effect of financial liberalization on economic growth in

effect of financial liberalization on economic growth in

effect of financial liberalization on economic growth in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

http//: www.managementjournals.org<br />

Internati<strong>on</strong>al Journal <str<strong>on</strong>g>of</str<strong>on</strong>g> Ec<strong>on</strong>omics and Management Sciences Vol. 1, No. 12, 2012, pp. 16-28<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> lend<strong>in</strong>g rate is -1.631900. This signifies that <strong>in</strong> the short run, lend<strong>in</strong>g rate (LR) is <strong>in</strong>versely related to GDP<br />

and this is <strong>in</strong> c<strong>on</strong>formity with the a priori expectati<strong>on</strong>. A unit <strong>in</strong>crease <strong>in</strong> LR means that GDP will decrease by<br />

1.631900 units. Also, the coefficient <str<strong>on</strong>g>of</str<strong>on</strong>g> exchange rate (EXR) is 1.257630 and this implies that a direct<br />

relati<strong>on</strong>ship exist between GDP and EXR <strong>in</strong> the short run. The short run equilibrium relati<strong>on</strong>ship exist<strong>in</strong>g<br />

between GDP and EXR does not c<strong>on</strong>form to the a priori expectati<strong>on</strong>. The relati<strong>on</strong>ship shows that a unit <strong>in</strong>crease<br />

<strong>in</strong> EXR will cause GDP to rise by 1.257630 units.<br />

The coefficient <str<strong>on</strong>g>of</str<strong>on</strong>g> INF is -0.008190. This means that a negative relati<strong>on</strong>ship subsists between GDP and INF and<br />

this is <strong>in</strong> c<strong>on</strong>s<strong>on</strong>ance with the a priori expectati<strong>on</strong>. GDP will decrease by 0.008190 units if the <strong>in</strong>flati<strong>on</strong> rate<br />

<strong>in</strong>creases by a unit. Also, the coefficient <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>f<strong>in</strong>ancial</str<strong>on</strong>g> deepen<strong>in</strong>g (FD) is -0.416888. This shows that FD is<br />

negatively related to GDP and this relati<strong>on</strong>ship discards that stated a priori expectati<strong>on</strong>. A unit <strong>in</strong>crease <strong>in</strong> the<br />

ratio <str<strong>on</strong>g>of</str<strong>on</strong>g> M 2 to GDP i.e. FD will c<strong>on</strong>sequently lead to GDP decreas<strong>in</strong>g by 0.416888 units.The coefficient <str<strong>on</strong>g>of</str<strong>on</strong>g> DOP<br />

(trade dependency ratio) is +0.283469. This is <strong>in</strong> agreement with the a priori expectati<strong>on</strong> because the value <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

the coefficient <str<strong>on</strong>g>of</str<strong>on</strong>g> DOP shows that <strong>in</strong> the short run, a direct relati<strong>on</strong>ship exists between GDP and DOP. A unit<br />

<strong>in</strong>crease <strong>in</strong> DOP i.e. ratio <str<strong>on</strong>g>of</str<strong>on</strong>g> imports (M) and exports (X) to GDP will lead to <strong>in</strong>crease <strong>in</strong> GDP by 0.283469<br />

units.<br />

The coefficient <str<strong>on</strong>g>of</str<strong>on</strong>g> multiple determ<strong>in</strong>ati<strong>on</strong> denoted as R 2 with a value <str<strong>on</strong>g>of</str<strong>on</strong>g> 0.9317 ≈ 0.93 shows that 93% <str<strong>on</strong>g>of</str<strong>on</strong>g> total<br />

variati<strong>on</strong> <strong>in</strong> GDP can be expla<strong>in</strong>ed by LR, EXR, INF, FD and DOP while the rema<strong>in</strong><strong>in</strong>g 7% is be<strong>in</strong>g expla<strong>in</strong>ed<br />

