Longtime Supporters of UCSF Make Bequest to the New Medical ...

Longtime Supporters of UCSF Make Bequest to the New Medical ...

Longtime Supporters of UCSF Make Bequest to the New Medical ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

If you wish <strong>to</strong> make a gift while preserving your<br />

assets during your lifetime, you might consider<br />

one <strong>of</strong> <strong>the</strong> following planned giving options.<br />

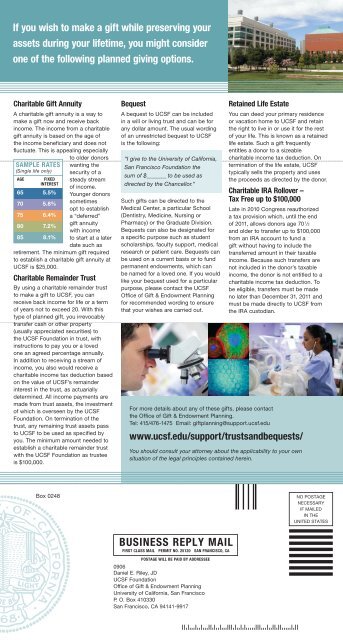

Charitable Gift Annuity<br />

A charitable gift annuity is a way <strong>to</strong><br />

make a gift now and receive back<br />

income. The income from a charitable<br />

gift annuity is based on <strong>the</strong> age <strong>of</strong><br />

<strong>the</strong> income beneficiary and does not<br />

fluctuate. This is appealing especially<br />

SAMPLE RATES<br />

(Single life only)<br />

AGE<br />

FIXED<br />

INTEREST<br />

65 5.5%<br />

70 5.8%<br />

75 6.4%<br />

80 7.2%<br />

85 8.1%<br />

<strong>to</strong> older donors<br />

wanting <strong>the</strong><br />

security <strong>of</strong> a<br />

steady stream<br />

<strong>of</strong> income.<br />

Younger donors<br />

sometimes<br />

opt <strong>to</strong> establish<br />

a “deferred”<br />

gift annuity<br />

with income<br />

<strong>to</strong> start at a later<br />

date such as<br />

retirement. The minimum gift required<br />

<strong>to</strong> establish a charitable gift annuity at<br />

<strong>UCSF</strong> is $25,000.<br />

Charitable Remainder Trust<br />

By using a charitable remainder trust<br />

<strong>to</strong> make a gift <strong>to</strong> <strong>UCSF</strong>, you can<br />

receive back income for life or a term<br />

<strong>of</strong> years not <strong>to</strong> exceed 20. With this<br />

type <strong>of</strong> planned gift, you irrevocably<br />

transfer cash or o<strong>the</strong>r property<br />

(usually appreciated securities) <strong>to</strong><br />

<strong>the</strong> <strong>UCSF</strong> Foundation in trust, with<br />

instructions <strong>to</strong> pay you or a loved<br />

one an agreed percentage annually.<br />

In addition <strong>to</strong> receiving a stream <strong>of</strong><br />

income, you also would receive a<br />

charitable income tax deduction based<br />

on <strong>the</strong> value <strong>of</strong> <strong>UCSF</strong>’s remainder<br />

interest in <strong>the</strong> trust, as actuarially<br />

determined. All income payments are<br />

made from trust assets, <strong>the</strong> investment<br />

<strong>of</strong> which is overseen by <strong>the</strong> <strong>UCSF</strong><br />

Foundation. On termination <strong>of</strong> <strong>the</strong><br />

trust, any remaining trust assets pass<br />

<strong>to</strong> <strong>UCSF</strong> <strong>to</strong> be used as specified by<br />

you. The minimum amount needed <strong>to</strong><br />

establish a charitable remainder trust<br />

with <strong>the</strong> <strong>UCSF</strong> Foundation as trustee<br />

is $100,000.<br />

<strong>Bequest</strong><br />

A bequest <strong>to</strong> <strong>UCSF</strong> can be included<br />

in a will or living trust and can be for<br />

any dollar amount. The usual wording<br />

<strong>of</strong> an unrestricted bequest <strong>to</strong> <strong>UCSF</strong><br />

is <strong>the</strong> following:<br />

“I give <strong>to</strong> <strong>the</strong> University <strong>of</strong> California,<br />

