Aberdeen Investment Funds ICVC - Aberdeen Asset Management

Aberdeen Investment Funds ICVC - Aberdeen Asset Management

Aberdeen Investment Funds ICVC - Aberdeen Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Investment</strong> Objectives, Policies and Other Details of the <strong>Funds</strong> continued<br />

ABERDEEN ASIA PACIFIC AND JAPAN FUND<br />

<strong>Investment</strong> objective and policy:<br />

The objective of the Fund is to achieve capital growth by investing in countries of the Asia Pacific region, including Japan.<br />

Share classes in issue:<br />

Share classes available for investment:<br />

Income:<br />

Initial issue of shares:<br />

Please refer to Appendix III.<br />

For up to date details of the share classes available for investment in this Fund, please<br />

refer to www.aberdeen-asset.co.uk.<br />

Income will be calculated annually as at 31 July with the appropriate allocation made<br />

within 3 months of this date.<br />

Shares were first issued pursuant to a scheme of arrangement with <strong>Aberdeen</strong> Asia Pacific<br />

Unit Trust, an authorised unit trust, in respect of which <strong>Aberdeen</strong> Unit Trust Managers<br />

Limited was the manager, on 21 April 2006.<br />

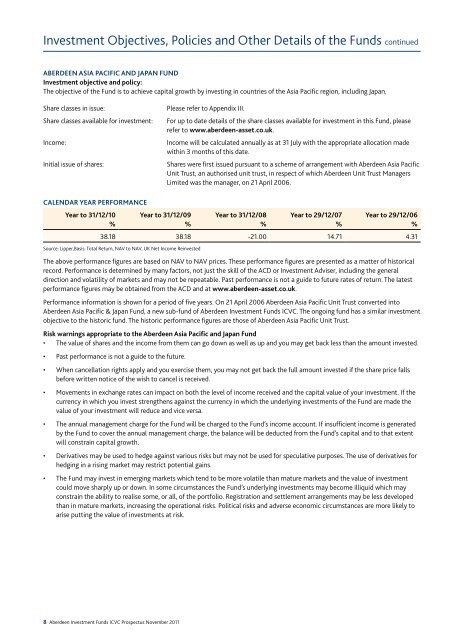

Calendar Year Performance<br />

Year to 31/12/10<br />

%<br />

Year to 31/12/09<br />

%<br />

Year to 31/12/08<br />

%<br />

Year to 29/12/07<br />

%<br />

Year to 29/12/06<br />

%<br />

38.18 38.18 -21.00 14.71 4.31<br />

Source: Lipper,Basis: Total Return, NAV to NAV, UK Net Income Reinvested<br />

The above performance figures are based on NAV to NAV prices. These performance figures are presented as a matter of historical<br />

record. Performance is determined by many factors, not just the skill of the ACD or <strong>Investment</strong> Adviser, including the general<br />

direction and volatility of markets and may not be repeatable. Past performance is not a guide to future rates of return. The latest<br />

performance figures may be obtained from the ACD and at www.aberdeen-asset.co.uk.<br />

Performance information is shown for a period of five years. On 21 April 2006 <strong>Aberdeen</strong> Asia Pacific Unit Trust converted into<br />

<strong>Aberdeen</strong> Asia Pacific & Japan Fund, a new sub-fund of <strong>Aberdeen</strong> <strong>Investment</strong> <strong>Funds</strong> <strong>ICVC</strong>. The ongoing fund has a similar investment<br />

objective to the historic fund. The historic performance figures are those of <strong>Aberdeen</strong> Asia Pacific Unit Trust.<br />

Risk warnings appropriate to the <strong>Aberdeen</strong> Asia Pacific and Japan Fund<br />

• The value of shares and the income from them can go down as well as up and you may get back less than the amount invested.<br />

• Past performance is not a guide to the future.<br />

• When cancellation rights apply and you exercise them, you may not get back the full amount invested if the share price falls<br />

before written notice of the wish to cancel is received.<br />

• Movements in exchange rates can impact on both the level of income received and the capital value of your investment. If the<br />

currency in which you invest strengthens against the currency in which the underlying investments of the Fund are made the<br />

value of your investment will reduce and vice versa.<br />

• The annual management charge for the Fund will be charged to the Fund’s income account. If insufficient income is generated<br />

by the Fund to cover the annual management charge, the balance will be deducted from the Fund’s capital and to that extent<br />

will constrain capital growth.<br />

• Derivatives may be used to hedge against various risks but may not be used for speculative purposes. The use of derivatives for<br />

hedging in a rising market may restrict potential gains.<br />

• The Fund may invest in emerging markets which tend to be more volatile than mature markets and the value of investment<br />

could move sharply up or down. In some circumstances the Fund’s underlying investments may become illiquid which may<br />

constrain the ability to realise some, or all, of the portfolio. Registration and settlement arrangements may be less developed<br />

than in mature markets, increasing the operational risks. Political risks and adverse economic circumstances are more likely to<br />

arise putting the value of investments at risk.<br />

8 <strong>Aberdeen</strong> <strong>Investment</strong> <strong>Funds</strong> <strong>ICVC</strong> Prospectus November 2011