Rank is worth substantially more than 150p per share ... - Rank Group

Rank is worth substantially more than 150p per share ... - Rank Group

Rank is worth substantially more than 150p per share ... - Rank Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Guoco <strong>Group</strong>’s Offer Substantially<br />

Undervalues <strong>Rank</strong> and its Prospects…<br />

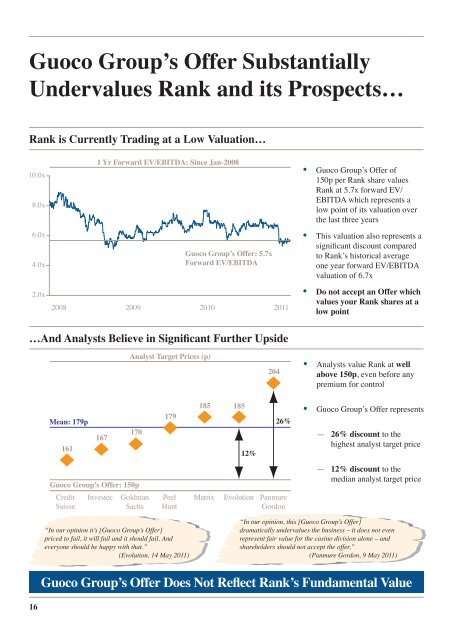

<strong>Rank</strong> <strong>is</strong> Currently Trading at a Low Valuation…<br />

10.0x<br />

8.0x<br />

6.0x<br />

4.0x<br />

2.0x<br />

1 Yr Forward EV/EBITDA: Since Jan-2008<br />

Guoco <strong>Group</strong>’s Offer: 5.7x<br />

Forward EV/EBITDA<br />

2008 2009 2010 2011<br />

• Guoco <strong>Group</strong>’s Offer of<br />

<strong>150p</strong> <strong>per</strong> <strong>Rank</strong> <strong>share</strong> values<br />

<strong>Rank</strong> at 5.7x forward EV/<br />

EBITDA which represents a<br />

low point of its valuation over<br />

the last three years<br />

• Th<strong>is</strong> valuation also represents a<br />

significant d<strong>is</strong>count compared<br />

to <strong>Rank</strong>’s h<strong>is</strong>torical average<br />

one year forward EV/EBITDA<br />

valuation of 6.7x<br />

• Do not accept an Offer which<br />

values your <strong>Rank</strong> <strong>share</strong>s at a<br />

low point<br />

…And Analysts Believe in Significant Further Upside<br />

Analyst Target Prices (p)<br />

204<br />

• Analysts value <strong>Rank</strong> at well<br />

above <strong>150p</strong>, even before any<br />

premium for control<br />

Mean: 179p<br />

161<br />

167<br />

170<br />

179<br />

185 185<br />

12%<br />

26%<br />

• Guoco <strong>Group</strong>’s Offer represents<br />

— 26% d<strong>is</strong>count to the<br />

highest analyst target price<br />

Guoco <strong>Group</strong>’s Offer: <strong>150p</strong><br />

— 12% d<strong>is</strong>count to the<br />

median analyst target price<br />

Credit<br />

Su<strong>is</strong>se<br />

Investec<br />

Goldman<br />

Sachs<br />

Peel<br />

Hunt<br />

Matrix Evolution Panmure<br />

Gordon<br />

“In our opinion it’s [Guoco <strong>Group</strong>’s Offer]<br />

priced to fail, it will fail and it should fail. And<br />

everyone should be happy with that.’’<br />

(Evolution, 14 May 2011)<br />

“In our opinion, th<strong>is</strong> [Guoco <strong>Group</strong>’s Offer]<br />

dramatically undervalues the business – it does not even<br />

represent fair value for the casino div<strong>is</strong>ion alone – and<br />

<strong>share</strong>holders should not accept the offer.’’<br />

(Panmure Gordon, 9 May 2011)<br />

Guoco <strong>Group</strong>’s Offer Does Not Reflect <strong>Rank</strong>’s Fundamental Value<br />

16