CHIVARO-DUES-1g.pdf

CHIVARO-DUES-1g.pdf

CHIVARO-DUES-1g.pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

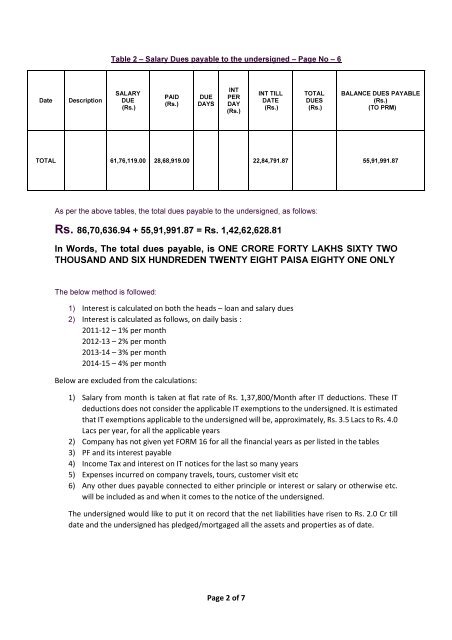

Table 2 – Salary Dues payable to the undersigned – Page No – 6<br />

Date<br />

Description<br />

SALARY<br />

DUE<br />

(Rs.)<br />

PAID<br />

(Rs.)<br />

DUE<br />

DAYS<br />

INT<br />

PER<br />

DAY<br />

(Rs.)<br />

INT TILL<br />

DATE<br />

(Rs.)<br />

TOTAL<br />

<strong>DUES</strong><br />

(Rs.)<br />

BALANCE <strong>DUES</strong> PAYABLE<br />

(Rs.)<br />

(TO PRM)<br />

TOTAL 61,76,119.00 28,68,919.00 22,84,791.87 55,91,991.87<br />

As per the above tables, the total dues payable to the undersigned, as follows:<br />

Rs. 86,70,636.94 + 55,91,991.87 = Rs. 1,42,62,628.81<br />

In Words, The total dues payable, is ONE CRORE FORTY LAKHS SIXTY TWO<br />

THOUSAND AND SIX HUNDREDEN TWENTY EIGHT PAISA EIGHTY ONE ONLY<br />

The below method is followed:<br />

1) Interest is calculated on both the heads – loan and salary dues<br />

2) Interest is calculated as follows, on daily basis :<br />

2011-12 – 1% per month<br />

2012-13 – 2% per month<br />

2013-14 – 3% per month<br />

2014-15 – 4% per month<br />

Below are excluded from the calculations:<br />

1) Salary from month is taken at flat rate of Rs. 1,37,800/Month after IT deductions. These IT<br />

deductions does not consider the applicable IT exemptions to the undersigned. It is estimated<br />

that IT exemptions applicable to the undersigned will be, approximately, Rs. 3.5 Lacs to Rs. 4.0<br />

Lacs per year, for all the applicable years<br />

2) Company has not given yet FORM 16 for all the financial years as per listed in the tables<br />

3) PF and its interest payable<br />

4) Income Tax and interest on IT notices for the last so many years<br />

5) Expenses incurred on company travels, tours, customer visit etc<br />

6) Any other dues payable connected to either principle or interest or salary or otherwise etc.<br />

will be included as and when it comes to the notice of the undersigned.<br />

The undersigned would like to put it on record that the net liabilities have risen to Rs. 2.0 Cr till<br />

date and the undersigned has pledged/mortgaged all the assets and properties as of date.<br />

Page 2 of 7