Newsletter Issue No 7-15th July 2012 - PKF Sridhar & Santhanam

Newsletter Issue No 7-15th July 2012 - PKF Sridhar & Santhanam

Newsletter Issue No 7-15th July 2012 - PKF Sridhar & Santhanam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>PKF</strong><br />

SRIDHAR & SANTHANAM<br />

Chartered Accountants<br />

GAAR: Indian Perspective<br />

Ms.Mahera Chauhan<br />

A constant debate has been<br />

raging over the issue of tax<br />

avoidance. Over the years, the<br />

term ‘tax avoidance’ has come<br />

to be understood as arranging<br />

affairs with the main object or<br />

purpose of obtaining tax<br />

advantage while prima facie<br />

fully intending to comply with<br />

the law in such respect<br />

Globally, tax avoidance has<br />

been recognized as an area of<br />

concern and several countries<br />

have expressed concern over<br />

tax evasion and avoidance.<br />

This is evident from the fact that<br />

either nations are legislating the<br />

doctrine of General Anti-<br />

Avoidance Regulations in their<br />

tax code or strengthening their<br />

existing code.<br />

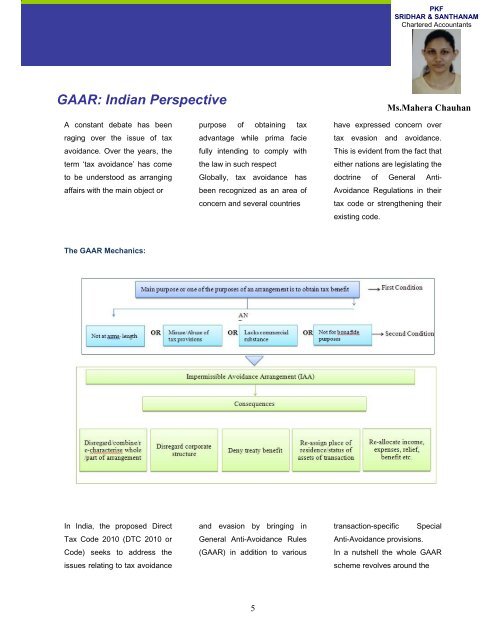

The GAAR Mechanics:<br />

In India, the proposed Direct<br />

Tax Code 2010 (DTC 2010 or<br />

Code) seeks to address the<br />

issues relating to tax avoidance<br />

and evasion by bringing in<br />

General Anti-Avoidance Rules<br />

(GAAR) in addition to various<br />

transaction-specific Special<br />

Anti-Avoidance provisions.<br />

In a nutshell the whole GAAR<br />

scheme revolves around the<br />

5<br />

www.pkfindia.in