San Francisco Foundation <strong>the</strong><br />

sum <strong>of</strong> $_______ <strong>to</strong> be used as<br />

directed by <strong>the</strong> Chancellor.”<br />

Such gifts can be directed <strong>to</strong> <strong>the</strong><br />

<strong>Medical</strong> Center, a particular School<br />

(Dentistry, Medicine, Nursing or<br />

Pharmacy) or <strong>the</strong> Graduate Division.<br />

<strong>Bequest</strong>s can also be designated for<br />

a specific purpose such as student<br />

scholarships, faculty support, medical<br />

research or patient care. <strong>Bequest</strong>s can<br />

be used on a current basis or <strong>to</strong> fund<br />

permanent endowments, which can<br />

be named for a loved one. If you would<br />

like your bequest used for a particular<br />

purpose, please contact <strong>the</strong> <strong>UCSF</strong><br />

Office <strong>of</strong> Gift & Endowment Planning<br />

for recommended wording <strong>to</strong> ensure<br />

that your wishes are carried out.<br />

Retained Life Estate<br />

For more details about any <strong>of</strong> <strong>the</strong>se gifts, please contact<br />

<strong>the</strong> Office <strong>of</strong> Gift & Endowment Planning.<br />

Tel: 415/476-1475 Email: giftplanning@support.ucsf.edu<br />

You can deed your primary residence<br />

or vacation home <strong>to</strong> <strong>UCSF</strong> and retain<br />

<strong>the</strong> right <strong>to</strong> live in or use it for <strong>the</strong> rest<br />

<strong>of</strong> your life. This is known as a retained<br />

life estate. Such a gift frequently<br />

entitles a donor <strong>to</strong> a sizeable<br />

charitable income tax deduction. On<br />

termination <strong>of</strong> <strong>the</strong> life estate, <strong>UCSF</strong><br />

typically sells <strong>the</strong> property and uses<br />

<strong>the</strong> proceeds as directed by <strong>the</strong> donor.<br />

Charitable IRA Rollover –<br />

Tax Free up <strong>to</strong> $100,000<br />

Late in 2010 Congress reauthorized<br />

a tax provision which, until <strong>the</strong> end<br />

<strong>of</strong> 2011, allows donors age 70 1 ⁄2<br />

and older <strong>to</strong> transfer up <strong>to</strong> $100,000<br />

from an IRA account <strong>to</strong> fund a<br />

gift without having <strong>to</strong> include <strong>the</strong><br />

transferred amount in <strong>the</strong>ir taxable<br />

income. Because such transfers are<br />

not included in <strong>the</strong> donor’s taxable<br />

income, <strong>the</strong> donor is not entitled <strong>to</strong> a<br />

charitable income tax deduction. To<br />

be eligible, transfers must be made<br />

no later than December 31, 2011 and<br />

must be made directly <strong>to</strong> <strong>UCSF</strong> from<br />

<strong>the</strong> IRA cus<strong>to</strong>dian.<br />

www.ucsf.edu/support/trustsandbequests/<br />

You should consult your at<strong>to</strong>rney about <strong>the</strong> applicability <strong>to</strong> your own<br />

situation <strong>of</strong> <strong>the</strong> legal principles contained herein.<br />

Box 0248<br />

NO POSTAGE<br />

NECESSARY<br />

IF MAILED<br />

IN THE<br />

UNITED STATES<br />

BUSINESS REPLY MAIL<br />

FIRST CLASS MAIL PERMIT NO. 25120 SAN FRANCISCO, CA<br />

POSTAGE WILL BE PAID BY ADDRESSEE<br />

0906<br />

Daniel E. Riley, JD<br />

<strong>UCSF</strong> Foundation<br />

Office <strong>of</strong> Gift & Endowment Planning<br />

University <strong>of</strong> California, San Francisco<br />

P. O. Box 410330<br />

San Francisco, CA 94141-9917