Edmonton Regional Airports Authority - Edmonton International Airport

Edmonton Regional Airports Authority - Edmonton International Airport

Edmonton Regional Airports Authority - Edmonton International Airport

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

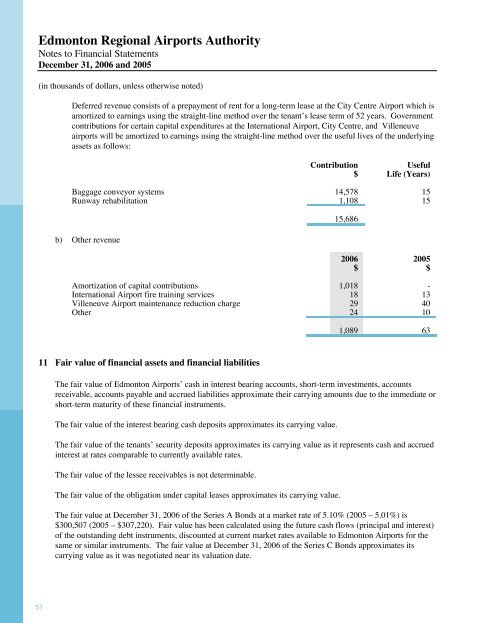

<strong>Edmonton</strong> <strong>Regional</strong> <strong><strong>Airport</strong>s</strong> <strong>Authority</strong><br />

Notes to Financial Statements<br />

December 31, 2006 and 2005<br />

(in thousands of dollars, unless otherwise noted)<br />

Deferred revenue consists of a prepayment of rent for a long-term lease at the City Centre <strong>Airport</strong> which is<br />

amortized to earnings using the straight-line method over the tenant’s lease term of 52 years. Government<br />

contributions for certain capital expenditures at the <strong>International</strong> <strong>Airport</strong>, City Centre, and Villeneuve<br />

airports will be amortized to earnings using the straight-line method over the useful lives of the underlying<br />

assets as follows:<br />

Contribution<br />

$<br />

Useful<br />

Life (Years)<br />

Baggage conveyor systems 14,578 15<br />

Runway rehabilitation 1,108 15<br />

b) Other revenue<br />

15,686<br />

2006<br />

$<br />

2005<br />

$<br />

Amortization of capital contributions 1,018 -<br />

<strong>International</strong> <strong>Airport</strong> fire training services 18 13<br />

Villeneuve <strong>Airport</strong> maintenance reduction charge 29 40<br />

Other 24 10<br />

1,089 63<br />

11 Fair value of financial assets and financial liabilities<br />

The fair value of <strong>Edmonton</strong> <strong><strong>Airport</strong>s</strong>’ cash in interest bearing accounts, short-term investments, accounts<br />

receivable, accounts payable and accrued liabilities approximate their carrying amounts due to the immediate or<br />

short-term maturity of these financial instruments.<br />

The fair value of the interest bearing cash deposits approximates its carrying value.<br />

The fair value of the tenants’ security deposits approximates its carrying value as it represents cash and accrued<br />

interest at rates comparable to currently available rates.<br />

The fair value of the lessee receivables is not determinable.<br />

The fair value of the obligation under capital leases approximates its carrying value.<br />

The fair value at December 31, 2006 of the Series A Bonds at a market rate of 5.10% (2005 – 5.01%) is<br />

$300,507 (2005 – $307,220). Fair value has been calculated using the future cash flows (principal and interest)<br />

of the outstanding debt instruments, discounted at current market rates available to <strong>Edmonton</strong> <strong><strong>Airport</strong>s</strong> for the<br />

same or similar instruments. The fair value at December 31, 2006 of the Series C Bonds approximates its<br />

carrying value as it was negotiated near its valuation date.<br />

51