by the stochastic/error term <strong>in</strong> the model.<br />

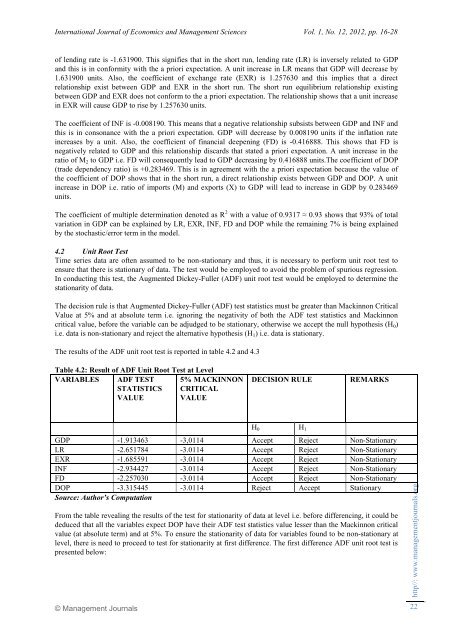

4.2 Unit Root Test<br />

Time series data are <str<strong>on</strong>g>of</str<strong>on</strong>g>ten assumed to be n<strong>on</strong>-stati<strong>on</strong>ary and thus, it is necessary to perform unit root test to<br />

ensure that there is stati<strong>on</strong>ary <str<strong>on</strong>g>of</str<strong>on</strong>g> data. The test would be employed to avoid the problem <str<strong>on</strong>g>of</str<strong>on</strong>g> spurious regressi<strong>on</strong>.<br />

In c<strong>on</strong>duct<strong>in</strong>g this test, the Augmented Dickey-Fuller (ADF) unit root test would be employed to determ<strong>in</strong>e the<br />

stati<strong>on</strong>arity <str<strong>on</strong>g>of</str<strong>on</strong>g> data.<br />

The decisi<strong>on</strong> rule is that Augmented Dickey-Fuller (ADF) test statistics must be greater than Mack<strong>in</strong>n<strong>on</strong> Critical<br />

Value at 5% and at absolute term i.e. ignor<strong>in</strong>g the negativity <str<strong>on</strong>g>of</str<strong>on</strong>g> both the ADF test statistics and Mack<strong>in</strong>n<strong>on</strong><br />

critical value, before the variable can be adjudged to be stati<strong>on</strong>ary, otherwise we accept the null hypothesis (H 0 )<br />

i.e. data is n<strong>on</strong>-stati<strong>on</strong>ary and reject the alternative hypothesis (H 1 ) i.e. data is stati<strong>on</strong>ary.<br />

The results <str<strong>on</strong>g>of</str<strong>on</strong>g> the ADF unit root test is reported <strong>in</strong> table 4.2 and 4.3<br />

Table 4.2: Result <str<strong>on</strong>g>of</str<strong>on</strong>g> ADF Unit Root Test at Level<br />

VARIABLES ADF TEST<br />

STATISTICS<br />

VALUE<br />

5% MACKINNON<br />

CRITICAL<br />

VALUE<br />

DECISION RULE<br />

REMARKS<br />

H 0 H 1<br />

GDP -1.913463 -3,0114 Accept Reject N<strong>on</strong>-Stati<strong>on</strong>ary<br />

LR -2.651784 -3.0114 Accept Reject N<strong>on</strong>-Stati<strong>on</strong>ary<br />

EXR -1.685591 -3.0114 Accept Reject N<strong>on</strong>-Stati<strong>on</strong>ary<br />

INF -2.934427 -3.0114 Accept Reject N<strong>on</strong>-Stati<strong>on</strong>ary<br />

FD -2.257030 -3.0114 Accept Reject N<strong>on</strong>-Stati<strong>on</strong>ary<br />

DOP -3.315445 -3.0114 Reject Accept Stati<strong>on</strong>ary<br />

Source: Author’s Computati<strong>on</strong><br />

From the table reveal<strong>in</strong>g the results <str<strong>on</strong>g>of</str<strong>on</strong>g> the test for stati<strong>on</strong>arity <str<strong>on</strong>g>of</str<strong>on</strong>g> data at level i.e. before differenc<strong>in</strong>g, it could be<br />

deduced that all the variables expect DOP have their ADF test statistics value lesser than the Mack<strong>in</strong>n<strong>on</strong> critical<br />

value (at absolute term) and at 5%. To ensure the stati<strong>on</strong>arity <str<strong>on</strong>g>of</str<strong>on</strong>g> data for variables found to be n<strong>on</strong>-stati<strong>on</strong>ary at<br />

level, there is need to proceed to test for stati<strong>on</strong>arity at first difference. The first difference ADF unit root test is<br />

presented below:<br />

© Management Journals<br />

22