You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Jet Airways (India) Limited - 16th Annual Report 2007-08<br />

b) During the year, the Holding Company to enable Jet Lite (India) Limited to pay installments<br />

of demand of income tax in respect of earlier years paid Rs. 3,708 lac on behalf of the selling<br />

shareholders of SAL since the liability in respect of income tax for the earlier years belongs<br />

to selling shareholders of SAL. The Holding Company also communicated this fact to selling<br />

shareholders vide its communication letter dated 26th March, 2008 and in the absence of<br />

reimbursement has adjusted the same towards the first installment due. Accordingly, the<br />

balance of first installment of Rs. 10,042 lac was paid on 30th March, 2008 and remaining<br />

installments payable subsequently in accordance with the consent terms of Rs. 41,250 lac has<br />

been disclosed under the separate head “Deferred payment liability towards Investments in<br />

wholly owned Subsidiary Company”.<br />

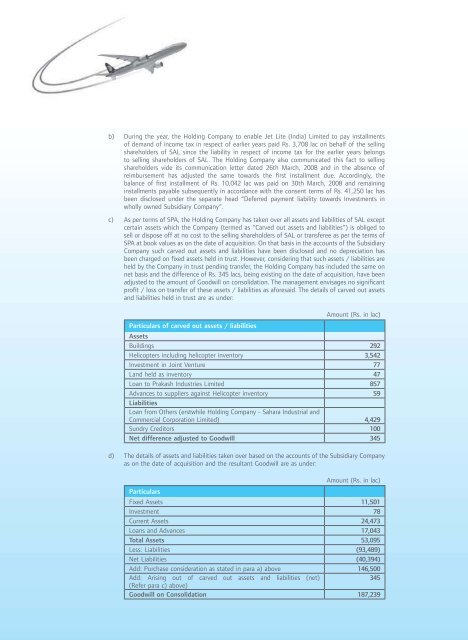

c) As per terms of SPA, the Holding Company has taken over all assets and liabilities of SAL except<br />

certain assets which the Company (termed as “Carved out assets and liabilities”) is obliged to<br />

sell or dispose off at no cost to the selling shareholders of SAL or transferee as per the terms of<br />

SPA at book values as on the date of acquisition. On that basis in the accounts of the Subsidiary<br />

Company such carved out assets and liabilities have been disclosed and no depreciation has<br />

been charged on fixed assets held in trust. However, considering that such assets / liabilities are<br />

held by the Company in trust pending transfer, the Holding Company has included the same on<br />

net basis and the difference of Rs. 345 lacs, being existing on the date of acquisition, have been<br />

adjusted to the amount of Goodwill on consolidation. The management envisages no significant<br />

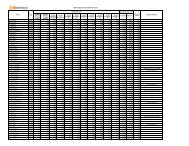

profit / loss on transfer of these assets / liabilities as aforesaid. The details of carved out assets<br />

and liabilities held in trust are as under:<br />

Amount (Rs. in lac)<br />

Particulars of carved out assets / liabilities<br />

Assets<br />

Buildings 292<br />

Helicopters including helicopter inventory 3,542<br />

Investment in Joint Venture 77<br />

Land held as inventory 47<br />

Loan to Prakash Industries Limited 857<br />

Advances to suppliers against Helicopter inventory<br />

Liabilities<br />

Loan from Others (erstwhile Holding Company - Sahara Industrial and<br />

59<br />

Commercial Corporation Limited) 4,429<br />

Sundry Creditors 100<br />

Net difference adjusted to Goodwill 345<br />

d) The details of assets and liabilities taken over based on the accounts of the Subsidiary Company<br />

as on the date of acquisition and the resultant Goodwill are as under:<br />

Amount (Rs. in lac)<br />

Particulars<br />

Fixed Assets 11,501<br />

Investment 78<br />

Current Assets 24,473<br />

Loans and Advances 17,043<br />

Total Assets 53,095<br />

Less: Liabilities (93,489)<br />

Net Liabilities (40,394)<br />

Add: Purchase consideration as stated in para a) above 146,500<br />

Add: Arising out of carved out assets and liabilities (net)<br />

(Refer para c) above)<br />

345<br />

Goodwill on Consolidation 187,239<br />

111