CF 7IM Opportunity Funds - Seven Investment Management

CF 7IM Opportunity Funds - Seven Investment Management

CF 7IM Opportunity Funds - Seven Investment Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Charges and Expenses<br />

What will I pay for my investment?<br />

The Fund will have a single price at which the shares<br />

are bought and sold back to the ACD. The single price<br />

is based on the value of the total assets of the Fund,<br />

minus its liabilities. This is known as the Net Asset<br />

Value, or NAV, of the Fund. The value of one share is<br />

the total NAV divided by the number of shares in issue.<br />

This is calculated each Tuesday (or where that is not a<br />

business day the preceding business day) and the last<br />

business day of each month at 12 noon (London time).<br />

Your investment is subject to the following charges:<br />

A preliminary charge – Each time you make an<br />

investment into the A, B and C share classes the<br />

investment incurs a charge of 3%. Each time you make<br />

an investment into the D share class the investment<br />

incurs a charge of 5%. This is known as an initial<br />

charge and is illustrated as a percentage ‘%’ of your<br />

investment.<br />

How much will advice cost?<br />

If your professional adviser is charging a fee they will<br />

provide you with details relating to the cost of their<br />

advice.<br />

Your professional adviser (who may also be an<br />

<strong>Investment</strong> Manager of the Fund) may be entitled to<br />

initial commission from the ACD. This will be paid by<br />

the ACD from the initial charge or other resources. In<br />

addition, for as long as you hold your investment your<br />

professional adviser may be entitled to receive annual<br />

commission from the ACD based on the value of your<br />

investment. The commission will not be deducted from<br />

your investment.<br />

An annual management charge (AMC) – The AMC or<br />

‘periodic charge’ as set out below is taken from the<br />

income the Fund. This is illustrated as a percentage ‘%’<br />

of the NAV of the Fund.<br />

The AMC applying to each Share Class may (other<br />

than the D Share Class) vary between the standard<br />

annual management charge (‘Standard AMC’) and the<br />

discounted annual management charge (‘Discounted<br />

AMC’) depending on the rolling performance of the<br />

Fund. The performance of the Fund for this purpose<br />

will be based on the price (i.e. the Net Asset Value) of<br />

the C Share Class (‘Performance’). Please note that for<br />

the D Share Class the Standard AMC will always apply<br />

and there is no Discounted AMC.<br />

Details of the Standard AMC and the Discounted AMC<br />

are set out below.<br />

The Performance will first be measured on<br />

31 December 2012 against the price of the C Share<br />

Class on the Fund’s launch. Thereafter it will be<br />

measured at quarterly intervals on the last business<br />

day of each quarter (i.e. 31 March, 30 June,<br />

30 September and 31 December assuming they are<br />

business days).<br />

The price of the C Share Class as at a quarter end date<br />

will be compared against the price of the C Share<br />

Class as at the corresponding quarter end date in the<br />

previous year. Where Performance is positive over the<br />

period (i.e. the price of the C Share Class has increased<br />

over the period) the Standard AMC will apply to all<br />

Share Classes for the next quarter period. Where<br />

Performance is negative (i.e. the price of the C Share<br />

Class has decreased or the price is unchanged) the<br />

Discounted AMC will apply to A, B and C Share Classes<br />

for the next quarter period.<br />

The Standard AMC will apply from the date of launch<br />

of the Fund (30 January 2012) until 31 December 2012.<br />

The first measure of Performance will therefore occur<br />

on the last business day of December 2012.<br />

Please note that the Performance is based on the price<br />

of the C Share Class which has a lower Standard AMC<br />

than the A and B Share Classes. It is possible therefore<br />

that the Performance of the C Share Class may be<br />

positive but the performance of the A and B Share<br />

Classes may not be due to the impact of the higher<br />

annual management charge applicable to the A and B<br />

Share Classes. Therefore, in those circumstances, the<br />

Standard AMC will apply for the next quarter to each<br />

Share Class even though the performance of those<br />

Share Classes may not have been positive.<br />

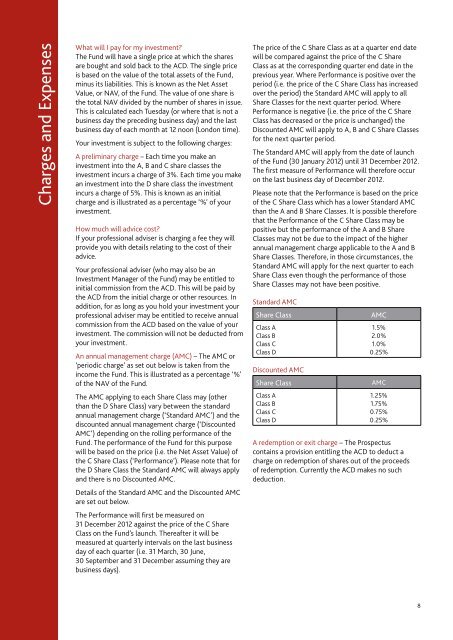

Standard AMC<br />

Share Class<br />

Class A<br />

Class B<br />

Class C<br />

Class D<br />

Discounted AMC<br />

Share Class<br />

Class A<br />

Class B<br />

Class C<br />

Class D<br />

AMC<br />

1.5%<br />

2.0%<br />

1.0%<br />

0.25%<br />

AMC<br />

1.25%<br />

1.75%<br />

0.75%<br />

0.25%<br />

A redemption or exit charge – The Prospectus<br />

contains a provision entitling the ACD to deduct a<br />

charge on redemption of shares out of the proceeds<br />

of redemption. Currently the ACD makes no such<br />

deduction.<br />

8