dealing mainly in two products; split<br />

between Murabaha (akin to a lo<strong>an</strong>) <strong>an</strong>d Ijara (akin to leasing<br />

operations). Most <strong>Islamic</strong> b<strong>an</strong>ks will advertise a wide r<strong>an</strong>ge of<br />

<strong>Islamic</strong> investment products, including mortgage<br />

funding but most – in fact nearly all - have the lion’s<br />

share of their investments in either Ijara or<br />

Murabaha form. Why is that<br />

<strong>Islamic</strong> b<strong>an</strong>k. During the author’s informal discussions with<br />

<strong>Islamic</strong> b<strong>an</strong>king staff, especially those dealing regularly with<br />

clients, three questions emerge that are nearly always asked by<br />

every prospective investor (depositor) in the b<strong>an</strong>k.<br />

The first is “Promise me this is <strong>an</strong> <strong>Islamic</strong> B<strong>an</strong>k” This is a<br />

particularly common question when a “windows” or<br />

“br<strong>an</strong>ches” approach is being used by the b<strong>an</strong>k but is also<br />

asked of wholly <strong>Islamic</strong> institutions. Some <strong>Islamic</strong> b<strong>an</strong>ks have<br />

questioned the wisdom of operating “windows” as a result of<br />

this const<strong>an</strong>t scrutiny <strong>an</strong>d to be fr<strong>an</strong>k, there is something<br />

“other worldly” about entering a conventional b<strong>an</strong>k <strong>an</strong>d<br />

following signs for “<strong>Islamic</strong> b<strong>an</strong>king, this way!”<br />

The second question is “Is my money safe” which is<br />

interesting, given that for those of us b<strong>an</strong>king with<br />

conventional b<strong>an</strong>ks, the prospect of <strong>an</strong> <strong>Islamic</strong> b<strong>an</strong>k failing<br />

would me<strong>an</strong> we are probably all doomed! In nearly every<br />

<strong>Islamic</strong> jurisdiction either the State or the Regulator has made<br />

it clear that investors will not be allowed to lose their money<br />

<strong>an</strong>d whilst nothing is impossible, it is hard to imagine <strong>an</strong> <strong>Islamic</strong><br />

b<strong>an</strong>k in the GCC in particular, being allowed to fail. The<br />

prospect of investors “sharing or<br />

bearing losses”<br />

as they<br />

THE COMMON QUESTIONS<br />

Before <strong>an</strong>swering the question <strong>an</strong>d as a<br />

preliminary expl<strong>an</strong>ation, let us consider <strong>Islamic</strong><br />

b<strong>an</strong>king from the customer’s viewpoint, as <strong>an</strong><br />

investor (in our l<strong>an</strong>guage, depositor) in <strong>an</strong>