Insurance - Endurance Specialty Insurance Ltd.

Insurance - Endurance Specialty Insurance Ltd.

Insurance - Endurance Specialty Insurance Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ENDURANCE SPECIALTY<br />

HOLDINGS LTD.<br />

<strong>Endurance</strong> <strong>Specialty</strong> Holdings <strong>Ltd</strong>. (NYSE:ENH) is<br />

an insurance and reinsurance provider focused on<br />

underwriting specialty lines on a global basis through<br />

our operating subsidiaries. Our clients are serviced by<br />

approximately 900 employees located in Bermuda,<br />

Europe, Asia and throughout the United States.<br />

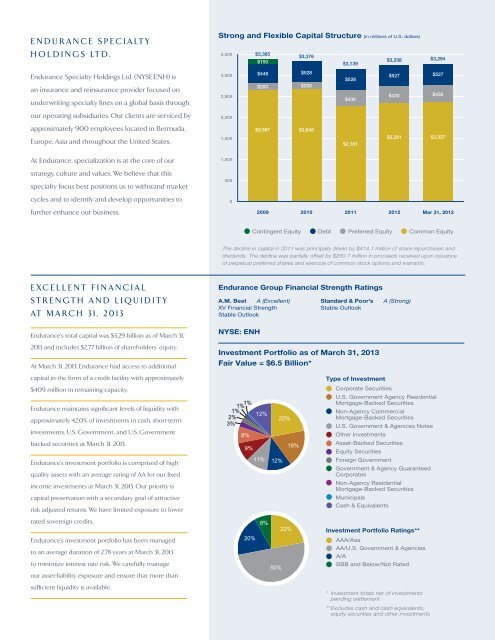

Strong and Flexible Capital Structure (in millions of U.S. dollars)<br />

3,500 $3,385<br />

$3,376<br />

$150<br />

$3,139<br />

$3,238<br />

3,000<br />

$448<br />

$528<br />

$528<br />

$527<br />

$200<br />

$200<br />

2,500<br />

2,000<br />

$430<br />

$430<br />

$2,587<br />

$2,648<br />

1,500<br />

$2,281<br />

$2,181<br />

$3,294<br />

$527<br />

$430<br />

$2,337<br />

At <strong>Endurance</strong>, specialization is at the core of our<br />

1,000<br />

strategy, culture and values. We believe that this<br />

specialty focus best positions us to withstand market<br />

500<br />

cycles and to identify and develop opportunities to<br />

0<br />

further enhance our business.<br />

2009<br />

2010<br />

2011<br />

2012<br />

Mar 31, 2013<br />

Contingent Equity Debt Preferred Equity Common Equity<br />

The decline in capital in 2011 was principally driven by $414.1 million of share repurchases and<br />

dividends. The decline was partially offset by $250.7 million in proceeds received upon issuance<br />

of perpetual preferred shares and exercise of common stock options and warrants.<br />

EXCELLENT FINANCIAL<br />

STRENGTH AND LIQUIDITY<br />

AT MARCH 31, 2013<br />

<strong>Endurance</strong>’s total capital was $3.29 billion as of March 31,<br />

2013 and includes $2.77 billion of shareholders’ equity.<br />

At March 31, 2013, <strong>Endurance</strong> had access to additional<br />

capital in the form of a credit facility with approximately<br />

$409 million in remaining capacity.<br />

<strong>Endurance</strong> maintains significant levels of liquidity with<br />

approximately 42.0% of investments in cash, short-term<br />

investments, U.S. Government, and U.S. Government<br />

backed securities at March 31, 2013.<br />

<strong>Endurance</strong>’s investment portfolio is comprised of high<br />

quality assets with an average rating of AA for our fixed<br />

income investments at March 31, 2013. Our priority is<br />

capital preservation with a secondary goal of attractive<br />

risk adjusted returns. We have limited exposure to lower<br />

rated sovereign credits.<br />

<strong>Endurance</strong>’s investment portfolio has been managed<br />

to an average duration of 2.78 years at March 31, 2013<br />

to minimize interest rate risk. We carefully manage<br />

our asset-liability exposure and ensure that more than<br />

sufficient liquidity is available.<br />

<strong>Endurance</strong> Group Financial Strength Ratings<br />

A.M. Best A (Excellent)<br />

XV Financial Strength<br />

Stable Outlook<br />

NYSE: ENH<br />

Standard & Poor’s<br />

Stable Outlook<br />

Investment Portfolio as of March 31, 2013<br />

Fair Value = $6.5 Billion*<br />

1% 1%<br />

1%<br />

12%<br />

2%<br />

3%<br />

8%<br />

9%<br />

20%<br />

11%<br />

12%<br />

22%<br />

18%<br />

A (Strong)<br />

Type of Investment<br />

Corporate Securities<br />

U.S. Government Agency Residential<br />

Mortgage-Backed Securities<br />

Non-Agency Commercial<br />

Mortgage-Backed Securities<br />

U.S. Government & Agencies Notes<br />

Other Investments<br />

Asset-Backed Securities<br />

Equity Securities<br />

Foreign Government<br />

Government & Agency Guaranteed<br />

Corporates<br />

Non-Agency Residential<br />

Mortgage-Backed Securities<br />

Municipals<br />

Cash & Equivalents<br />

8%<br />

22% Investment Portfolio Ratings**<br />

AAA/Aaa<br />

AA/U.S. Government & Agencies<br />

A/A<br />

BBB and Below/Not Rated<br />

50%<br />

* Investment totals net of investments<br />

pending settlement<br />

** Excludes cash and cash equivalents,<br />

equity securities and other investments