n?u=RePEc:dnb:dnbwpp:463&r=ban

n?u=RePEc:dnb:dnbwpp:463&r=ban

n?u=RePEc:dnb:dnbwpp:463&r=ban

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

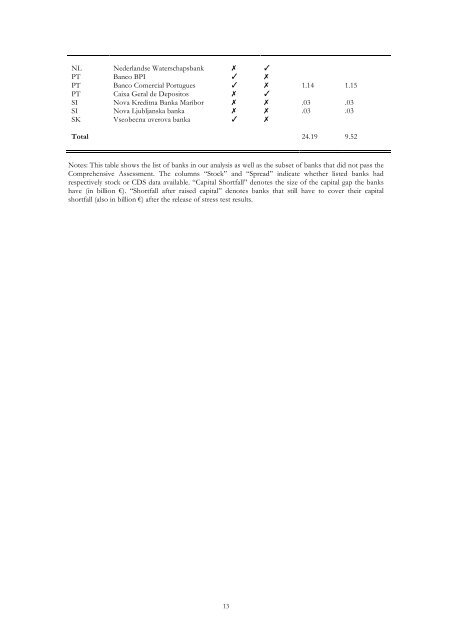

NL Nederlandse Waterschapsbank ✗ ✓<br />

PT Banco BPI ✓ ✗<br />

PT Banco Comercial Portugues ✓ ✗ 1.14 1.15<br />

PT Caixa Geral de Depositos ✗ ✓<br />

SI Nova Kreditna Banka Maribor ✗ ✗ .03 .03<br />

SI Nova Ljubljanska banka ✗ ✗ .03 .03<br />

SK Vseobecna uverova banka ✓ ✗<br />

Total 24.19 9.52<br />

Notes: This table shows the list of banks in our analysis as well as the subset of banks that did not pass the<br />

Comprehensive Assessment. The columns “Stock” and “Spread” indicate whether listed banks had<br />

respectively stock or CDS data available. “Capital Shortfall” denotes the size of the capital gap the banks<br />

have (in billion €). “Shortfall after raised capital” denotes banks that still have to cover their capital<br />

shortfall (also in billion €) after the release of stress test results.<br />

<br />

13