Annual report and financial statements - NVM Private Equity Ltd.

Annual report and financial statements - NVM Private Equity Ltd.

Annual report and financial statements - NVM Private Equity Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

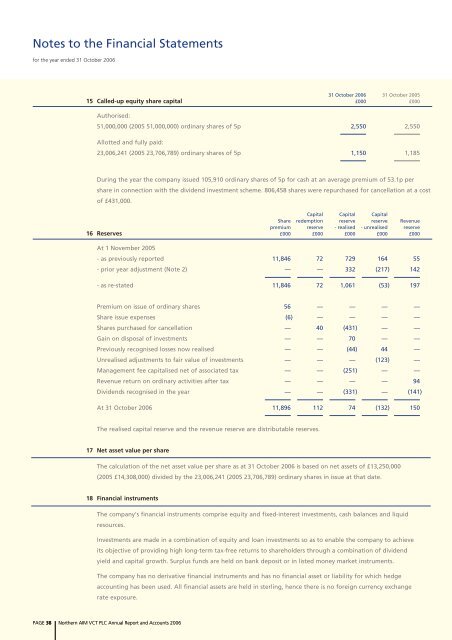

Notes to the Financial Statements<br />

for the year ended 31 October 2006<br />

31 October 2006 31 October 2005<br />

15 Called-up equity share capital £000 £000<br />

Authorised:<br />

51,000,000 (2005 51,000,000) ordinary shares of 5p 2,550 2,550<br />

Allotted <strong>and</strong> fully paid:<br />

23,006,241 (2005 23,706,789) ordinary shares of 5p 1,150 1,185<br />

During the year the company issued 105,910 ordinary shares of 5p for cash at an average premium of 53.1p per<br />

share in connection with the dividend investment scheme. 806,458 shares were repurchased for cancellation at a cost<br />

of £431,000.<br />

Capital Capital Capital<br />

Share redemption reserve reserve Revenue<br />

premium reserve - realised - unrealised reserve<br />

16 Reserves £000 £000 £000 £000 £000<br />

At 1 November 2005<br />

- as previously <strong>report</strong>ed 11,846 72 729 164 55<br />

- prior year adjustment (Note 2) — — 332 (217) 142<br />

- as re-stated 11,846 72 1,061 (53) 197<br />

Premium on issue of ordinary shares 56 — — — —<br />

Share issue expenses (6) — — — —<br />

Shares purchased for cancellation — 40 (431) — —<br />

Gain on disposal of investments — — 70 — —<br />

Previously recognised losses now realised — — (44) 44 —<br />

Unrealised adjustments to fair value of investments — — — (123) —<br />

Management fee capitalised net of associated tax — — (251) — —<br />

Revenue return on ordinary activities after tax — — — — 94<br />

Dividends recognised in the year — — (331) — (141)<br />

At 31 October 2006 11,896 112 74 (132) 150<br />

The realised capital reserve <strong>and</strong> the revenue reserve are distributable reserves.<br />

17 Net asset value per share<br />

The calculation of the net asset value per share as at 31 October 2006 is based on net assets of £13,250,000<br />

(2005 £14,308,000) divided by the 23,006,241 (2005 23,706,789) ordinary shares in issue at that date.<br />

18 Financial instruments<br />

The company's <strong>financial</strong> instruments comprise equity <strong>and</strong> fixed-interest investments, cash balances <strong>and</strong> liquid<br />

resources.<br />

Investments are made in a combination of equity <strong>and</strong> loan investments so as to enable the company to achieve<br />

its objective of providing high long-term tax-free returns to shareholders through a combination of dividend<br />

yield <strong>and</strong> capital growth. Surplus funds are held on bank deposit or in listed money market instruments.<br />

The company has no derivative <strong>financial</strong> instruments <strong>and</strong> has no <strong>financial</strong> asset or liability for which hedge<br />

accounting has been used. All <strong>financial</strong> assets are held in sterling, hence there is no foreign currency exchange<br />

rate exposure.<br />

PAGE 38 Northern AIM VCT PLC <strong>Annual</strong> Report <strong>and</strong> Accounts 2006