Short Form Return of Organization Exempt From Income Tax

Short Form Return of Organization Exempt From Income Tax

Short Form Return of Organization Exempt From Income Tax

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

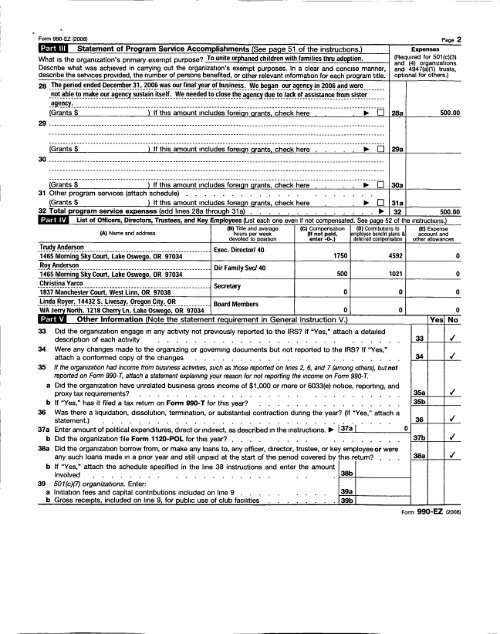

<strong>Form</strong> 990-EZ (2006) Page 2<br />

Statement <strong>of</strong> Program Service Accom plishments (See pag e 51 <strong>of</strong> the instructions . ) Expenses<br />

Wh at is the organization's primary exempt purpose To unite orphaned children with families thru ado ption . (Required a nd (4) organizations<br />

for 501(c)(3)<br />

and (4) organizations<br />

Des ribe what was achieved in carrying out the organization's exempt purposes. In a clear and concise manner, and 4947(a)(1) trusts,<br />

describe the services provided, the number <strong>of</strong> persons benefited, or other relevant information for each program title. optional for others.)<br />

28 The period ended December 31, 2006 was our final year <strong>of</strong> business . We_began our agency in 2006 and_were<br />

----<br />

not able to make our agency sustain itself. We needed to close the<br />

- - - - -------------------------------<br />

agency due - to - lack <strong>of</strong> assistance from sister<br />

-----------------------------------<br />

agency _ -----------------------------------------------------------------------------------------------------------------<br />

Grants $ If this amount includes forei g n g rants , check here . ► El 28a 500.00<br />

29<br />

--------------------------------------------------------------------------------------------------------------------------<br />

--------------------------------------------------------------------------------------------------------------------------<br />

--------------------------------------------------------------------------------------------------------------------------<br />

Grants If this amount includes forei g n g rants , check here ► El 9a<br />

30 --------------------------------------------------------------------------------------------------------------------------<br />

--------------------------------------------------------------------------------------------------------------------------<br />

--------------------------------------------------------------------------------------------------------------------------<br />

Grants $ If this amount includes forei g n rants, check here . IN- q 0a<br />

31 Other program services (attach schedule) . . . . . . . . . . . . . . . . . . . .<br />

Grants $ If this amount includes forei gn rants, check here . It- 1 311a ,<br />

32 Total program service expenses (add lines 28a through 31 a) . NO- 32 500.00<br />

List <strong>of</strong> Officers , Directors , Trustees , and Key Employees (List each one even if not compensated. See page 52 <strong>of</strong> the instructions.)<br />

(B) Title and average<br />

(C) Compensation (D) Contributions to<br />

(E) Expense<br />

(A) Name and address<br />

hours per week<br />

Qf not paid,<br />

e mployee benefit plans & account and<br />

devoted to position<br />

enter - 0-.)<br />

deferred compensation other allowances<br />

Trudy Anderson ____________________________________________<br />

Exec . Director/ 40<br />

1465 Mornin g Sky Court , Lake Oswe go, OR 97034 1750 4592 0<br />

RoxAnderson<br />

___________<br />

1465 Mornin g S Court , - Lake -------<br />

-<br />

DirFamilySvc/40<br />

Oswe g o, OR 97034<br />

500 1021 0<br />

Christina Yarco<br />

-------------------------------------- -<br />

____ Secretary<br />

1837 Manchester Court , West Linn , OR 97038<br />

0 0 0<br />

Linda Royer , 14432 S . Livesay, Oregon City, OR Board Members<br />

WA Je rry North , 1218 Cherry In, Lake Oswego, OR 97034 0 0 0<br />

Other Information (Note the statement req uirement in General Instruction V. ) Yes No<br />

33 Did the organization engage in any activity not previously reported to the IRS If "Yes," attach a detailed<br />

description <strong>of</strong> each activity . . . . . . . . . . . . . . . . . . . . . . . . . . 33 3<br />

34 Were any changes made to the organizing or governing documents but not reported to the IRS If "Yes,"<br />

attach a conformed copy <strong>of</strong> the changes . . . . . . . . . . . . . . . . . . 3 3<br />

35 If the organization had income from business activities, such as those reported on lines 2, 6, and 7 (among others), but not<br />

reported on <strong>Form</strong> 990-T, attach a statement explaining your reason for not reporting the income on <strong>Form</strong> 990-T.<br />

a Did the organization have unrelated business gross income <strong>of</strong> $1,000 or more or 6033(e) notice, reporting, and<br />

proxy tax requirements . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35a 3<br />

b If "Yes," has it filed a tax return on <strong>Form</strong> 990-T for this year . . . . . . . . . . . . . . . . 35b<br />

36 Was there a liquidation, dissolution, termination, or substantial contraction during the year (If "Yes," attach a<br />

statement.) . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

.<br />

. 36 3<br />

37a Enter amount <strong>of</strong> political expenditures, direct or indirect, as described in the instructions. Poo- 37a I 0<br />

b Did the organization file <strong>Form</strong> 1120-POL for this year . . . . . . . . . . . . . . . , 37b 3<br />

38a Did the organization borrow from, or make any loans to, any <strong>of</strong>ficer, director, trustee, or key employee or were<br />

any such loans made in a prior year and still unpaid at the start <strong>of</strong> the period covered by this return . . 38a 3<br />

b If "Yes," attach the schedule specified in the line 38 instructions and enter the amount<br />

involved . . . . . . . . . . . . . . . . . . . 38b<br />

39 501(c)(7) organizations. Enter:<br />

a Initiation fees and capital contributions included on line 9 . . . . . . . . . 39a<br />

b Gross recei pts, included on line 9, for p ublic use <strong>of</strong> club facilities . 39b<br />

<strong>Form</strong> 990-EZ (2006)