Unemployment Insurance Claimant Guide - Job Service North Dakota

Unemployment Insurance Claimant Guide - Job Service North Dakota

Unemployment Insurance Claimant Guide - Job Service North Dakota

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

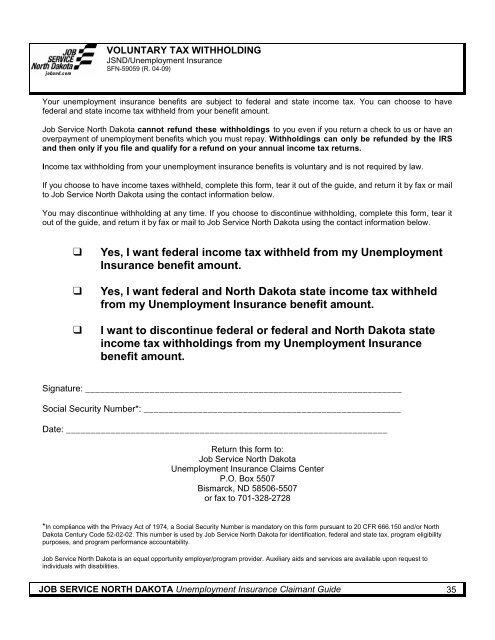

VOLUNTARY TAX WITHHOLDING<br />

JSND/<strong>Unemployment</strong> <strong>Insurance</strong><br />

SFN-59059 (R. 04-09)<br />

Your unemployment insurance benefits are subject to federal and state income tax. You can choose to have<br />

federal and state income tax withheld from your benefit amount.<br />

<strong>Job</strong> <strong>Service</strong> <strong>North</strong> <strong>Dakota</strong> cannot refund these withholdings to you even if you return a check to us or have an<br />

overpayment of unemployment benefits which you must repay. Withholdings can only be refunded by the IRS<br />

and then only if you file and qualify for a refund on your annual income tax returns.<br />

Income tax withholding from your unemployment insurance benefits is voluntary and is not required by law.<br />

If you choose to have income taxes withheld, complete this form, tear it out of the guide, and return it by fax or mail<br />

to <strong>Job</strong> <strong>Service</strong> <strong>North</strong> <strong>Dakota</strong> using the contact information below.<br />

You may discontinue withholding at any time. If you choose to discontinue withholding, complete this form, tear it<br />

out of the guide, and return it by fax or mail to <strong>Job</strong> <strong>Service</strong> <strong>North</strong> <strong>Dakota</strong> using the contact information below.<br />

❑ Yes, I want federal income tax withheld from my <strong>Unemployment</strong><br />

<strong>Insurance</strong> benefit amount.<br />

❑ Yes, I want federal and <strong>North</strong> <strong>Dakota</strong> state income tax withheld<br />

from my <strong>Unemployment</strong> <strong>Insurance</strong> benefit amount.<br />

❑ I want to discontinue federal or federal and <strong>North</strong> <strong>Dakota</strong> state<br />

income tax withholdings from my <strong>Unemployment</strong> <strong>Insurance</strong><br />

benefit amount.<br />

Signature: ________________________________________________________________<br />

Social Security Number*: ____________________________________________________<br />

Date: _________________________________________________________________<br />

Return this form to:<br />

<strong>Job</strong> <strong>Service</strong> <strong>North</strong> <strong>Dakota</strong><br />

<strong>Unemployment</strong> <strong>Insurance</strong> Claims Center<br />

P.O. Box 5507<br />

Bismarck, ND 58506-5507<br />

or fax to 701-328-2728<br />

*In compliance with the Privacy Act of 1974, a Social Security Number is mandatory on this form pursuant to 20 CFR 666.150 and/or <strong>North</strong><br />

<strong>Dakota</strong> Century Code 52-02-02. This number is used by <strong>Job</strong> <strong>Service</strong> <strong>North</strong> <strong>Dakota</strong> for identification, federal and state tax, program eligibility<br />

purposes, and program performance accountability.<br />

<strong>Job</strong> <strong>Service</strong> <strong>North</strong> <strong>Dakota</strong> is an equal opportunity employer/program provider. Auxiliary aids and services are available upon request to<br />

individuals with disabilities.<br />

JOB SERVICE NORTH DAKOTA <strong>Unemployment</strong> <strong>Insurance</strong> <strong>Claimant</strong> <strong>Guide</strong> 35