YUKON ZINC CORPORATION

YUKON ZINC CORPORATION

YUKON ZINC CORPORATION

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

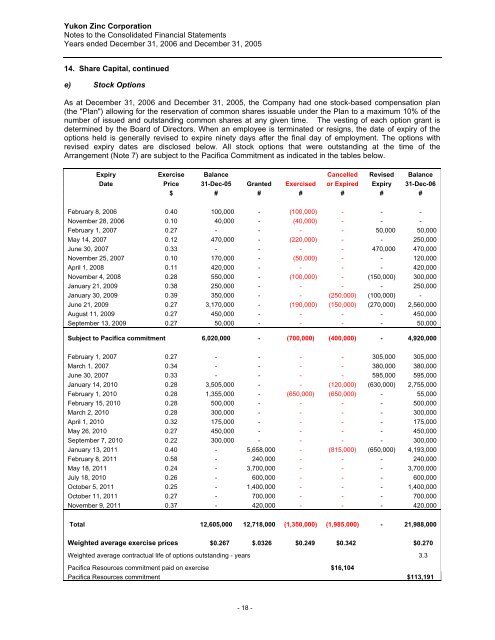

Yukon Zinc Corporation<br />

Notes to the Consolidated Financial Statements<br />

Years ended December 31, 2006 and December 31, 2005<br />

14. Share Capital, continued<br />

e) Stock Options<br />

As at December 31, 2006 and December 31, 2005, the Company had one stock-based compensation plan<br />

(the "Plan") allowing for the reservation of common shares issuable under the Plan to a maximum 10% of the<br />

number of issued and outstanding common shares at any given time. The vesting of each option grant is<br />

determined by the Board of Directors. When an employee is terminated or resigns, the date of expiry of the<br />

options held is generally revised to expire ninety days after the final day of employment. The options with<br />

revised expiry dates are disclosed below. All stock options that were outstanding at the time of the<br />

Arrangement (Note 7) are subject to the Pacifica Commitment as indicated in the tables below.<br />

Expiry Exercise Balance Cancelled Revised Balance<br />

Date Price 31-Dec-05 Granted Exercised or Expired Expiry 31-Dec-06<br />

$ # # # # # #<br />

February 8, 2006 0.40 100,000 - (100,000) - - -<br />

November 28, 2006 0.10 40,000 - (40,000) - - -<br />

February 1, 2007 0.27 - - - - 50,000 50,000<br />

May 14, 2007 0.12 470,000 - (220,000) - - 250,000<br />

June 30, 2007 0.33 - - - - 470,000 470,000<br />

November 25, 2007 0.10 170,000 - (50,000) - - 120,000<br />

April 1, 2008 0.11 420,000 - - - - 420,000<br />

November 4, 2008 0.28 550,000 - (100,000) - (150,000) 300,000<br />

January 21, 2009 0.38 250,000 - - - - 250,000<br />

January 30, 2009 0.39 350,000 - - (250,000) (100,000) -<br />

June 21, 2009 0.27 3,170,000 - (190,000) (150,000) (270,000) 2,560,000<br />

August 11, 2009 0.27 450,000 - - - - 450,000<br />

September 13, 2009 0.27 50,000 - - - - 50,000<br />

Subject to Pacifica commitment 6,020,000 - (700,000) (400,000) - 4,920,000<br />

February 1, 2007 0.27 - - - - 305,000 305,000<br />

March 1, 2007 0.34 - - - - 380,000 380,000<br />

June 30, 2007 0.33 - - - - 595,000 595,000<br />

January 14, 2010 0.28 3,505,000 - - (120,000) (630,000) 2,755,000<br />

February 1, 2010 0.28 1,355,000 - (650,000) (650,000) - 55,000<br />

February 15, 2010 0.28 500,000 - - - - 500,000<br />

March 2, 2010 0.28 300,000 - - - - 300,000<br />

April 1, 2010 0.32 175,000 - - - - 175,000<br />

May 26, 2010 0.27 450,000 - - - - 450,000<br />

September 7, 2010 0.22 300,000 - - - - 300,000<br />

January 13, 2011 0.40 - 5,658,000 - (815,000) (650,000) 4,193,000<br />

February 8, 2011 0.58 - 240,000 - - - 240,000<br />

May 18, 2011 0.24 - 3,700,000 - - - 3,700,000<br />

July 18, 2010 0.26 - 600,000 - - - 600,000<br />

October 5, 2011 0.25 - 1,400,000 - - - 1,400,000<br />

October 11, 2011 0.27 - 700,000 - - - 700,000<br />

November 9, 2011 0.37 - 420,000 - - - 420,000<br />

Total 12,605,000 12,718,000 (1,350,000) (1,985,000) - 21,988,000<br />

Weighted average exercise prices $0.267 $.0326 $0.249 $0.342 $0.270<br />

Weighted average contractual life of options outstanding - years 3.3<br />

Pacifica Resources commitment paid on exercise $16,104<br />

Pacifica Resources commitment $113,191<br />

- 18 -