Learn How to Analyze Stocks Using the Strategies of Buffett, Lynch ...

Learn How to Analyze Stocks Using the Strategies of Buffett, Lynch ...

Learn How to Analyze Stocks Using the Strategies of Buffett, Lynch ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

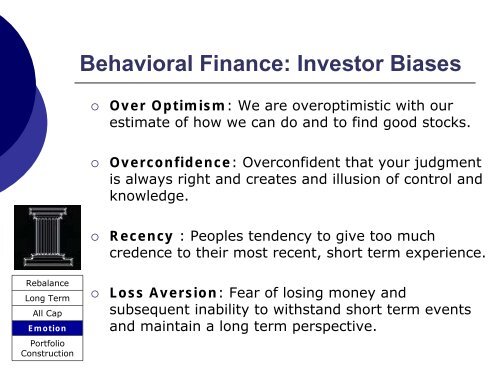

Behavioral Finance: Inves<strong>to</strong>r Biases<br />

◦ Over Optimism: We are overoptimistic with our<br />

estimate <strong>of</strong> how we can do and <strong>to</strong> find good s<strong>to</strong>cks.<br />

◦ Overconfidence: Overconfident that your judgment<br />

is always right and creates and illusion <strong>of</strong> control and<br />

knowledge.<br />

◦ Recency : Peoples tendency <strong>to</strong> give <strong>to</strong>o much<br />

credence <strong>to</strong> <strong>the</strong>ir most recent, short term experience.<br />

Rebalance<br />

Long Term<br />

All Cap<br />

Emotion<br />

Portfolio<br />

Construction<br />

◦ Loss Aversion: Fear <strong>of</strong> losing money and<br />

subsequent inability <strong>to</strong> withstand short term events<br />

and maintain a long term perspective.