Bulk Insured Pensions - A Good Practice Guide - NAPF

Bulk Insured Pensions - A Good Practice Guide - NAPF

Bulk Insured Pensions - A Good Practice Guide - NAPF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

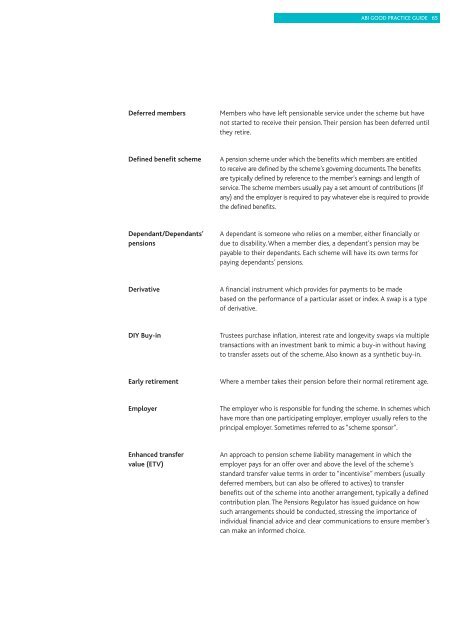

ABI GOOD PRACTICE GUIDE 65<br />

Deferred members<br />

Members who have left pensionable service under the scheme but have<br />

not started to receive their pension. Their pension has been deferred until<br />

they retire.<br />

Defined benefit scheme<br />

A pension scheme under which the benefits which members are entitled<br />

to receive are defined by the scheme’s governing documents. The benefits<br />

are typically defined by reference to the member’s earnings and length of<br />

service. The scheme members usually pay a set amount of contributions (if<br />

any) and the employer is required to pay whatever else is required to provide<br />

the defined benefits.<br />

Dependant/Dependants’<br />

pensions<br />

A dependant is someone who relies on a member, either financially or<br />

due to disability. When a member dies, a dependant’s pension may be<br />

payable to their dependants. Each scheme will have its own terms for<br />

paying dependants’ pensions.<br />

Derivative<br />

A financial instrument which provides for payments to be made<br />

based on the performance of a particular asset or index. A swap is a type<br />

of derivative.<br />

DIY Buy-in<br />

Trustees purchase inflation, interest rate and longevity swaps via multiple<br />

transactions with an investment bank to mimic a buy-in without having<br />

to transfer assets out of the scheme. Also known as a synthetic buy-in.<br />

Early retirement<br />

Where a member takes their pension before their normal retirement age.<br />

Employer<br />

The employer who is responsible for funding the scheme. In schemes which<br />

have more than one participating employer, employer usually refers to the<br />

principal employer. Sometimes referred to as “scheme sponsor”.<br />

Enhanced transfer<br />

value (ETV)<br />

An approach to pension scheme liability management in which the<br />

employer pays for an offer over and above the level of the scheme’s<br />

standard transfer value terms in order to “incentivise” members (usually<br />

deferred members, but can also be offered to actives) to transfer<br />

benefits out of the scheme into another arrangement, typically a defined<br />

contribution plan. The <strong>Pensions</strong> Regulator has issued guidance on how<br />

such arrangements should be conducted, stressing the importance of<br />

individual financial advice and clear communications to ensure member’s<br />

can make an informed choice.