LEX Africa's 'Guide to Doing Business'

LEX Africa's 'Guide to Doing Business'

LEX Africa's 'Guide to Doing Business'

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

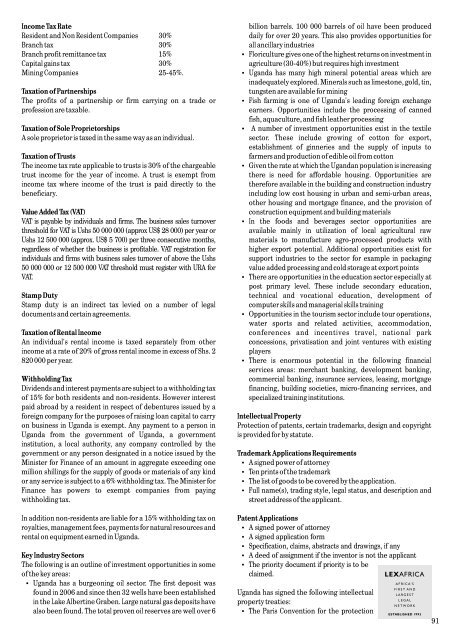

Income Tax Rate<br />

Resident and Non Resident Companies 30%<br />

Branch tax 30%<br />

Branch profit remittance tax 15%<br />

Capital gains tax 30%<br />

Mining Companies 25-45%.<br />

Taxation of Partnerships<br />

The profits of a partnership or firm carrying on a trade or<br />

profession are taxable.<br />

Taxation of Sole Proprie<strong>to</strong>rships<br />

A sole proprie<strong>to</strong>r is taxed in the same way as an individual.<br />

Taxation of Trusts<br />

The income tax rate applicable <strong>to</strong> trusts is 30% of the chargeable<br />

trust income for the year of income. A trust is exempt from<br />

income tax where income of the trust is paid directly <strong>to</strong> the<br />

beneficiary.<br />

Value Added Tax (VAT)<br />

VAT is payable by individuals and firms. The business sales turnover<br />

threshold for VAT is Ushs 50 000 000 (approx US$ 28 000) per year or<br />

Ushs 12 500 000 (approx. US$ 5 700) per three consecutive months,<br />

regardless of whether the business is profitable. VAT registration for<br />

individuals and firms with business sales turnover of above the Ushs<br />

50 000 000 or 12 500 000 VAT threshold must register with URA for<br />

VAT.<br />

Stamp Duty<br />

Stamp duty is an indirect tax levied on a number of legal<br />

documents and certain agreements.<br />

Taxation of Rental Income<br />

An individual's rental income is taxed separately from other<br />

income at a rate of 20% of gross rental income in excess of Shs. 2<br />

820 000 per year.<br />

Withholding Tax<br />

Dividends and interest payments are subject <strong>to</strong> a withholding tax<br />

of 15% for both residents and non-residents. However interest<br />

paid abroad by a resident in respect of debentures issued by a<br />

foreign company for the purposes of raising loan capital <strong>to</strong> carry<br />

on business in Uganda is exempt. Any payment <strong>to</strong> a person in<br />

Uganda from the government of Uganda, a government<br />

institution, a local authority, any company controlled by the<br />

government or any person designated in a notice issued by the<br />

Minister for Finance of an amount in aggregate exceeding one<br />

million shillings for the supply of goods or materials of any kind<br />

or any service is subject <strong>to</strong> a 6% withholding tax. The Minister for<br />

Finance has powers <strong>to</strong> exempt companies from paying<br />

withholding tax.<br />

billion barrels. 100 000 barrels of oil have been produced<br />

daily for over 20 years. This also provides opportunities for<br />

all ancillary industries<br />

Floriculture gives one of the highest returns on investment in<br />

agriculture (30-40%) but requires high investment<br />

Uganda has many high mineral potential areas which are<br />

inadequately explored. Minerals such as limes<strong>to</strong>ne, gold, tin,<br />

tungsten are available for mining<br />

Fish farming is one of Uganda's leading foreign exchange<br />

earners. Opportunities include the processing of canned<br />

fish, aquaculture, and fish leather processing<br />

A number of investment opportunities exist in the textile<br />

sec<strong>to</strong>r. These include growing of cot<strong>to</strong>n for export,<br />

establishment of ginneries and the supply of inputs <strong>to</strong><br />

farmers and production of edible oil from cot<strong>to</strong>n<br />

Given the rate at which the Ugandan population is increasing<br />

there is need for affordable housing. Opportunities are<br />

therefore available in the building and construction industry<br />

including low cost housing in urban and semi-urban areas,<br />

other housing and mortgage finance, and the provision of<br />

construction equipment and building materials<br />

In the foods and beverages sec<strong>to</strong>r opportunities are<br />

available mainly in utilization of local agricultural raw<br />

materials <strong>to</strong> manufacture agro-processed products with<br />

higher export potential. Additional opportunities exist for<br />

support industries <strong>to</strong> the sec<strong>to</strong>r for example in packaging<br />

value added processing and cold s<strong>to</strong>rage at export points<br />

There are opportunities in the education sec<strong>to</strong>r especially at<br />

post primary level. These include secondary education,<br />

technical and vocational education, development of<br />

computer skills and managerial skills training<br />

Opportunities in the <strong>to</strong>urism sec<strong>to</strong>r include <strong>to</strong>ur operations,<br />

water sports and related activities, accommodation,<br />

conferences and incentives travel, national park<br />

concessions, privatisation and joint ventures with existing<br />

players<br />

There is enormous potential in the following financial<br />

services areas: merchant banking, development banking,<br />

commercial banking, insurance services, leasing, mortgage<br />

financing, building societies, micro-financing services, and<br />

specialized training institutions.<br />

Intellectual Property<br />

Protection of patents, certain trademarks, design and copyright<br />

is provided for by statute.<br />

Trademark Applications Requirements<br />

A signed power of at<strong>to</strong>rney<br />

Ten prints of the trademark<br />

The list of goods <strong>to</strong> be covered by the application.<br />

Full name(s), trading style, legal status, and description and<br />

street address of the applicant.<br />

In addition non-residents are liable for a 15% withholding tax on<br />

royalties, management fees, payments for natural resources and<br />

rental on equipment earned in Uganda.<br />

Key Industry Sec<strong>to</strong>rs<br />

The following is an outline of investment opportunities in some<br />

of the key areas:<br />

Uganda has a burgeoning oil sec<strong>to</strong>r. The first deposit was<br />

found in 2006 and since then 32 wells have been established<br />

in the Lake Albertine Graben. Large natural gas deposits have<br />

also been found. The <strong>to</strong>tal proven oil reserves are well over 6<br />

Patent Applications<br />

A signed power of at<strong>to</strong>rney<br />

A signed application form<br />

Specification, claims, abstracts and drawings, if any<br />

A deed of assignment if the inven<strong>to</strong>r is not the applicant<br />

The priority document if priority is <strong>to</strong> be<br />

claimed.<br />

Uganda has signed the following intellectual<br />

property treaties:<br />

The Paris Convention for the protection<br />

91