NI38 Social Security abroad - HM Revenue & Customs

NI38 Social Security abroad - HM Revenue & Customs

NI38 Social Security abroad - HM Revenue & Customs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

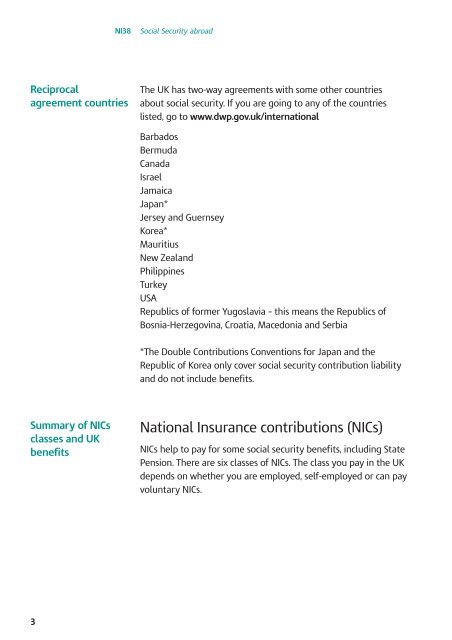

Reciprocal<br />

agreement countries<br />

Summary of NICs<br />

classes and UK<br />

benefits<br />

3<br />

<strong>NI38</strong> <strong>Social</strong> <strong>Security</strong> <strong>abroad</strong><br />

The UK has twoway agreements with some other countries<br />

about social security. If you are going to any of the countries<br />

listed, go to www.dwp.gov.uk/international<br />

Barbados<br />

Bermuda<br />

Canada<br />

Israel<br />

Jamaica<br />

Japan*<br />

Jersey and Guernsey<br />

Korea*<br />

Mauritius<br />

New Zealand<br />

Philippines<br />

Turkey<br />

USA<br />

Republics of former Yugoslavia – this means the Republics of<br />

BosniaHerzegovina, Croatia, Macedonia and Serbia<br />

*The Double Contributions Conventions for Japan and the<br />

Republic of Korea only cover social security contribution liability<br />

and do not include benefits.<br />

National Insurance contributions (NICs)<br />

NICs help to pay for some social security benefits, including State<br />

Pension. There are six classes of NICs. The class you pay in the UK<br />

depends on whether you are employed, selfemployed or can pay<br />

voluntary NICs.